At a recent an industry conference, Brett King delivered a compelling speech about how technology is going to eliminate the need for branches and other tangible, physical notions of banking like checking accounts. Over 1,000 bankers from brick-and-mortar banks across the U.S. listened with a mix of reactions ranging from “Yikes!” “How fast?” and “It’ll never happen to banks” to “I’m glad I’m retiring soon.”

The concept of branchless banks has been around a lonnnggg time. Who remembers NetBank and Wingspan? When they launched, they offered better online features but less convenient ways to deposit funds. Traditional banks’ online capabilities quickly caught up, and the upstarts flamed out.

In the mid-2000’s, online banks won over a subset of consumers with much better rates on deposit accounts, lower fees and excellent digital capabilities. But today’s low-rate environment has undercut one of their key selling features; who cares if the rate is 400% better than the competition when it’s still only 0.84%?!? Another factor working against online banks is that many consumers today still want nearby branches… even if they rarely ever step foot in one.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Read More: Consumer Hypocrisy Clouds Retail Branch Strategies

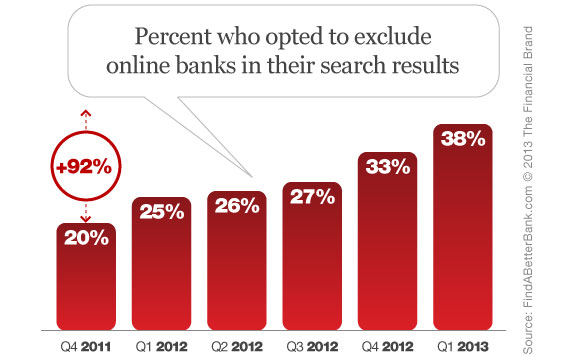

On FindABetterBank, users can exclude online banks from their search results by deselecting the pre-checked option. Since October 2011, more and more bank shoppers are choosing to exclude online banks from the range of financial institutions they are willing to consider. The steady decline of consumers willing to consider online banks suggests that consumers don’t believe today’s online banks offer enough advantages to make it worth surrendering the physical attributes they expect with a checking account.