In 2010 and 2011, banks saw a decline in revenue from overdraft fees because the Federal Reserve changed the rules about how banks can charge for “overdraft protection.” However, in 2012 banks turned the corner and reported higher fee revenue from overdraft protection. Why the increase? Slowly, banks have been raising overdraft-related fees like insufficient funds fees and overdraft protection transfer fees. But they may be hitting a ceiling for three consumer-driven reasons:

1.) Consumers have noticed the fee increases. In a recent survey on FindABetterBank, more than half of bank shoppers said they’re switching banks because they’re unsatisfied with their current institution. High fees were the most cited reason.

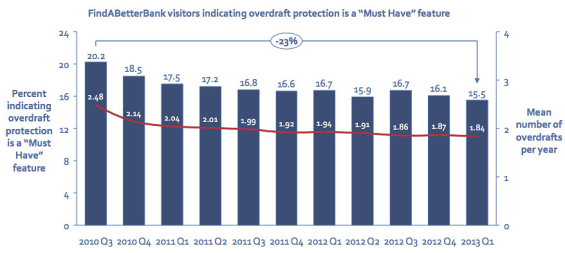

2.) Consumers are changing their behavior. Since 2010, there has been a steady decline in the percentage of shoppers on FindABetterBank indicating that overdraft protection is a “must have” feature (see Figure 1). In addition, consumers who must have overdraft protection are overdrafting less frequently than in the past.

3.) Consumers have better tools to avoid fees. Widespread adoption of mobile banking also has an impact on overdraft behavior, because it provides people with better access to account information and other tools to avoid fees. We recently asked smartphone owners what (if any) banking activities they do on their mobile phone, and 65% indicated they check their balances at least weekly.

Demand and use of overdraft protection will continue to decline as banks try to recover lost fee revenue and consumers adopt technology to help them avoid the fees banks want to recover.