When a community bank recently decided to deploy an online account opening solution, their VP of marketing said their primary rationale was that this method was what younger consumers preferred. This is a reasonable assumption, because young consumers are indeed more digitally-centric than older segments of the population. But…

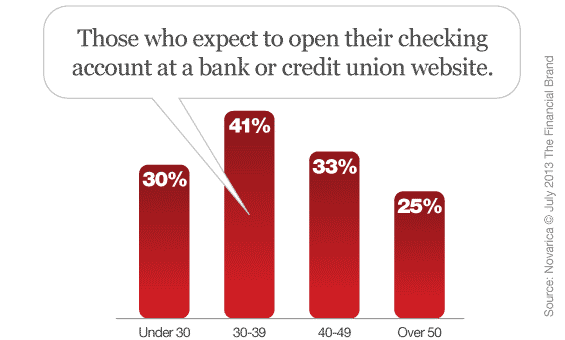

There’s an adage about online buying behavior: Consumers are only comfortable purchasing products or services online that they completely understand. And the reality is that many younger consumers shopping online for banking products have little- to no experience with banking products. A survey among checking account shoppers on FindABetterBank found that those under 30 were 30% more likely to say they didn’t have a checking account. It is this lack of experience that pushes many Gen-Y consumers into branches to open accounts. Checking account shoppers ages 30 to 39 are actually the group most likely to open accounts online. They want to save time, understand the products and are digitally-savvy enough to do it.

Read More: Checks Die While Online Thrives, But Gen-Y Still Use Branches

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Gen-Y Consumers Aren’t The Most Likely to Open a New Checking Account Online

Insights & Takeaways

Consumers of all ages are willing to open accounts online, but they must first have an understanding of the product category gained through first-hand experience. Once consumers are familiar with a particular type of product, they will be comfortable using technology to save time.

To help bring more young consumers over the finish line, banks and credit unions should:

- Put live chat on category and product pages. Young consumers are comfortable with using chat. Live chat could help address questions that someone might otherwise visit a branch to ask.

- Post customer reviews. For consumers that have grown-up shopping online, reviews help make shoppers feel comfortable moving forward.

Please visit Novarica for more information on consumers’ bank channel preferences.