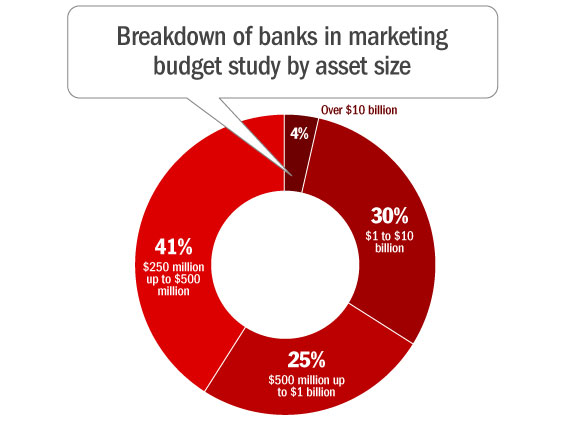

Total # of Banks in Study: 256

Average Asset Size: $2.9 billion

Median Asset Size: $593 million

Biggest by Assets: BB&T ($175.6 billion)

Smallest by Assets: Wedbush ($250.6 million)

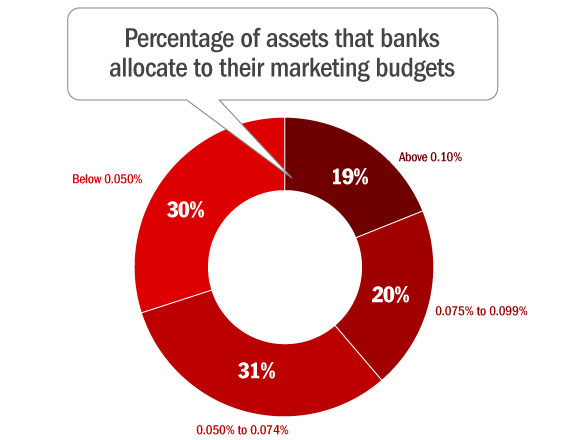

Average Marketing Budget: $2.1 million

Median Marketing Budget: $437,000

Average % of Assets Allocated to Marketing: 0.073%

Median % of Assets Allocated to Marketing: 0.066%

Biggest Marketing Budget: BMO Harris ($118.7 million, 0.13% of assets)

Smallest Marketing Budget: Hometown Bank ($54,000, 0.018% of assets)

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Average Marketing Budget Allocated by Asset Tier

Looking at bank marketing budgets along each asset class doesn’t reveal any obvious trends. Banks of all asset sizes tend to allocate roughly the industry average — around 0.073% of assets.

| Asset Tier | # | Median Bank Marketing Budget |

Average Asset % Allocated to Marketing |

|---|---|---|---|

| Over $10 Billion | 10 | $13.6 million | 0.075% |

| $1 Billion to $10 Billion | 76 | $1.28 million | 0.072% |

| $500 Million to $1 Billion | 64 | $477,500 | 0.077% |

| $250 Million to $500 Million | 106 | $220,000 | 0.068% |

We can draw a few inferences from the data. First, banks between $500 million and $1 billion might allocate proportionately more to marketing than other asset tiers because they are so heavily growth-focused. Once a bank hits $1 billion, there’s a little less pressure and it’s got a bit of a cushion — larger banks are more likely to be the acquirer than the acquired. But getting to that first billion takes hard work and extra marketing muscle. Once a bank reaches “critical mass” — assets north of $1 billion — there start to be some real, meaningful economies of scale. After all, a $1 million marketing budget gives you a lot more leverage and room to maneuver than smaller budgets. When you’ve only got $400,000, you’re going to have to make some pretty significant sacrifices (there may be multiple media channels you’ll have to overlook), and you’ve got to make every penny count. When you’re a small institution, it’s hard generating the ROA you need to devote big sums to marketing. Skyrocketing compliance and regulatory costs are enough to make a serious dent in any small bank’s marketing plans.

Read More: 5 Things You Should Know About Credit Union Marketing Budgets

Percentage of Assets Allocated to Marketing: Top 10 Big Spenders

Only one internet/direct bank showed up in our study, but you can quickly see the impact that a branchless model has on the marketing budget: First Internet Bank has to spend at least 2-3 times what everyone else does. When it comes to big spenders, there doesn’t appear to be much correlation between the size of the institution and the relative size of their marketing investment. However, you’ll notice that only one bank in the list below tops $1 billion in assets. Smaller banks have always cried that big banks have an edge. Maybe they feel like they need to dial up the marketing heat to keep up?

| Rank | Bank | Assets | Marketing Budget |

Ratio |

|---|---|---|---|---|

| 1 | First Internet | $737,240,000 | $1,824,000 | 0.247% |

| 2 | Community Bank (MO) | $289,136,000 | $531,000 | 0.184% |

| 3 | Blue Hills | $1,210,218,000 | $2,141,000 | 0.177% |

| 4 | Rondout | $273,025,000 | $479,000 | 0.175% |

| 5 | Valley (NE) | $339,549,000 | $583,000 | 0.172% |

| 6 | Bank of Labor | $518,087,000 | $881,000 | 0.170% |

| 7 | Salin | $780,345,000 | $1,306,000 | 0.167% |

| 8 | The Bank Trust (TX) | $416,548,000 | $651,000 | 0.156% |

| 9 | Fidelity Deposit (PA) | $639,886,000 | $919,000 | 0.144% |

| 10 | Heartland (MO) | $866,913,000 | $1,234,000 | 0.142% |

Percentage of Assets Allocated to Marketing: Top 10 Most Stingy

These banks invest between one-fourth and one-fifth what most banks do on marketing. In fact, if you look at the FDIC call reports for many of these stingy spenders, you’ll see that they spend more on their directors than they do on marketing. Granted, there could be some discrepancies with how the data is reported — not every accounts for advertising and marketing dollars the same way — and each market has its own dynamics (level of competition, media costs). But it’s hard to imagine how an institution with more than $2 billion in assets could survive on a paltry marketing budget floating barely above $400,000. Typically a bank that spends $400,000 to $500,000 on marketing has around $750 million in assets, not $2+ billion.

| Rank | Bank | Assets | Marketing Budget | Ratio |

|---|---|---|---|---|

| 1 | MainSource | $2,810,094,000 | $442,000 | 0.016% |

| 2 | Yakima Federal | $1,771,413,000 | $324,000 | 0.018% |

| 3 | North Dallas | $1,202,084,000 | $212,000 | 0.018% |

| 4 | Hometown (AL) | $301,622,000 | $54,000 | 0.018% |

| 5 | Progress Bank & Trust | $523,621,000 | $102,000 | 0.019% |

| 6 | Muncy | $353,295,000 | $71,000 | 0.020% |

| 7 | Independent (TX) | $1,942,964,000 | $413,000 | 0.021% |

| 8 | Highlands Union | $597,106,000 | $132,000 | 0.022% |

| 9 | Bank of New England | $548,108,000 | $123,000 | 0.022% |

| 10 | Lindell | $491,354,000 | $122,000 | 0.025% |

Just Right: How Big Should Your Marketing Budget Be?

Two out of every five banks allocate more marketing dollars relative to their assets than the industry average (0.073%). One out of every five allocated more than 0.10% of assets to marketing.

The Financial Brand has frequently recommended that banks looking for healthy growth should allocate roughly 0.10% of their assets to marketing. If you want to see modest growth rates — the kind of numbers any bank can generate — then allocate the same amount to marketing that they do. But if you want to grow at a faster pace, you need to invest more. Instead of investing 0.073% of your current asset size into marketing, think about investing 0.073% of the asset size you want to be.

Example: If your bank has $750 million in assets today but you want to hit $1 billion in the future, your marketing investment should be around 0.073% of the future number — $730,000 — not 0.073% of your asset size ($547,500). Notice that a marketing budget of $730,000 is close to 0.10% of current assets.

Bottom Line: If you want average performance, make an industry average investment in marketing. But if your bank’s strategic plan calls for aggressive growth, you better be prepared to support your plan with the additional marketing necessary to hit the goal. (Of course allowances and adjustments need to be made for a myriad of other factors geographic and competitive factors unique to each financial institution’s situation.)

Read More: Bank & CU Marketing Budgets: Woes, Worries and The Sweet Spot

Top 10 Spenders: $1 to $10 Billion in Assets

| Rank | $1 Billion to $10 Billion | Assets | Marketing Budget |

Ratio |

|---|---|---|---|---|

| 1 | Blue Hills | $1,210,218,000 | $2,141,000 | 0.177% |

| 2 | Enterprise | $1,831,728,000 | $2,578,000 | 0.141% |

| 3 | Landmark (MO) | $1,845,901,000 | $2,560,000 | 0.139% |

| 4 | Independence (KY) | $1,341,643,000 | $1,805,000 | 0.135% |

| 5 | Wilshire | $2,826,877,000 | $3,666,000 | 0.130% |

| 6 | Hills | $2,134,336,000 | $2,638,000 | 0.124% |

| 7 | Wilson | $1,720,450,000 | $2,104,000 | 0.122% |

| 8 | Beneficial | $4,680,216,000 | $5,324,000 | 0.114% |

| 9 | Canadaigua | $1,923,286,000 | $2,166,000 | 0.113% |

| 10 | Independent (MI) | $2,172,438,000 | $2,416,000 | 0.111% |

Top 10 Spenders: $500 Million to $1 Billion in Assets

| Rank | $500 Million to $1 Billion | Assets | Marketing Budget |

Ratio |

|---|---|---|---|---|

| 1 | First Internet | $737,240,000 | $1,824,000 | 0.247% |

| 2 | Bank of Labor | $518,087,000 | $881,000 | 0.170% |

| 3 | Salin | $780,345,000 | $1,306,000 | 0.167% |

| 4 | Fidelity Deposit (PA) | $639,886,000 | $919,000 | 0.144% |

| 5 | Heartland (MO) | $866,913,000 | $1,234,000 | 0.142% |

| 6 | Olympia Federal | $549,268,000 | $748,000 | 0.136% |

| 7 | Nebraskaland | $507,988,000 | $645,000 | 0.127% |

| 9 | Rosedale Federal | $781,388,000 | $961,000 | 0.123% |

| 10 | Ouachita | $664,161,000 | $817,000 | 0.123% |

Top 10 Spenders: $250 to $500 Million in Assets

| Rank | $250 Million to $500 Million | Assets | Marketing Budget |

Ratio |

|---|---|---|---|---|

| 1 | Community Bank (MO) | $289,136,000 | $531,000 | 0.184% |

| 2 | Rondout | $273,025,000 | $479,000 | 0.175% |

| 3 | Valley (NE) | $339,549,000 | $583,000 | 0.172% |

| 4 | The Bank & Trust (TX) | $416,548,000 | $651,000 | 0.156% |

| 5 | Richland State | $266,702,000 | $369,000 | 0.138% |

| 6 | Edgar County | $362,534,000 | $444,000 | 0.122% |

| 7 | Shamrock | $257,167,000 | $314,000 | 0.122% |

| 8 | 1st Security (WA) | $396,044,000 | $474,000 | 0.120% |

| 9 | Port Washington | $452,741,000 | $502,000 | 0.111% |

| 10 | Gibsland | $268,521,000 | $295,000 | 0.110% |