Note: All data based on NCUA 5300 call reports.

Average Asset Size: $3.9 billion

Median Asset Size: $2.6 billion

#1 by Assets: Navy Federal ($48.0 billion)

#100 by Assets: Connecticut State Employees ($1.6 billion)

Average Membership: 284,985

Median Membership: 200,426

#1 by Members: Navy Federal (3.9 million members, $48.0 billion assets)

#100 by Members: Melrose (24,285 members, $1.7 billion assets)

Average Marketing Budget: $3.9 million

Median Marketing Budget: $2.6 million

Average % of Assets Allocated to Marketing: 0.10%

Median % of Assets Allocated to Marketing: 0.10%

Average Marketing Dollars Allocated Per Member: $13.81

Median Marketing Dollars Allocated Per Member: $13.00

Most Marketing Dollars Allocated Per Member: Melrose ($203)

Least Marketing Dollars Allocated Per Member: State Farm (5¢)

Average Member Growth: 5.16%

Median Member Growth: 4.81%

Average Marketing Investment Per Net New Member: $281.48

Median Marketing Investment Per Net New Member: $223.00

Average Marketing Investment Per Branch: $190,954

Median Marketing Investment Per Branch: $102,278

Most Marketing Dollars Allocated Per Branch: Melrose ($4.9 million, 1 branch)

Least Marketing Dollars Allocated Per Branch: State Farm ($283, 24 branches)

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

1.) Credit unions spend more on marketing than you think.

Credit unions were once seen as a quaint, sleepy little corner of the financial industry. Not anymore. The top 10 credit unions invest $155 million annually on marketing, and the top 100 credit unions spend a combined $400 million on advertising and related educational expenses. Not many years ago, there weren’t many marketing vendors specifically targeting credit unions. It’s not hard to see why the credit union marketing business is no longer seen as a “cottage industry.” There’s some serious money at stake here. The Financial Brand estimates that the amount America’s 7,000+ credit unions invest in marketing annually flirts around the $1 billion mark. Still, that’s small potatoes compared to the estimated $2 billion BofA alone spends on marketing every year.

| Biggest Budgets |

Assets | Mktg. Budget | % of Assets Allocated to Mktg. |

Mktg. $ Per Member |

Asset Growth |

Member Growth |

Mktg. $ Per Net New Member |

|---|---|---|---|---|---|---|---|

| Navy | $48.0B | $77.0M | 0.16% | $20 | 8.83% | 6.27% | $333 |

| Pentagon | $15.1B | $14.1M | 0.09% | $13 | 0.35% | 6.99% | $199 |

| BECU | $10.6B | $13.0M | 0.12% | $17 | 10.39% | 11.25% | $168 |

| Suncoast Schools | $5.1B | $11.3M | 0.22% | $21 | 2.24% | 5.16% | $434 |

| Municipal | $1.8B | $7.1M | 0.39% | $21 | 6.88% | 2.92% | $733 |

| San Diego County | $5.7B | $6.6M | 0.12% | $29 | 11.31% | 7.59% | $406 |

| Mountain America | $3.2B | $6.6M | 0.21% | $17 | 9.71% | 7.72% | $241 |

| The Golden 1 | $7.8B | $6.6M | 0.08% | $11 | -0.29% | 2.86% | $385 |

| Security Service | $6.7B | $6.4M | 0.10% | $7 | 3.54% | 4.51% | $169 |

| American Airlines | $5.5B | $6.0M | 0.11% | $26 | 4.05% | 2.97% | $897 |

[top spenders]

2.) Some very large credit unions spend almost nothing on marketing.

All the credit unions in The Financial Brand’s study had assets in excess of $1.6 million, meaning they should typically have a marketing budget of at least $1 million. However ten of the credit unions in the study spent less than that in 2012. Merck Employees FCU’s marketing budget was only $124,961 last year, and APCO Employees was just a little bit more.

State Farm FCU ($3.8 billion in assets, 130,000 members) spent only $6,793 on marketing and advertising in all of 2012. Despite this, the credit union managed to grow assets by 3.08% and loans by 1.17%… but they also lost over 2,000 members in the process.

Similarly, Connecticut State Employees Credit Union ($1.6 billion in assets, 70,000 members) invested a paltry $14,697 on marketing last year. They eked out 2.50% asset growth, but an impressive 12.94% increase in loans. Unfortunately they lost 1,146 members along the way.

3.) Some credit unions are marketing extremely aggressively.

Normally, a credit union with $2 billion in assets would have a marketing budget around $2 million dollars. But there are a number of credit unions in the neighborhood of $2 billion spending over $4 million on marketing — more than twice as much as would be expected.

Municipal Credit Union tops the list. With a marketing budget that crests $7.1 million dollars, this $1.8 billion institution is spending nearly four times the normal amount on advertising. And Grow Financial spent $4 million for net member growth of -1.

Among these aggressive credit unions, the average marketing cost per net new member is substantially higher than average: over $1,000 vs. $281.

| Most Aggressive Marketers |

Assets | Mktg. Budget |

% of Assets Allocated to Mktg. |

Mktg. Per Member |

Asset Growth | Member Growth | Mktg. $ Per Net New Member |

|---|---|---|---|---|---|---|---|

| Municipal | $1.8B | $7.1M | 0.39% | $21 | 6.88% | 2.92% | $733 |

| Melrose | $1.7B | $4.9M | 0.29% | $203 | 17.20% | 5.14% | $4,148 |

| Georgia’s Own | $1.7B | $4.6M | 0.26% | $24 | 3.67% | 11.15% | $244 |

| CommunityAmerica | $1.9B | $5.0M | 0.26% | $29 | 6.71% | 1.77% | $1,684 |

| MidFlorida | $1.7B | $4.2M | 0.25% | $27 | 5.86% | 5.31% | $534 |

| Grow Financial | $1.8B | $4.0M | 0.22% | $26 | 5.51% | 0.00% | N/A |

| Suncoast Schools | $5.1B | $11.2M | 0.22% | $21 | 2.24% | 5.16% | $434 |

| Founders | $1.7B | $3.6M | 0.22% | $19 | 4.47% | 1.07% | $1,788 |

| Citadel | $1.8B | $3.9M | 0.21% | $29 | 16.80% | 7.77% | $398 |

| MSU | $2.3B | $4.7M | 0.21% | $28 | 10.11% | 5.33% | $557 |

4.) Some credit unions are spending thousands of dollars for every new member.

The average large credit union added around 14,000 net new members last year, spending $281 per net new member on marketing. However, there are credit unions spending thousands of dollars just to pick up a few new members.

Western FCU, with $1.7 billion in assets and 154,000 members, had a marketing budget of over $3 million dollars in 2012 but only netted 105 new members at an average cost of just over $30,000 each. Melrose Credit Union paid over $4,000 per net new member, adding 1,187 to its 24,000 members (5.14% growth). But based on Melrose Credit Union’s highly lucrative audience, this may well be worth it.

| Most Marketing Dollars Per New Member |

Mktg. Budget |

Members | Net New Members |

Member Growth |

Mktg. $ Per Net New Member |

|---|---|---|---|---|---|

| Western | $3,173,556 | 154,231 | 105 | 0.07% | $30,224 |

| Melrose | $4,924,108 | 24,285 | 1,187 | 5.14% | $4,148 |

| Atlanta Postal | $888,343 | 100,232 | 443 | 0.44% | $2,005 |

| Founders | $3,568,328 | 189,375 | 1,996 | 1.07% | $1,788 |

| San Antonio | $2,455,297 | 255,511 | 1,402 | 0.55% | $1,751 |

| CommunityAmerica | $4,966,969 | 169,631 | 2,950 | 1.77% | $1,684 |

| California Coast | $1,796,617 | 118,507 | 1,707 | 1.46% | $1,052 |

| Patelco | $1,352,226 | 273,013 | 1,484 | 0.55% | $911 |

| American Airlines | $6,023,159 | 232,948 | 6,712 | 2.97% | $897 |

| Citizens Equity | $4,980,944 | 287,962 | 6,088 | 2.16% | $818 |

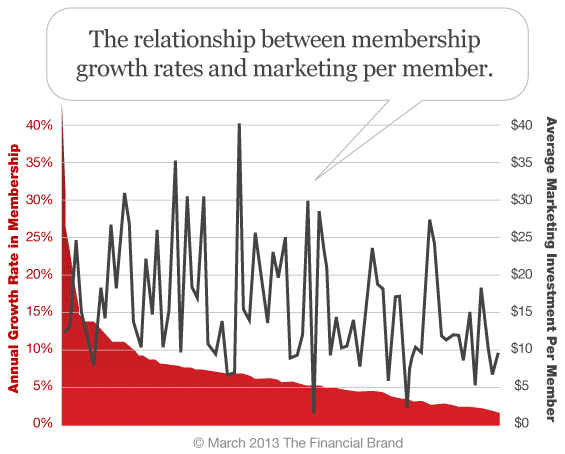

5.) Credit unions that invest more marketing dollars per member see larger membership growth, asset growth and loan growth.

In The Financial Brand’s study, there was no stronger correlation between two variables than “Membership Growth” and “Average Marketing Dollars Allocated Per Member.” Those that invested less than $10 per member saw net negative membership growth of -3.90%. But those credit unions allocating slightly more than $15 per member enjoyed membership growth hovering around +15%.

| Mktg. Spend Per Net New Member |

Mktg. $ Per Member |

Member Growth |

% of Assets Allocated to Mktg. |

Mktg. $ Per Branch |

Asset Growth |

Loan Growth |

|---|---|---|---|---|---|---|

| Over 10% Member Growth | $16.78 | 14.85% | 0.12% | $144,564 | 12.67% | 8.16% |

| Member Growth Between 5% and 10% | $14.94 | 6.52% | 0.11% | $153,66 | 8.52% | 3.21% |

| Member Growth Between 0% and 5% | $12.09 | 2.97% | 0.09% | $107,488 | 6.20% | 1.99% |

| Negative Member Growth | $9.59 | -3.90% | 0.07% | $71,863 | 6.56% | -0.36% |

Look at the chart below and you’ll see that most credit unions budgeting $15 or more to marketing per member saw member growth exceed +5%.

What Are Your Questions About Credit Union Marketing Budgets

The Financial Brand is happy to answer your questions. We have a lot of data, so tell us what you want to know. Leave a comment below, and we’ll try our best to dig through the research and find an answer for you.