ASB Bank in New Zealand is among the first banks in the world to pioneer interactive, two-way video banking applications for mobile phones and tablet devices. If customers can get face-to-face service over the internet, why would they ever need to step foot in a branch again?

Cutting-edge video technology will soon allow ASB customers to connect directly with banking specialists face-to-face, at a time and place convenient to them. ASB’s move comes as the result of a partnership agreement signed with New Zealand technology company FaceMe who will provide ASB with its browser-based video conferencing system.

Customers can make a video-call appointment in advance by phone, email or in-branch and then connect to a banking specialist at the appointment time through a simple email link that automatically starts the video call. ASB expects the technology will be popular for customers wanting to discuss insurance needs, home loans and business lending, and will allow greater flexibility to small businesses who will be able to talk directly with their banker outside of normal business hours.

ASB and FaceMe say the video banking environment is 100% secure.

The FaceMe system works on almost all computers, allowing customers to connect directly with ASB representatives over a secure video-conferencing platform — all without the need for the customer to download any additional software.

The service also allows for the secure sharing of documents, making customer support interactions as robust and functional as a real face-to-face meeting, meaning banking issues can be addressed without customers ever stepping foot in a branch.

With initial testing complete, a full pilot program for the technology is currently underway. ASB anticipates a full rollout to the public sometime in the near future.

The service will also be available on mobile devices within the next few months, and additional video banking services such as account opening are under development.

“Video technology has matured to the point where lifelike video conversations, combined with live document sharing can provide a rich and satisfying experience for customers,” says Ian Park, ASB’s Executive General Manager for Retail & Business Banking. “We believe that the New Zealand market, with its geographically dispersed and often time-challenged population will see some real benefits in having a simple, convenient and effective channel to engage with their bank when and where they want to.”

“It’s a very exciting development in the sense that it provides a new level of choice and convenience to customers who may live some distance from a branch or who don’t have the time or interest to attend a physical meeting with their bank,” adds Mr. Park. “Direct video is a new channel that will complement our existing branch network and contact center in addition to the other technology-based services we have launched recently such as our upgraded ASB mobile banking app and our Facebook Virtual Branch.”

ASB has been at the forefront of the adoption of video technology in New Zealand. Besides their radical Facebook Virtual Branch, the bank has offered in-branch video banking for some time, enabling branch visitors to connect with off-site financial specialists.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Video Banking: Great on Personal Internet Devices, Silly in Branches

Banks have been flirting with two-way video conferencing for years now. There are some financial institutions that have swapped video tellers for live people at all their branches. Others have built kiosks at malls where users can interact with bank staff remotely through two-way video.

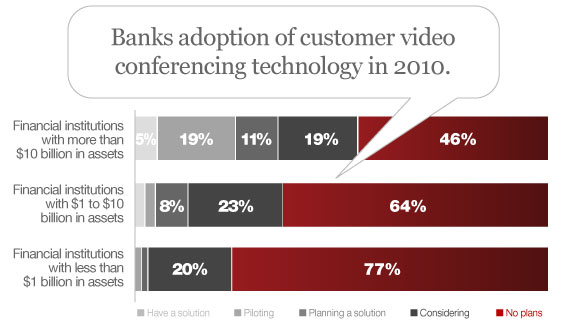

In a 2010 survey, research firm Celent found desktop video conferencing (for customer use) among the least likely deployed of any of the technologies studied in the research. Overall, just 10% of FIs surveyed had or were piloting solutions and another 7% were planning to implement a desktop videoconferencing solution. Larger banks were more likely to be considering.

These days, there are a number of banks experimenting with video conferencing in branches — BofA, BMO, Citizens Bank, ABSA and many others. They all tout the “convenience” of being able to interact with knowledgeable financial experts, that customers can access more experts than they would otherwise. But they all seem to ignore the fact that asking a customer to get in their car and drive to a branch to conduct a two-way video conference in the branch is a major inconvenience. Why can’t people just video chat from the comfort of home? This is the big technological leap ASB has made.

Bottom Line: Despite the financial industry’s enthusiasm for in-branch two-way video, this service is little more than a novelty with a short life and limited usefulness. The only future for video banking is putting it on customers’ laptops, mobile phones and tablet devices. Asking people to drive anywhere to do anything on the internet is simply ridiculous. But once bankers figure out how to deliver video banking the right way, the role and number of physical branches will constrict severely.