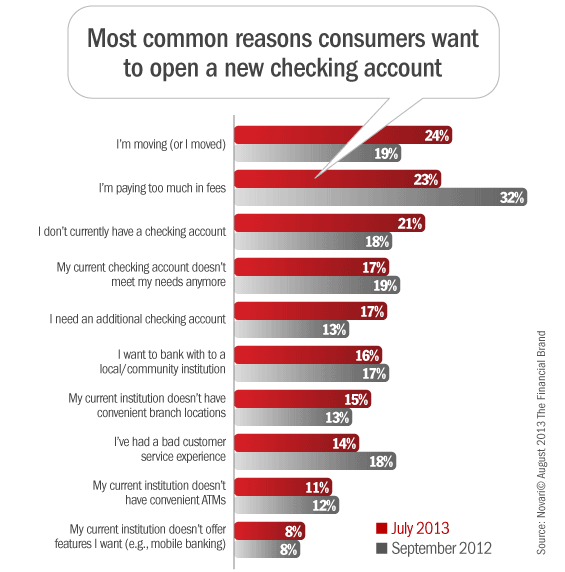

Bank Transfer Day, an organized effort to encourage consumers to switch banks over runaway bank fees, seems like a distant memory. Ten months ago, we asked consumers shopping for a new bank or credit union on FindABetterBank about the reasons they’re shopping, and nearly one-third indicated that high bank fees were a key factor in their rationale. But today, less than one-quarter of bank shoppers on FindABetterBank cite high bank fees as a reason why they are for shopping for a new bank.

Why is this?

Banks haven’t reduced or eliminated bank fees. In fact, in many cases, fees have actually increased. Also, most mega-banks have done away with free checking. The primary reason people get wound up about bank fees seems more related to media coverage than anything else. Most people are unaware exactly how much bank fees cost them each month because they don’t even bother to look at their bank statements.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

So if it’s not because of fees, why are shoppers looking for a new checking account now? Relocating (for work or personal reasons) has always been a primary driver of bank switching, and summertime is peak moving season. Other notable differences between this year’s query and the one fielded September 2012 include a decline in the percentage of shoppers indicating they’re switching because of a bad customer experience. There has also been increases in the number of shoppers currently without checking accounts and those looking for an additional account.