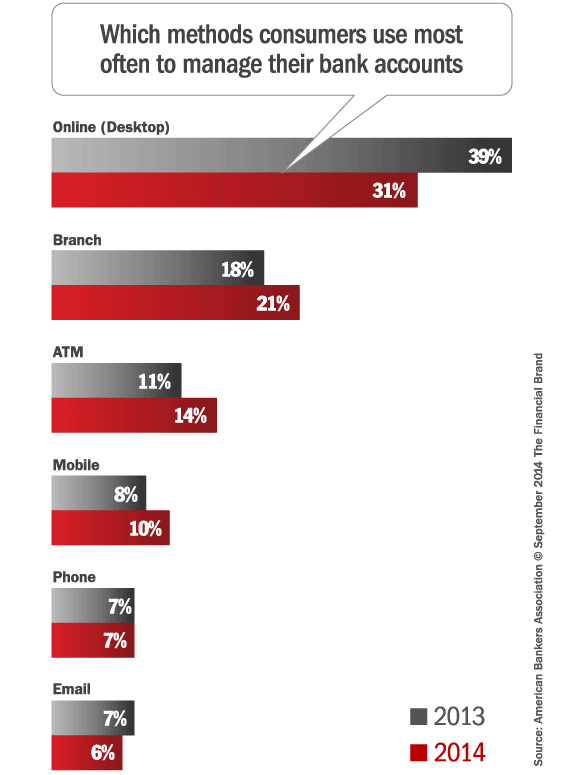

According to a survey fielded by the American Bankers Association, the internet remains consumers’ most favored channel to manage their financial accounts.

The annual survey of 1,000 U.S. adults was conducted for ABA by Ipsos Public Affairs, an independent market research firm in early August. This is the sixth year in a row that consumers have cited the internet as their favorite way of conducting their banking business, albeit by a much narrower margin than last year.

Yes, you read that correctly: the online channel is slipping.

“We’re seeing a branch renaissance in some areas, with many banks transforming their branches to become more efficient and customer-friendly.”

— Nessa Feddis, ABA

In 2013, 39% of Americans said they preferred banking online using traditional desktop/laptop computers. One year later, that number had dropped down to only 31%.

While the mobile channel made modest gains — growing from 8% to 10% over a 12-month period — the real surprise is in the brick-and-mortar channel.

Consumers who said branches were their preferred method to manage their banking activities grew from 18% to 21% — that’s a relative increase of 17%… in one year.

Key Question: Aren’t branches supposed to be losing their popularity? Isn’t the historical consumer preference for the brick-and-mortar channel supposed to be waning?

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Similarly, those preferring to use ATMs rose to 14%, a relative increase of 27% over the previous year.

“It’s clear that branches are still popular with many bank customers,” said Nessa Feddis, the ABA’s SVP and Deputy Chief Counsel for Consumer Protection & Payments. “When people are conducting a complex transaction like opening an account or applying for a home or business loan, they often prefer to do it in person.”

“We’re seeing a branch renaissance in some areas,” Feddis continued, “with many banks transforming their branches to become more efficient and customer-friendly.”

Online banking first became the most preferred banking method in 2009, when only 25% of customers naming it as their favorite. Prior to 2009, branches were the most popular method, followed by ATMs.

Feddis noted that the growth in certain channels (namely branches, ATMs and mobile) reflects banks’ recent investment in technological upgrades to enhance efficiency and customer service in these channels.

“Advances in technology have enabled banks to expand customer choices and make it easier for consumers to manage their account anywhere, any time,” said Feddis. “Consumers can deposit their check through a teller or interactive kiosk at a local branch, at an ATM or through an app on their mobile device. Most people use a mix of these methods.”

Millennials Prefer Plastic, But Those Over 50 Overwhelmingly Opt for Cash

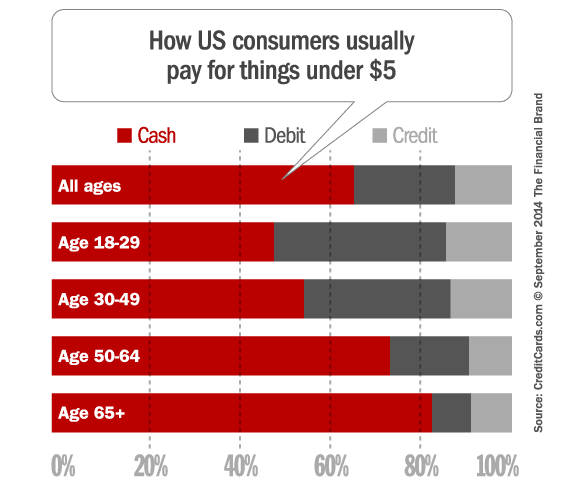

In a separate study by CreditCards.com, approximately two in three US credit cardholders say they typically use cash for purchases of less than five dollars. But a clear generational divide in the way Americans pay for small purchases means that might not be the case for much longer.

The tendency to use cash increases sharply with age. Almost eight in 10 ages 50 and older prefer to use cash for small transactions. For cardholders between ages 18 and 49, it’s virtually a dead heat between cash (52%) and credit/debit cards (46%).

The youngest cardholders (18-29 year-olds) are the only age group to prefer plastic. Digging a little deeper, Millennials with credit cards prefer debit over credit by a ratio of nearly three-to-one. Among all cardholders, debit outpaces credit by a two-to-one margin.

“The question is whether Millennials will eventually embrace credit as they age and their financial situations change,” said Matt Schulz, senior industry analyst with CreditCards.com. “I believe they will, due in large part to credit’s more lucrative rewards programs and better consumer protections.”

Cash is the preferred payment method for almost eight in 10 rural cardholders versus just 62% of city dwellers and suburbanites.

The casual use of plastic is moving steadily through age brackets — and already has a firm grip not only on millennials but also increasingly on Gen Xers. Crunched another way, the data show that if you’re 49 or younger, you’re almost as likely to pay for a $5 purchase with plastic as you are to pay with cash — 52 percent prefer cash, 46 percent prefer debit or credit cards. For now, if you’re 50 or older, you’re still somewhat unlikely to pay for a $5 purchase with plastic — 77 percent still prefer cash, with 21 percent reaching for debit cards or credit cards.

Whereas 70% of Republicans and 69% of Democrats who have major credit cards would rather pay for small purchases with cash, that holds true for only 59% of declared Independents.

Cardholders without children under 18 are 10 percentage points more likely to use cash than those with young children.