This study encompassed 314 banks on Twitter, estimated to represent around 4.2% of all U.S-based deposit-taking retail institutions in the U.S. and at least 20% of all such banks on Twitter. Only banks that sent at least one tweet from a public Twitter account with a customized profile were included. Banks with uncustomized or protected accounts, and those with no tweets or followers were ignored. This is believed to be the first and only public study of its kind in the retail banking industry.

The Prototypical Bank on Twitter

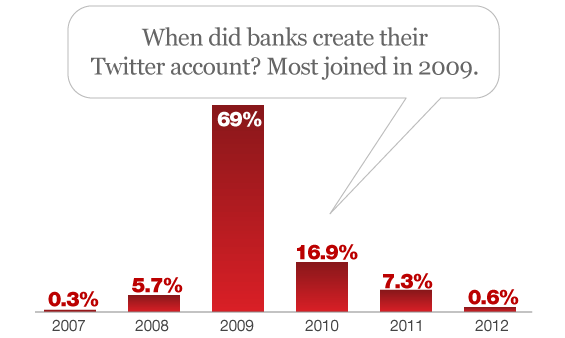

If you took the 314 banks in this Twitter study and picked one right in the middle (#157, the median), this is what that bank would look like: They would have launched their account in late September 2009, accruing 277 followers since then — an average of one new follower gained every four days. During that time, they would have sent around 330 total tweets, or one about every 3-4 days. They’d follow no more than 100 accounts back.

Twitter Quitters

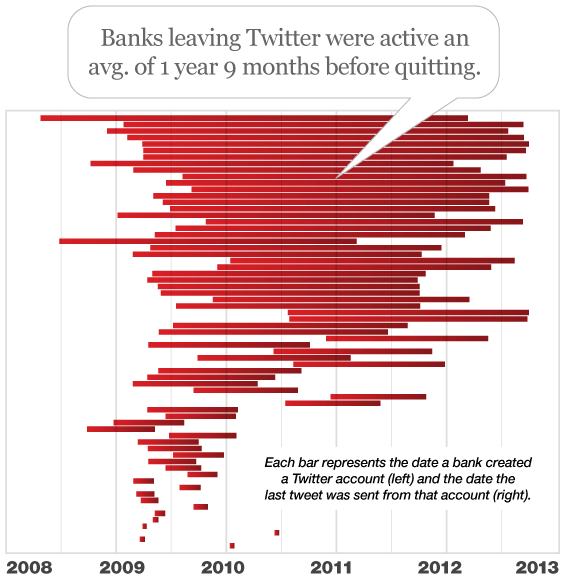

A total of 67 accounts (21.3%) were found to be dormant or abandoned entirely. Accounts considered dormant or abandoned did not send a tweet in at least the last 6 weeks. That means more than one in five banks launching a Twitter initiative gave up (21.3%). This is nearly identical to the number of credit union Twitter quitters The Financial Brand identified back in February — 74 of 350 credit unions studied, or 21.1%.

But banks didn’t roll over as easily as you might suspect. The average bank quitting Twitter sent an average of 128 tweets over a period of 1 year and 9 months before throwing in the towel.

Six of the 18 banks that adopted Twitter in 2008 have since shut down their accounts. 51 of the 67 banks quitting Twitter had started their account in 2009 (76%), while only 10 that started in 2010 have quit.

The bank on Twitter longest before surrendering — Foster Bank — had created their Twitter account way back in April 2008 and kept it account active until March 2012. Their 1,527 followers haven’t heard a peep from them in seven months.

Another bank walked away from their account after sending 1,107 tweets over a period stretching two years.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Follower Growth

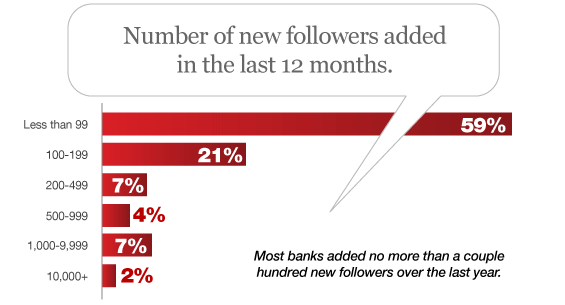

18.4% of banks at least doubled their follower base in the last year, but only 15 total (5.3%) saw increases of more than 200%. The average annual growth rate was 90%. The median, however, was only 51.1% — meaning half the banks studied only added one new follower (or less) for every two followers they had the year prior.

84.5% of banks added less than 400 followers in the last year — less than one per day. Five banks actually lost followers over the past 12 months, with Pinnacle Bank (SC) losing the most — a net loss of 348 followers, down to 5,132.

Total # of followers (all 314 banks): 626,164

Median # of followers: 277

Average # of followers: 1,994

Number of accounts with over 1,000 followers: 45 (14.3%)

Number of accounts with less than 200 followers: 141 (44.9%)

Average # followers added per day: 1.97

Most followers of any bank: 106,959 (Citi)

| Ranked by Net New Followers |

New Followers in Last Year |

Total Followers Today |

% YoY Follower Growth |

Avg. Followers Added Per Day (All-Time) |

Avg. Followers Added Per Day (Last Year) |

|

|---|---|---|---|---|---|---|

| 1 | Citi | 96,925 | 106,959 | 966% | 94.2 | 265.5 |

| 2 | BofA Community | 67,408 | 98,424 | 217% | 130.7 | 184.7 |

| 3 | BofA News | 49,754 | 56,734 | 713% | 75.9 | 136.3 |

| 4 | Wells Fargo | 18,293 | 31,250 | 141% | 15.1 | 50.1 |

| 5 | USAA | 16,154 | 36,614 | 79.0% | 24.4 | 44.3 |

| 6 | BofA Help | 13,730 | 31,598 | 76.8% | 22.5 | 37.6 |

| 7 | TD Bank US | 8,922 | 13,193 | 209% | 11.2 | 24.4 |

| 8 | BofA Careers | 8,120 | 20,453 | 65.8% | 20.3 | 22.2 |

| 9 | Ally | 7,287 | 9,563 | 320% | 10.2 | 20.0 |

| 10 | Union Bank | 4,784 | 5,146 | 1322% | 3.5 | 13.1 |

| Ranked by % Increase in New Followers |

% YoY Follower Growth |

New Followers in Last Year |

Total Followers |

Avg. Followers Added Per Day (All-Time) |

Avg. Followers Added Per Day (Last Year) |

|

|---|---|---|---|---|---|---|

| 1 | FirstMerit Bank | 3980% | 398 | 408 | 0.3 | 1.1 |

| 2 | Union Bank | 1322% | 4,784 | 5,146 | 3.5 | 13.1 |

| 3 | Citi | 966% | 96,925 | 106,959 | 94.2 | 265.5 |

| 4 | BofA News | 713% | 49,754 | 56,734 | 75.9 | 136.3 |

| 5 | Citi Jobs | 557% | 4,297 | 5,068 | 4.1 | 11.8 |

| 6 | Huntington Bank | 504% | 3,376 | 4,046 | 3.6 | 9.2 |

| 7 | MB Financial | 349% | 611 | 786 | 0.7 | 1.7 |

| 8 | Fifth Third | 339% | 1,877 | 2,431 | 3.6 | 5.1 |

| 9 | Ally | 320% | 7,287 | 9,563 | 10.2 | 20.0 |

| 10 | Associated Bank | 317% | 736 | 968 | 2.0 | 2.0 |

Tweeting Activity

Of those banks actively tweeting in the past year, one in four averaged at least one tweet per day. 50% of banks studied sent less than one tweet every three days. One in 10 banks (11.3%) sent fewer than 20 tweets… that’s total — all year long.

Three banks actually deleted tweets, resulting in a net negative for the number of tweets they “sent” last year. For instance, the number of tweets Secure Trust Bank has sent (all-time) dropped from 43 to only 5 showing now.

Total # of tweets sent (all 314 banks in the study): 475,330

Median # of tweets sent: 330

Average # of tweets sent per bank: 1,514

Average # of tweets sent per day per bank: 1.49

Most tweets sent by a single bank (all-time): 127,958 or 91 per day (BofA_Help)

| Ranked by Most Tweets Sent Last Year |

New Tweets Sent in Last Year |

Total Tweets Sent All-Time |

Avg. Tweets Per Day Last Year |

Followers Added Per New Tweet |

|

|---|---|---|---|---|---|

| 1 | BofA Help | 79,852 | 127,958 | 56.92 | 0.17 |

| 2 | TD Bank US | 19,558 | 27,467 | 16.60 | 0.46 |

| 3 | Ask SunTrust | 17,449 | 34,890 | 14.86 | 0.09 |

| 4 | Citi Help | 11,996 | 20,586 | 10.67 | 0.27 |

| 5 | Ally | 8,141 | 12,985 | 8.72 | 0.90 |

| 6 | State Bank of WW | 4,764 | 7,492 | 4.44 | 0.03 |

| 7 | Citizens | 4,013 | 5,537 | 5.42 | 0.43 |

| 8 | Citi | 3,011 | 5,799 | 2.65 | 32.19 |

| 9 | BofA Careers | 2,587 | 7,629 | 2.56 | 3.14 |

| 10 | North Shore | 2,389 | 5,282 | 1.49 | 0.36 |

Tweeting Efficiency

One way to evaluate banks’ use of Twitter is to compare the number of tweets they send to the number of new followers they add. You could call this a “tweeting efficiency” ratio. Those banks who send out few tweets but get the most followers in return have a “high tweet efficiency,” while those who send out disproportionately more tweets than they get followers could be considered to have a “low efficiency.” Here are the top 10 most efficient tweeters — those who yielded the biggest bang for a minimal investment. Bottom line: Sending out a bunch of tweets is no guarantee you’ll get a ton of followers.

| Ranked by Tweet Efficiency |

New Followers Per Tweet in Last Year |

New Followers in Last Year |

New Tweets in Last Year |

Total Followers Today |

% YoY Follower Growth |

|

|---|---|---|---|---|---|---|

| 1 | BofA News | 100.31 | 49,754 | 496 | 56,734 | 713% |

| 2 | BofA Community | 80.34 | 67,408 | 839 | 98,424 | 217% |

| 3 | Citi | 32.19 | 96,925 | 3,011 | 106,959 | 966% |

| 4 | Wells Fargo | 12.50 | 18,293 | 1,464 | 31,250 | 141% |

| 5 | USAA | 7.86 | 16,154 | 2,056 | 36,614 | 79.0% |

| 6 | BofA Tips | 8.87 | 2,634 | 297 | 4,461 | 144% |

| 7 | First National Bank TX | 7.55 | 83 | 11 | 221 | 60.1% |

| 8 | Union Bank | 4.69 | 4,784 | 1,019 | 5,146 | 1322% |

| 9 | Square 1 Bank | 4.11 | 230 | 56 | 670 | 52.3% |

| 10 | HomeTown Bank | 5.33 | 96 | 18 | 438 | 28.1% |

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Sorry, Not Following You

Social media experts are constantly nagging banks to use social channels to “listen.” Well, it’s pretty darn hard to “listen” on Twitter if you aren’t following anyone. Sure, banks might be using social media monitoring software… but you know most aren’t.

The average bank follows one account for every 3-4 followers they have. Of the 314 banks studied, 40 follow more accounts than they have followers.

Banks that follow fewer than ten accounts will struggle to ever break 1,000 followers themselves — most will have 175-300 followers.

One common theory among social media experts is that you can boost the number of Twitter users following you if you go out and follow a bunch of accounts yourself. This theory does seem to bare itself out in the study’s data; those banks who added the most followers also started following the most new accounts.

Total # of accounts followed (all 314 banks): 184,628

Median # of accounts followed: 98

Average # of accounts followed: 588

Number of banks following no one: 19 (6.1%)

Number of banks following 10 accounts or less: 59 (18.8%)

Most accounts followed by one bank: 34,501 (BofA_Help)

| Ranked by Most Accounts Followed |

Following 2012 |

Following 2011 |

New Accounts Followed in 2012 |

Followers Total |

New Followers in Last Year |

Ratio of Followers to Following |

|

|---|---|---|---|---|---|---|---|

| 1 | BofA Help | 34,501 | 15,850 | 18,651 (#1) | 31,598 | 13,730 (#6) | 0.9:1 |

| 2 | USAA | 25,895 | 7,481 | 18,414 (#2) | 36,614 | 16,154 (#5) | 1.4:1 |

| 3 | Wells Fargo Help | 14,701 | n/a | n/a | 15,433 | n/a | 1:1 |

| 4 | Citi Help | 10,158 | 6,497 | 3,661 (#4) | 9,317 | 3,240 (#14) | 0.9:1 |

| 5 | TD Bank US | 7,104 | 3,802 | 3,302 (#5) | 13,193 | 8,922 (#7) | 1.9:1 |

| 6 | Pinnacle Bank SC | 5,426 | 5,543 | -117 (last) | 5,132 | -348 (last) | 0.9:1 |

| 7 | Citi | 4,692 | 4,428 | 264 (#29) | 106,959 | 96,925 (#1) | 23:1 |

| 8 | USAA Help |

3,866 | 1,210 | 2,656 (#6) | 6,565 | 2,067 (#16) | 1.7:1 |

| 9 | Citi Jobs | 3,830 | 0 | 3,830 (#3) | 5,068 | 4,297 (#11) | 1.3:1 |

| 10 | PNC Virtual Wallet | 3,317 | 2,184 | 1,133 (#9) | 4,025 | 1,846 (#18) | 1.2:1 |

Account Longevity

Average # of years active on Twitter: 1.97

Banks active on Twitter less than a year: 28 (12.1%)

Banks active on Twitter for 1 year: 32 (10.2%)

Banks active on Twitter for 2 years: 78 (28.4%)

Banks active on Twitter for 3 years: 166 (52.9%)

Banks active on Twitter for 4+ years: 9 (3.2%)

Bank on Twitter the longest: Wells Fargo (5.7 years)

There doesn’t appear to be any correlation between when accounts were created and follower growth. In other words, there is no real, significant advantage (at least in terms of follower growth) to being an early adopter.

There seems to be only one thing that can spike massive follower growth: Twitter Verification. Only banks big enough to partner with Twitter can get verified because they are the only ones who can afford to pay for promoted tweets and accounts. (Twitter only verifies accounts for celebrities and its advertisers.) Basically, if you’re big enough, you can buy followers. Only three of the following 15 accounts aren’t verified by Twitter: USAA, USAA Help and Citi Jobs.

| Ranked by Highest Daily Follower Growth |

Avgerage Followers Added Per Day |

Account Created |

Years Active |

Total Followers |

|

|---|---|---|---|---|---|

| 1 | BofA Community | 130.7 | 2010 Oct | 2.1 | 98,424 |

| 2 | Citi | 94.2 | 2009 Oct | 3.1 | 106,959 |

| 3 | BofA News | 75.9 | 2010 Oct | 2.0 | 56,734 |

| 4 | USAA | 24.4 | 2008 Oct | 4.1 | 36,614 |

| 5 | BofA Help | 22.5 | 2009 Jan | 3.8 | 31,598 |

| 6 | Chase | 21.9 | 2010 Feb | 2.7 | 21,995 |

| 7 | BofA Careers | 20.3 | 2010 Feb | 2.8 | 20,453 |

| 8 | Wells Fargo | 15.1 | 2007 Mar | 5.7 | 31,250 |

| 9 | TD Bank US | 11.2 | 2009 Aug | 3.2 | 13,193 |

| 10 | Ally Bank | 10.2 | 2010 Apr | 2.6 | 9,563 |

| 11 | Citi Help | 8.3 | 2009 Oct | 3.1 | 9,317 |

| 12 | PNC News | 5.4 | 2009 Dec | 2.9 | 5,700 |

| 13 | USAA Help |

4.3 | 2008 Sep | 4.2 | 6,565 |

| 14 | Citi Jobs | 4.1 | 2009 Jun | 3.4 | 5,068 |

| 15 | BofA Tips | 4.1 | 2009 Nov | 3.0 | 4,461 |

Why Don’t More Banks Give Up?

Nearly two-thirds of banks on Twitter have less than 200 followers. Three in five added fewer than 100 new followers last year. 83% add less than one new follower every two days. Two thirds sent less than 200 tweets in the past 12 months, and a third have sent fewer than 200 tweets ever. And yet they’ve been at it an average of two years.

It makes you wonder… Why don’t more banks just give up already?

There are two kinds of financial institutions on Twitter: a handful who take it seriously (mostly big banks)… and everyone else, who should probably ask themselves, “Why bother?”

Many are just going through the motions, spewing lame tweets about rate changes or happy holiday wishes. These guys can probably find more productive things to do with their time.