Barclaycard US has introduced the Barclaycard Ring MasterCard, the first social credit card to be designed and built through the power of community crowdsourcing.

The new card will offer a low interest rate, low fees, simple terms and the opportunity for cardmembers to shape and share in the product’s financial success.

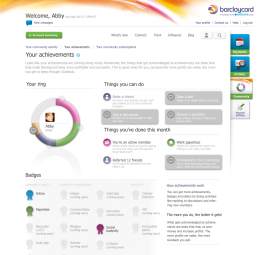

The online community leverages a social media forum where cardmembers can exchange ideas, share knowledge and provide direct feedback to Barclaycard Ring to help determine future features of the product. The community will also provide a forum where cardmembers can exchange ideas, share knowledge and provide direct feedback to Barclaycard US to help determine future features of the product.

Cardmembers will help determine how the card is managed, and a unique Giveback program will enable the community to share in the profit generated from its collective decisions.

Community members will be also able to view the card’s financial profit and loss statements, something Barclays says is a first.

“We want to change the way people think about credit cards and their credit card company by putting the power back in the hands of customers,” said Paul Wilmore, Managing Director/Consumer Markets, Barclaycard US. “Barclaycard Ring will give cardmembers a voice to help decide how the card can best work for them — along with the unique opportunity to benefit from its collective performance.”

The Barclaycard Ring MasterCard will have one, low interest rate of 8% for all balances. There will be no balance transfer fee, no annual fees and simple, easy-to-understand terms.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

“Through simple and transparent terms, we want to pull back the curtain that has traditionally separated banks from their customers and give our community a say in weighing economic tradeoffs that can create a better cardholder experience,” Mr. Wilmore added. “Some might say we’re creating a virtual credit union or community bank, but we’re taking that model much further by giving our members a seat at the table to help decide what card features and benefits are really best for them.”

Barclaycard Ring first launched in alpha testing in December 2011, and will open to consumers in April 2012.

More About Barclaycard

Barclaycard, part of Barclays Global Retail Banking division, is a leading global payment business that helps consumers, retailers and businesses to make and accept payments flexibly, and to access short-term credit when needed.

Barclaycard operates in the United States, Europe, Africa and the Middle and Far East.

The company is one of the pioneers of new forms of payments, and is at the forefront of developing viable contactless and mobile payment options for today and cutting edge forms of payment for the future. It also issues credit and charge cards to corporate customers and the British Government. Barclaycard partners with a wide range of organizations across the globe to offer their customers or members payment options and credit.

Headquartered in Wilmington, Delaware, Barclaycard US creates customized, co-branded credit card programs for some of the country’s most successful travel, entertainment, retail, affinity and financial institutions. The company employs 1,300 associates.