Most social media initiatives undertaken by banks and credit unions represent a misapplication of resources (e.g., posting Facebook updates about Saturday hours and tweets promoting International Credit Union Day); they simply have more important things they could be doing. But that is not to say “social media is useless.” There are certainly some specific applications where social media can be beneficial, such as the following five examples…

*Along with some fairly significant caveats.

#1) Peer-to-peer networking and professional development

With the financial industry fixated on sexy consumer-facing social media initiatives, a much more dull — but arguably more productive — facet of social media is often overlooked. Social media’s greatest potential for financial marketers isn’t its power to “generate buzz by building social currency” (whatever that means). Social media’s real power is its ability to connect people who share common interests — whether that be equestrians or financial marketers.

Using social networking tools like Twitter, blogs and LinkedIn, you can find literally thousands of bank and credit union marketers exchanging ideas and information. Knowledge that was once considered highly proprietary is now freely shared between vendors, analysts, consultants and trade press across the financial industry. These days, if you have a question, you can turn to your online social network for fast answers. It’s almost better than Google.

Ten years ago, this level of knowledge-sharing was inconceivable. Vendors — sworn enemies — never spoke to each other, not even at tradeshows. Bank X kept a polite distance from Bank Y down the street, and neither of them ever said boo to any credit union anywhere…ever. All this has changed. Vendors and consultants improve each other’s ideas and processes while talking about perfecting “best practices.” Execs at financial institutions who may be competitors are now Facebook friends and follow each other on Twitter.

For financial marketers, social media tools have become almost more valuable than industry conferences. To keep yourself abreast of the latest developments in the retail banking industry, you simply must get involved in social media at a personal/professional level.

Caveat: Don’t kid yourself into thinking that sitting around tweeting with peers all day will have a direct impact on your organization’s bottom line. Sure you will become a smarter marketer, but this kind of activity is classified as “professional development” — a form of continuing education akin to reading trade magazines or attending a seminar. Indirectly, it can have a profound effect on your marketing activities, but that requires you be good at (1) separating B.S. from sound, strategic thinking, and (2) actually applying what you learn. If you sit around doing little more than swapping shop talk and pithy anecdotes with cohorts, don’t expect your boss to be super thrilled. You still need to demonstrate an organizational return for the ways in which you invest your time.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

#2) Listening

When social media enthusiasts implore people to “jump in and join the conversation,” they don’t mean “open your mouth and start blathering.” What they really mean is that there are some very interesting conversations occurring in social media spaces, and some of them may be relevant to you.

There are two ways you can “listen” to the social web: passively and proactively. With the passive approach, you are simply trying to eavesdrop on conversations that occur organically and naturally among regular consumers. With the proactive approach, you are actively trying to stimulate these conversations with questions and dialogue.

Reality Check: If you really want to know what people think about you, listen to what they say when they think you’re not around.

THE PASSIVE APPROACH

With the myriad of social media monitoring tools available today, it’s easy to automate searches for consumers mentioning your brand on the internet. You can start by setting up Google Alerts and Twitter searches. If you’re ready for something more advanced, consider buying an integrated tool from a company like CoTweet or Radian6.

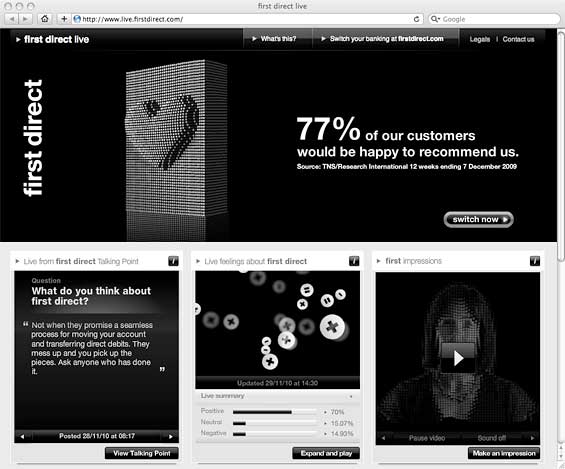

Firstdirect has a microsite that streams people’s raw sentiments about the bank — both good and bad — in a very open and transparent way. The comments are all scraped from social media sites.

Caveat: Just because you’ve invested time and money into monitoring the social web does not mean you’ll find (m)any people talking about you. For smaller financial institutions — those with less than $500 million in assets and fewer than 50,000 customers — you aren’t likely to see more than a handful of references, and even then, they will likely be casual and/or insignificant mentions.

BofA’s VP of Social Spaces has told The Financial Brand that the bank is mentioned around 1,250 times a day on Twitter. While that might sound impressive, it only works out to around 0.0017% of BofA’s 75,000,000 customers. And remember we’re talking about a huge, well-known, international brand that has invested literally billions of dollars into its image over the last 100 years. Using BofA’s customer-to-tweet ratio, a financial institution with 20,000 customers would be lucky to see 10 tweets a month about its brand — hardly anything to get excited about.

There is another challenge involved with a passive approach to listening. Many people — especially those who are customers at smaller financial institutions — refer to their financial institution as simply “my bank” or “the bank” (a problem compounded by the commoditization of financial services). And for those financial institutions sharing similar/identical names, you may need to sort through 50 false-positives before finding a single relevant mention. If your name includes words like “Community,” “First,” “Federal,” “National” or any of the other terms commonly used by financial institutions, you might find monitoring the social web isn’t worth the hassle.

THE PROACTIVE APPROACH

This isn’t complicated. You simply ask questions. “What do you think we should be doing differently?” “What do you think about our new policy on overdraft fees?” This approach uses social media tools to solicit feedback.

Stimulating social media dialogue proactively can take many forms. You can ask questions on platforms like Facebook and Twitter (provided you have more than just a couple hundred followers). You could create a blog hosted by your CEO. Or you can create a forum, as USAA did with its “What’s On Your Mind” project. For some financial institutions, this idea has transcended the internet and jumped into the real world, with things like HSBC’s “Soapbox” or Westpac’s “Truth Pod.”

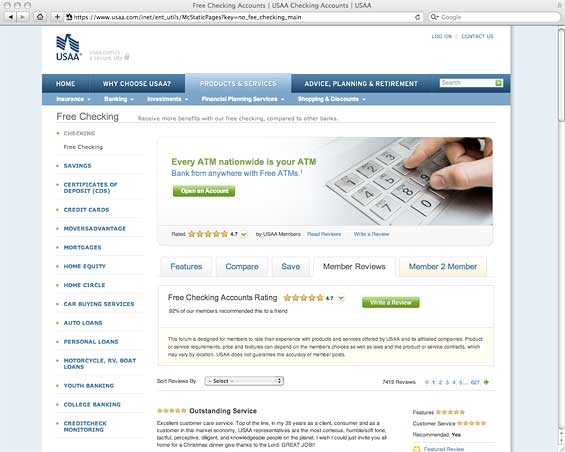

One of the best ways to utilize the concept of social media is to invite and publish customer reviews on your website, as both USAA and America First have done.

USAA has 7,417 reviews of its ‘No Fee Checking Account.’

Caveat: This approach is not for thin-skinned management teams. People are going to tell you that you suck, why they hate you and why no one should ever do business with you. You will also receive many suggestions for things you could never realistically implement. How will people respond when you only act on one out of every 100 suggestions? You have to be willing to adapt, and have the ability to be flexible. Can you work around the limitations of your core data system?

If you can pull it off, allowing people to rate and comment on your services and products should result in two things: 1) It should encourage your organization to hold itself accountable, and 2) provide meaningful, useful information to financial shoppers.

#3) Resolving Customer Issues

In many ways, the social web can be viewed as essentially as one giant virtual comment card. If you find people complaining about your financial institution on the web, consider yourself lucky. Set up Google Alerts and Twitter searches, and look specifically for things like “[your bank] sucks” and “hate [your bank].” Reach out to those with whom you feel you can reason with. Always apologize, and offer options that help reach a resolution. There is real, measurable impact on your organization’s bottom line whenever you successfully defeat attrition, so this is not wasted energy. Every time you rescue a relationship, you are not only retaining business, you are creating a potential brand evangelist. People who have been flipped from “completely pissed” to “completely satisfied” are the most likely to become avid brand fans.

BofA was the first bank to provide customer service via Twitter, followed by Wells Fargo, Wachovia and others. Now they all have dedicated Twitter teams and fancy CMS tools to manage their Twitter-based customer service interactions.

A team of six employees spends the day responding to those who have encountered problems with BofA. Now some customers believe it’s faster and more effective to head straight to Twitter than to bother calling an automated 800 number.

But you don’t need to be on Twitter to provide next-generation customer support. For example, you can text “unhappy” to the State Bank of India and they guarantee they will respond to your complaint within 48 hours.

Caveat: The rules of scale apply. This approach really only makes sense for larger financial institutions. If you don’t have a lot of customers, you simply won’t find a lot of people moaning about you online. Besides, consumers are a lot more rash with big banks than they are with little ones. A Citibank customer may feel like a helpless, insignificant number whose only option is to vent on Twitter, whereas a community bank customer might be more inclined to pick up the phone and call Jane, the local branch manager.

Also, nothing freaks financial institutions out more than compliance and privacy issues, and there are plenty of those involved with providing customer service through social media platforms. What happens when someone accidentally shares account information on Twitter? Or when your Twitter account gets hacked? Or when a third-party app can see private messages?

#4) Corporate social responsibility initiatives

If you give money away to charitable organizations, you can use social media tools like blogs, Facebook and Twitter to help your financial institution allocate its donations. Umpqua Bank’s “Click 4A Cause” giveaway pitted a community garden, a youth money program and a kids food bank against each other. A public vote determined who got the most.

Umpqua Bank’s “Click 4A Cause” promo had three charities slug it out for online votes.

Most famously, Chase gave away $5 million to charities via a Facebook promotion that ultimately led to 2,510,642 “fans” on the bank’s page. Of course, we’re talking about $5 million dollars (you give away how much? $25,000?) donated by a bank that’s so large, it has more employees (236,810) than many financial institutions have in their entire geographic area.

Reality Check: Big bucks + big brand = a bigger response.

There are other ways social media can be used to forge ties with the community. In the throes of the financial crisis, three financial institutions launched websites offering local residents tips for recession relief. Another credit union used a social media contest to give away a $2,000 scholarship. And credit unions who serve a specific audience like educators can have initiatives with specific relevance, like OnPoint’s “Prize for Excellence in Education” and Queensland Teachers’ “Staffroom Makeover” promotion.

Reality Check: It’s easy to give money away. Anyone can do that. That’s why you see social media promotions built around creative challenges like photo competitions and video contests. It doesn’t matter whether you give $5,000 to a needy charity or some nerdy doofus with a funny YouTube video, the question is still the same: “What do you get in return?”

Caveat: For this approach to work, your organization has to see significant value in (1) its corporate giving program, and (2) social media. That doesn’t apply to very many financial institutions. For starters, many banks and credit unions approach to corporate giving is as willy-nilly as their approach to social media — someone’s daughter is in Girl Scouts, or the CEO is involved in the local arts council. When you ask why they donate money, some financial institutions don’t really know the answer. Is it a habit? A sense of obligation? Their strategy is seldom more sophisticated than “We want to be able to say we give back to the community.” That’s nice, but why?

Charitable donations can be used for many strategic purposes: to create business partnerships with local organizations, generate name awareness, foster relationships with businesses and their executives, build employee morale, etc. Just be clear about your motives, and make sure they align with your organization’s goals, priorities and strategic plan.

Much of this charitable stuff is hard to measure, so in the end, you’re left with a faith-based system. You have to believe in the “halo effect” — that your brand benefits from associating itself with feel-good organizations. You are hoping that people think happy thoughts when they hear your name. But you can’t realistically expect people will flock to your doors for new accounts.

Another important factor for success with this approach is ensuring you pick the right charitable organization(s). You need to not only find the one(s) that align with your brand and strategic priorities, they need to be adept at online grassroots marketing. They should have a web-savvy audience that can be mobilized at a moment’s notice. While your local animal rescue might be a very deserving charity, they might not have the base necessary to compete effectively. To classify an online charity contest as successful, you need a lot of voters.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

#5) Public relations and corporate communications

Most financial institutions have a press release section on their website, but these days that’s the bare minimum. If you want to see what an online newsroom should really look like, take a peek at firstdirect. They have all the modern tools contemporary journalists expect. RSS feeds for press releases, along with social media sharing tools. Photos, videos and podcasts. Reporters can sign up for email alerts. There is contact information for media liaisons, and a company backgrounder with facts and figures — assets, branches, customers, number of employees, key management, etc.

Most financial institutions have a press release section on their website, but these days that’s the bare minimum. If you want to see what an online newsroom should really look like, take a peek at firstdirect. They have all the modern tools contemporary journalists expect. RSS feeds for press releases, along with social media sharing tools. Photos, videos and podcasts. Reporters can sign up for email alerts. There is contact information for media liaisons, and a company backgrounder with facts and figures — assets, branches, customers, number of employees, key management, etc.

When you make a reporter’s life easier, you’re going to get a lot more press. For instance, if you issue a statement about a new branch location, include photos of the branch in your online press release. That alone increases your chances at least two-fold that a news outlet will pick up the story.

If your financial institution is actively involved in local charities and community organizations, highlight it in your online newsroom. Do everything possible to paint your organization in a good light and encourage positive press coverage. That means talking about how much time and money you’ve given away, and all the wonderful things you’ve made possible. More facts and figures.

If your bank is publicly traded, you should have annual reports and quarterly statements available as PDFs, along with a separate RSS feed to alert investors when relevant information becomes available.

If you have a press kit, make it available online.

Also, it doesn’t hurt to have a Twitter account and Facebook page ready in the event of a corporate communications crisis. You don’t have to maintain these accounts and keep them active, you just want to be prepared if something ugly (like a CEO scandal) blows up in your face. If your PR team has rehearsed a “fire drill,” it will know what to say, when and where in the event a nasty situation arises. It’s better than getting caught off guard, as Motrin so painfully learned in 2008.

Caveat: This isn’t really marketing, and it doesn’t really lead to new business, at least not directly. Your organization needs to take public relations seriously if it’s going to make the most out of an online corporate communications channel. If your financial institution seeks national PR coverage and/or already has a fulltime PR person on staff, then you should consider developing a robust online corporate communications portal. But if your bank or credit union is relatively small and/or serves a very limited geographic market, then you probably already personally know the reporters in your area. For small financial institutions, an online newsroom certainly wouldn’t hurt, but there are probably more significant improvements you could make to your website (e.g., improving its basic customer functionality).