According to the 2016 U.S. Retail Banking Customer Satisfaction Study published by J.D. Power, the six largest banks (Bank of America, Citigroup, JPMorgan Chase, PNC Financial, U.S. Bancorp and Wells Fargo) have taken the lead in customer satisfaction for the first time ever. The primary reasons include better consumer-facing technology and better in-person interactions, as well as the impact of positive performance scores from Millennials, emerging affluent consumers and minorities.

The research, based on detailed surveys of 20,000 banking consumers, evaluated the performance of retail banking organizations classified as Big Banks (assets of $180 billion or more), Regional Banks (assets of $33 billion – $180 billion) and Midsize Banks (assets of $2 billion-$33 billion).

The highlights of the report are included below.

Big Banks Take the Lead for the First Time

As shown below, the biggest banks, while improving their satisfaction scores over time, have always trailed small and mid-sized banks in overall customer satisfaction. But since 2012, the biggest banks have improved their satisfaction scores by 50 points (to 793 on a 100 point index) to close the initial 40 point gap and achieve the highest overall satisfaction scores of all categories of retail banks.

According to Rocky Clancy, vice president of the financial services practice at J.D. Power, “This improvement could be the result of significant focus and investment by the larger banks on all digital and non-digital components that combine for an improved customer experience.”

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team. Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.![Big_banks_take_the_lead_in_satisfaction_for_the_first_time[1]](https://thefinancialbrand.com/wp-content/uploads/2016/02/Big_banks_take_the_lead_in_satisfaction_for_the_first_time1-565x366.png)

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Industry Cloud for Banking?

Big Banks Do Best With Millennials, Emerging Affluent and Minorities

While the big banks have outpaced small and mid-sized banks by improving satisfaction with every generational and income category of consumer (as shown below), they still lag small and mid-sized banks with Boomers, Pre-Boomers and the affluent consumer. The real appeal of the biggest banks is with Millennials, emerging affluent and minorities (specifically black/African-American, Latino/Hispanic and Asian/Asian-American).

![Change_in_satisfaction_by_generation[1]](https://thefinancialbrand.com/wp-content/uploads/2016/02/Change_in_satisfaction_by_generation1-565x399.png)

![Change_in_satisfaction_by_affluence[1]](https://thefinancialbrand.com/wp-content/uploads/2016/02/Change_in_satisfaction_by_affluence1-565x377.png)

Big Banks Do Digital Best

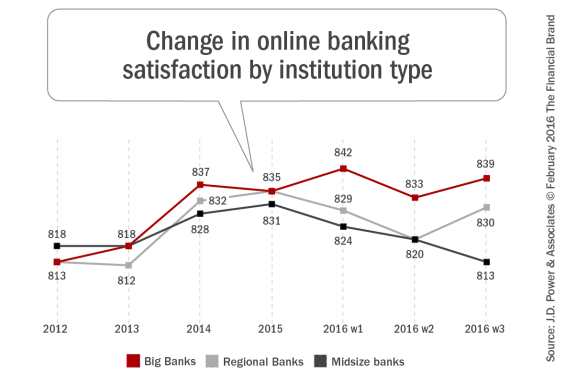

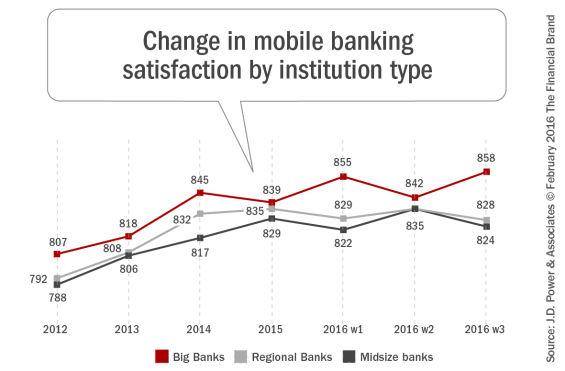

The impact of digital technologies on customer satisfaction continues to be apparent in JD Power Customer Satisfaction surveys. In 2015, there was a noticeable decline in the online and mobile banking satisfaction levels for the biggest banks, attributed to the increasing expectations of digital consumers going unmet.

Continued heavy investment in digital channels by the biggest banks was rewarded in this most recent survey, however, with the top six banks showing significant improvements in all digital categories. The Big Banks scored highest in online satisfaction (839), mobile (858) and ATM (841) interactions in the most recent study.

The inability for the majority of regional and mid-sized banks to keep pace with investment in digital technology became more apparent in the most recent survey, with online, mobile and ATM satisfaction levels all being below 2015 levels. In fact, it is possible that the prioritization of investment in the mobile channel has had the most significant impact on mid-sized banks, where the lowest satisfaction in four years is seen for both online and ATM channels.

Digital Banking Satisfaction Halo Effect

When reviewing all of the components of customer satisfaction, there could be a positive “halo effect” from the improvement in the digital channel satisfaction levels. For instance, JD Power found that there have been significant improvements in satisfaction in the areas of problem resolution, account information and fees compared to regional and mid-sized banks.

Alternatively, the satisfaction with facilities, product offerings and transaction activities have all decreased over the last four years for the smallest banks in the study. Finally, there is evidence that the impact of a strong digital offering can also impact in-person satisfaction ratings, according to JD Power.

As shown below, smallest financial institutions studied recorded their lowest level of satisfaction ever for in-person transactions … a traditional strength for this asset category. While lower than in 2015, the largest organizations have had the strongest growth in satisfaction over the past four years.

![Change_in_in_person_satisfaction_by_institution_type[1]](https://thefinancialbrand.com/wp-content/uploads/2016/02/Change_in_in_person_satisfaction_by_institution_type1-565x366.png)

Options for the Future

It is becoming more apparent with each study that there is a growing need to serve the increasingly digital consumer. Once defined by demographic variables like age and income, the digital native is becoming a larger component of every demographic group.

How a financial institution responds to the challenges of an increasingly demanding consumer will differ from bank to bank. Some organizations may decide to “double down” with their investment in digital channels. It appears this increased investment will help, but the investment can’t only be focused on mobile channels. Recent trends show that satisfaction will drop if adequate investment is not made in the online and ATM channels as well.

An alternative strategy could be to focus more heavily on segments that do not demand cutting edge digital offerings, offering digital banking “basics” and forgoing the more advanced offerings. This strategy has challenges in the future, however, as the proportion of consumers not wanting the conveniences of digital channels decreases.

The overriding question becomes, can banking organizations avoid the inevitable digital transformation occurring in the banking industry? And if so, for how long?