By Luke “Kip” Owen, Account Manager for Truebridge Financial Marketing

Financial marketers often wrestle with a difficult question: How do you “sell” to consumers when they don’t want to be sold? The answer is to give them the information they want, not the products you think they need. Give them what they’re looking for — helpful, easy to read information on topics important to them.

Many banks and credit unions recognizing the importance of “content marketing,” as the practice is called, have built blogs, created Twitter accounts and launched Facebook pages. Sadly, many of these bank and credit union initiatives are mostly one-dimensional. Here are three projects illustrating some important lessons for financial content marketers.

The importance of a professional presentation

Smart Banking Tips, a blog-style website from Western Community Bank, is a model for how a bank blog should look. Its presentation is very professional, with the feeling of an online magazine. Topics range from helpful shopping tips to ideas for small businesses on how to survive the financial crisis.

Western Community launched the blog-like site after concluding that traditional ad campaigns were no longer having the same impact as they once did.

“The ironic part about it all is that our blog doesn’t focus at all on our products like our traditional ad campaigns,” noted Western Community SVP Adam Weight who is in charge of the site. “We focus instead on topics that we know are important to our clients.”

WESTERN COMMUNITY BANK – SMART BANKING TIPS

The site has a large article library spread among six topics: Business & Economy, Family Finances, Loans & Credit, Online Tools, Security Helps and Ways to Save.

There may not be many comments at the site itself, but the bank says the list of email subscribers is growing. Western Community emails full articles in the body of the email.

Now that the website has been up for about a year, Weight said the bank is preparing to promote it through the various customer touch points.

Presently, the bank gets an average of about one visitor per day to click through back to the main Western Community website.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The value of a large library of content

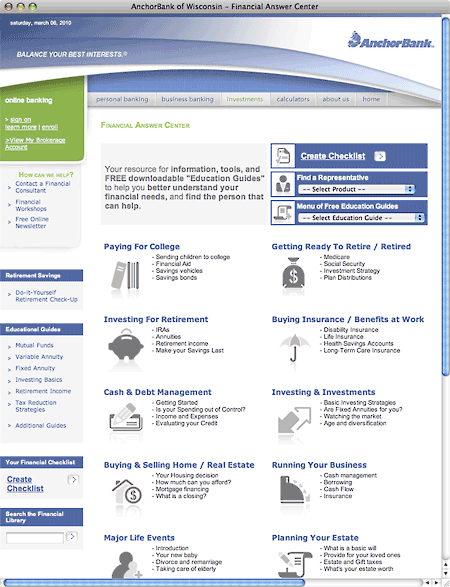

AnchorBank in Wisconsin has a slightly different approach to content marketing. Instead of a separate blog, they host a large library of educational content at a subdomain called the Financial Answer Center right on their primary website.

AnchorBank’s Financial Answer Center hosts a massive library of content, organized into 12 different sections, each with about 10 articles each:

- Paying for College

- Investing for Retirement

- Cash & Debt Management

- Buying & Selling Home/Real Estate

- Major Life Events

- Your 401(k)

- Getting Ready to Retire

- Buying Insurance

- Investing & Investments

- Running Your Business

- Planning Your Estate

- Career Transition

ANCHORBANK – FINANCIAL ANSWER CENTER

Appropriate sections include a link to “Contact a Financial Consultant.”

There are six lifestage stories you can read as well, from “Adam” who is just starting out to empty-nesters “Paul & Julie.”

Having such a large library of content is a luxury for the folks manning AnchorBank’s Twitter and Facebook efforts. This gives them a lot of material — hosted on their own website — that they can share with fans and followers. Liz Boelter, PR manager for AnchorBank, says that the messages they send about things other than products are the ones that get the best response.

“Our content library makes it easy for us to continue sending out messages around important topics we know our followers would be interested in reading,” Boelter said. “Without our library of content the opportunities we’ve created may never have occurred.”

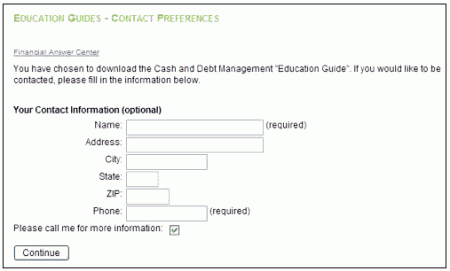

One of the most popular topics to date came just after the New Year when they sent out a message saying, “Have you resolved to better manage your cash or pay off debt? Download a free Education Guide online today.” A shortened URL steered people to a page where they could download the guide free. They also mentioned that their online calculators are very popular among their social media hits.

ANCHORBANK – OPT-IN FORM

If you’re going give something that has significant value, like a multi-page PDF Financial Education Guide, you can ask for something in return. Collecting MCIF information is a vital tactic in any content marketing or social media strategy.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Generating leads for new business

Dedham Savings Bank, a $1 billion community bank just outside of Boston, shows that content marketing can directly contribute to the bottom-line. For roughly five years now, they’ve been using educational content both online and in branches as tools to help start conversations with customers.

Jerry Lavoie, EVP and COO, says that without these materials available in the branches, many opportunities that have come in over the years may never have happened.

“The other day I was having a conversation with a branch employee about a commercial lead that started by a simple request for our educational guide on borrowing for small businesses,” Lavoie said in an interview.

And there’s a bonus for staff, too. “The guides give our employees a sense of comfort knowing that they don’t have to remember all the answers,” he said.

Dedham Savings says the point isn’t just to give customers the information they’re looking for, it’s about maximizing the opportunities every time someone requests something like an educational guide. Each request is a signal to the bank that the customer has a need that goes beyond the traditional checking or savings account. Dedham Savings forwards each request it captures directly to the appropriate sales rep who follows up accordingly.

Key Takeaways

Years ago, advertisers discovered a simple secret to getting their messages heard. They discovered the social contract between the marketer and the listener. Entertain me and I will listen to what you have to say. Content marketing is based on a similar contract – Give me helpful information and I will listen to your message. What they are basically saying is, “Answer my questions and I will consider you for solutions.”

Today’s consumers no longer want to be sold. They’re looking for more than catchy slogans. They need information. One of the main reasons social media exists is that people are looking for answers, specifically from their peers and other trusted resources. They like social media because it filters out the noise (e.g., ads from you and your competitors).

Content marketing can be as basic as having helpful information. The reality is that you have to do more than just provide content.