Mobile wallets will revolutionize payments. But what do consumers know, what are they afraid of, and who are they counting on to provide the features they expect? Chadwick Martin Bailey asked nearly 1,500 smartphone owners to share what’s keeping them from adopting mobile wallet, and what’s going to push them to start using one.

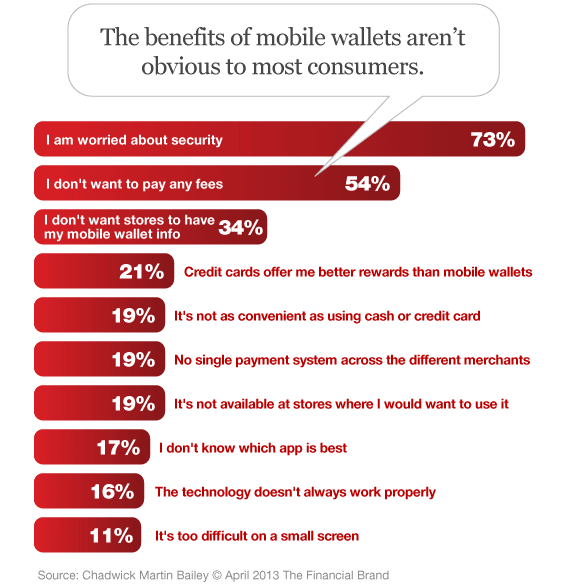

In “The Mobile Moment: Barriers and Opportunities for Mobile Wallets,” Chadwick Martin Bailey found that one-half of smartphone owners are familiar with mobile wallets, but many have reservations about adopting them. The research revealed that beyond allaying security concerns, mobile wallet providers must do more to articulate the advantages of the technology over more traditional forms of payment.

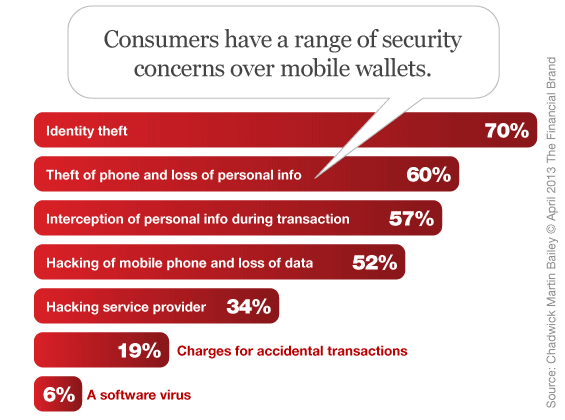

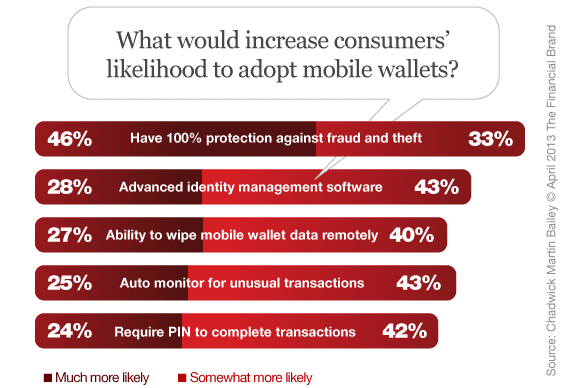

Concerns over security remain a significant barrier to adoption, but the promise of 100% fraud protection substantially increases willingness to adopt. Notably, these security-conscious smartphone users are the most likely to identify banks and credit card companies as their preferred mobile wallet provider. Mobile wallet providers who offer fraud and theft protection will be better positioned to drive adoption among mainstream consumers.

Read More: Will You Be Ready When Mobile Wallets Turn Banking Upside Down?

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Customers find the benefits of location-based services appealing, but privacy and battery life remain concerns. Respondents indicate location-based services that facilitate information gathering drive adoption, but too many alerts and offers are unappealing. Providers willing to allow users to customize the number and type of offers they receive will find an advantage.

While banks and credit card companies are the clear choice for the security conscious consumer, opportunities exist for other providers. Convenience, features, and usability are compelling attributes for many current and prospective mobile wallet users. While banks win on security, the feature-conscious prefer tech giants, with Amazon and Google topping the list as their preferred mobile wallet provider. For those who value convenience, credit card companies hold the advantage.

“These findings reveal that consumers are still in the early stages of understanding the uses and benefits of mobile wallets,” says Jim Garrity, SVP of Chadwick Martin Bailey’s Financial Services practice. “There remain many elements — players, features, positioning, etc. — that will evolve over the next 12 to 18 months.”

“With security concerns a key hurdle to adoption, banks are well-positioned as trusted providers of secure financial services,” Garrity adds. “But this window of opportunity won’t remain open for very long. Consumers already have the technology at their fingertips, and as familiarity increases, other entrants are proving that they are secure, reliable, and offer clear advantages that drive adoption.”