In less than a day, Google News listed no less than 300 different stories about the failure of three corporate credit unions. Many reports inaccurately characterized the conservatorship of these institutions and the NCUIF payback plan as a “bailout.” Regardless of the truth and how it all works, a significant portion of the public isn’t happy about it.

The Wall Street Journal’s article, “Credit Unions Bailed Out,” was besieged with over 374 comments. The Huffington Post’s article generated 287 comments Yahoo! had 188. Fox over 100.

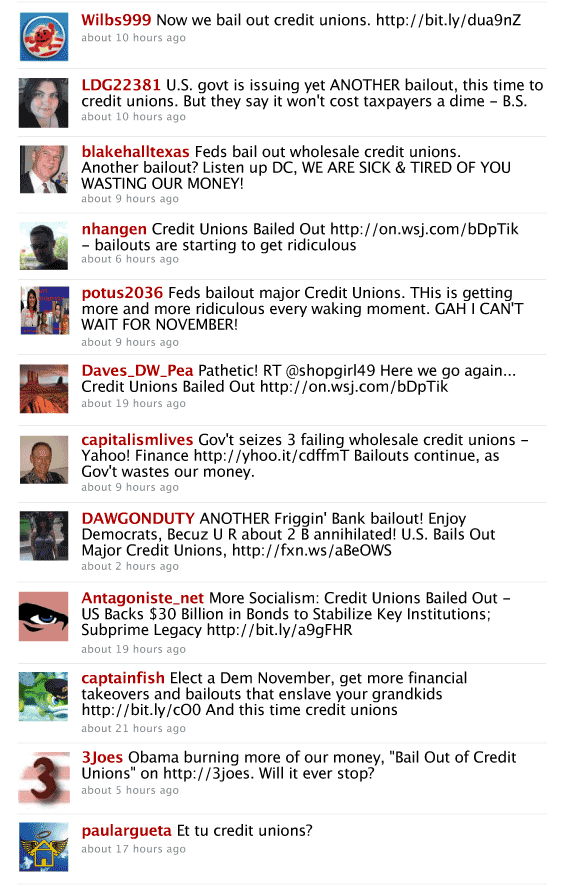

In a 24 hour period, around 500 people mentioned “credit unions” on Twitter, 95% of them spreading the word about the “bailout.” Scanning recent tweets reveals a range of dour reactions:

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Are Credit Unions a Safe Choice? Most troubling to credit unions are the ripples of fear consumers now feel when they hear someone mention “credit unions.” How deep and widespread are these feelings? [Actual comments from the public on news articles are italicized.]

- “Ruh -ROh I thought credit unions were safe.”

- “Should we worry about our money in credit unions? It’s insured by the FDIC, but this makes me wonder.”

- “I thought the political liars had told us that credit unions were safe.”

Credit Unions Are No Better Than Banks. Read some people’s comments and you’ll realize how many folks now see zero difference between banks and credit unions. This event has pushed plenty of people from merely “jaded-and-skeptical” to full-tilt pathological cynicism. “See! Anyone involved in banking is a no-good crook. Credit unions are just as culpable for the mess we’re in as anyone else.” To these people, there are no “good guys” wearing white capes. “Thieves, every last one of them…”

- “Any uninformed people STILL think Credit Unions are soooo much better than banks when in fact they are just as bad and in just as much trouble.”

- “So, where are all the people who constantly fill up the comments when a bank is shutdown telling folks to only deal with credit unions?”

- “I am so pleased to see that the Government started intervening with all the corruption at these credit unions.”

- “Same old theme: bail out the bankster crooks, now the credit unions.”

- “Wow, we are bailing out private credit unions who are paying outrageous salaries to employees and making loans.”

- “Where are the ‘perp walks’ for the regulators, directors and officers of the corporate credit unions who failed their fiduciary responsibilities and legal limits? Seize their assets and bonuses to recover some of what they lost. Let they and their families feel some of the pain!”

Great, Another Kick to the Balls… To plenty of Americans, the news of credit unions failing is just one more sour reminder of how bad things really are. Economists may say the recession is over, but tell that to the 10% who are still unemployed. And now, credit unions, who were supposedly one of America’s safest institutions, need a bailout too? It leaves many people with a sense of helplessness, depression and resignation. “Great…What next?” Consumers feel shell shocked, ambushed and betrayed.

- “OMG, credit unions too… Now I am worried…”

My Tax Dollars?!? Some people leaving comments are savvy and sensitive to credit unions’ tax exemptions:

- “Credit Unions are EXEMPT from Federal Taxes, and they get a bailout?”

- “So now my tax dollars are being used to bailout Credit Unions which pay no taxes. At least GM and CitiBank pay taxes.”

It’s a Democratic Conspiracy. Many Republicans hear the word “union” and immediately suspect a Democratic plot to curry votes. Those on the far right rush to connect Obama, socialism, bailouts and anything containing the word “union.” This serves as another sore reminder to America’s financial cooperatives that the term “credit union” is a hindrance.

- “Now the government takeover of the Credit Unions begins!!”

- “The White House and Democrats must really be scrambling for votes if they want to bail out the credit unions.”

- “When will he consider financial & regulatory policies which are based on creating jobs in the private sector and not paying back unions?”

Reality Check: Read the comments on any news story and you’ll see how uniformed, angry, illogical and uneducated people are. They will believe what they want.

Conclusion. Credit unions need to take a close look at what people are saying around the internet and on Twitter, then think about how they should respond. What can be done to prepare staff with answers? How can credit unions help clarify consumers’ confusion? What can the credit union industry do to combat press inaccuracies and distortions? Will credit unions manage a PR response? Or will they flounder, stunned and unable to coordinate resources?

Most importantly, what affect will this have on consumers’ perceptions of- and trust in America’s credit unions?

Meanwhile, consumers may be wondering what impact this will have on their bottom line:

- “You think the retail credit unions aren’t going to pass these extra fees of paying off bad loans to the membership members of those credit unions…? Yeah right.”