How well does your brand and products appeal to young consumers? Are they even aware you exist? If your institution is missing the Gen-Y train, do you think it’ll catch the next train with even younger consumers on it? Not likely.

By 2020, Gen-Y consumers will comprise 40% of the US workforce. These consumers are establishing their financial relationships now, and many institutions — particularly community banks and credit unions — are standing in their branch lobbies watching future customers drive by.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

According to data on FindABetterBank, the top criteria for most consumers shopping for checking accounts are fees and features. But shoppers under 30 are more likely to select an account that offers the best fees and features than any other segment.

This seems like a slam dunk for smaller institutions. Checking accounts at smaller banks and credit unions compare very favorably to products at national banks. Many offer advanced features like P2P payments and mobile deposit capture, free access to large ATM networks (or ATM fee rebates), and their fees are typically lower than the national banks.

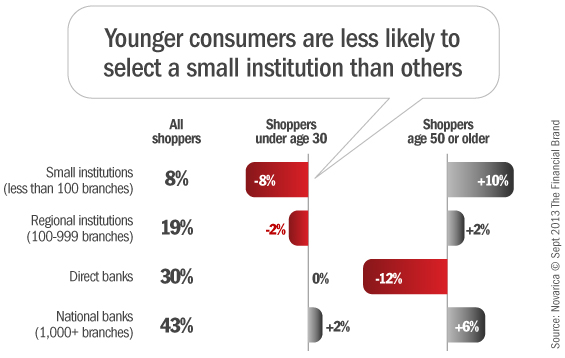

Nevertheless small institutions are losing the battle for young consumers. But why? Three reasons.

1. Branding. Many small institutions don’t deliver brand messages that resonate with younger consumers. Everything from store signage, lobbies, and websites say one thing: “We. Are. Old.”

2. Awareness. Many young consumers rely on digital channels and social networks to learn about banking products, and most small institutions are simply not visible in these channels.

3. First Impressions. Most community banks and credit unions have drastically under-invested in their .com websites. Small institutions will spend more than of $1 million on a branch, but spending $100,000 to upgrade their .com website is out of the question. But for young consumers, this might be their first (and last) interaction with the institution.