Banking is an industry that has historically been slow to change, benefitting from unique product-specific expertise, extensive distribution networks, protective regulations and a very large and loyal customer base that are slow to switch financial providers. Until the relatively recent past, established financial organizations have generated good returns despite an increasingly outdated business model and back-office technology that was developed when ATMs were young.

Even as the Internet was developed and new technology-based competitors entered the financial services marketplace, few survived. According to McKinsey & Company, “In the eight-year period between the Netscape IPO and the acquisition of PayPal by eBay, more than 450 attackers – new digital currencies, wallets, networks, and so on – attempted to challenge incumbents. Fewer than 5 of these challengers survive as stand-alone entities today. In many ways, PayPal is the exception that proves the rule: it is tough to disrupt banks.”

A New Battlefield

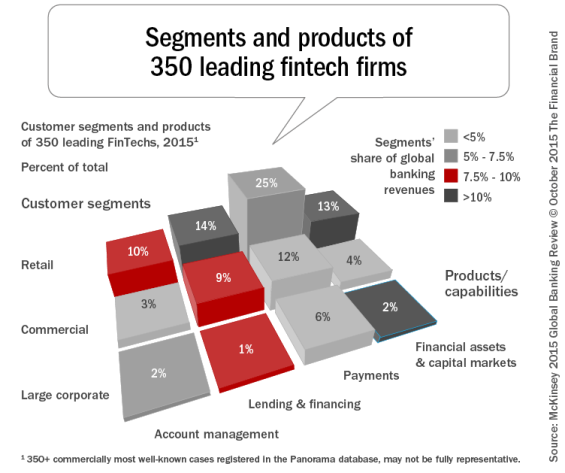

As everyone in the banking industry realizes, there has been a new wave of disruption occurring in the banking industry over the past several years. As was found in the McKinsey research report, the number of fintech start-ups is greater than 2,000 today, compared with 800 in April 2015. And the offerings of these firms spans product lines, consumer segments and industry boundaries.

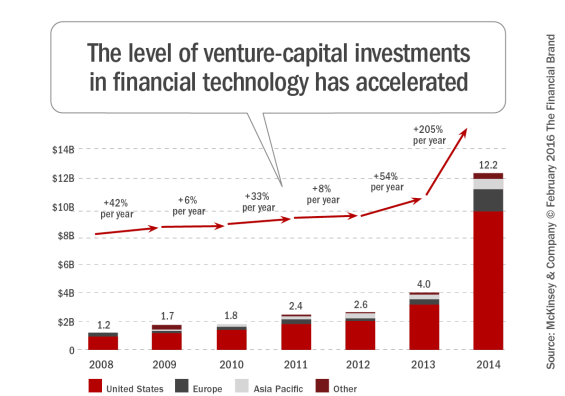

According to research from McKinsey and CB Insights, nearly $23 billion of venture capital and growth equity has been deployed to fintech firms globally over the past five years, with $12.2 billion being deployed in 2014 alone.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional. Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Instant Messaging. Instant Impact.

Are You Ready for a Digital Transformation?

Will History Repeat Itself?

The question asked in the McKinsey article is whether the competitive dynamics are different this time around compared to the beginning of the dot.com era. The banking industry is still highly regulated, managing a majority of deposits, loans, and payments activity and, despite a loss of trust caused by the financial crisis, has been relatively resilient in maintaining customers.

On the other hand, the capabilities of mobile devices have negatively impacted the advantages of physical distribution that banking previously enjoyed. Mobile banking has simplified many rudimentary transactions, such as checking balances, making deposits, transferring funds and paying bills, while making payments using a smartphone may be on the horizon. In addition, the accessibility of big data, combined with the lower cost of advanced analytics is quickly enabling highly personalized contextual engagements.

One other significant change impacting the future of banking is the consumer demographics. According to McKinsey, “In the United States alone, 85 million millennials, all digital natives, are coming of age, and they are considerably more open than the 40 million Gen Xers who came of age during the dot-com boom were to considering a new financial-services provider that is not their parents’ bank.” More importantly, this new breed of digital consumer is becoming more and more comfortable with researching, shopping, buying, engaging and becoming loyal without ever walking into a physical structure. Unfortunately, according to McKinsey, the origination and sales component of banking represents 60% of banking profits.

Six Fintech Keys to Success

While the failure rate for fintech businesses this time around is still likely to be high due to many of the challenges discussed in our article, there will still be some fintech winners. In fact, according to McKinsey, 10% to 40% of banking revenues could be at risk by 2025 due to the digitization of processes and engagement by fintech firms which will drive pricing lower.

McKinsey believes the fintech ‘winners’ will be firms with the following benefits, offered either by themselves or in partnership with legacy banking firms:

1. Improved Modes of Customer Acquisition

One of the major disadvantages of most fintech firms today is that they lack the scalability that most banking firms possess. To be successful, fintech firms will need to find ways to attract significant numbers of customers cost-effectively. The equation is not only one of lower costs, but the ability to market to mass markets cost effectively. This requires capital, but also requires consumer name recognition, trust and a strong value proposition.

2. Lower Cost to Serve

The economic advantages of digital distribution over physical distribution are one of the primary advantages for fintech firms. According to McKinsey, many fintech lenders have up to a 400-basis-point cost advantage over banks because they have no physical-distribution costs. This cost advantage enables fintech firms to pass savings to customers with regard to cost and time to process loan applications.

3. Advanced Analytics

Big data and advanced analytics provides several significant advantages to fintechs, including the ability to redesign products (new credit scoring algorithms) to developing contextual offers based on a better understanding of customer needs. According to McKinsey, “In a world where more than 90% of data has been created in the last two years, fintech data experiments hold promise for new products and services, delivered in new ways.”

4. Segment-Specific Offerings

One of the ways fintech firms have been successful is to focus on segments with unmet needs as opposed to being all things to all people (like legacy banking firms have been). Many fintech start-ups have focused on three segments – millennials, small businesses, and the underbanked, because of their sensitivity to cost, openness to remote delivery and distribution, and their large scale.

5. Leveraging Existing Infrastructure

Successful fintech will find ways to engage with the existing ecosystem of banks. Lending Club, PayPal and other successful start-ups have found ways to leverage what currently exists. Many firth firms will accomplish this through partnerships with banking organizations. While the fintech will bring agility, a penchant for innovation and technological prowess, they will benefit from an established customer base, a regulatory “ombudsman,” and significant capital..

6. Understanding Risk and Regulations

While many fintech attackers fly largely under the regulatory radar, they will attract attention as they acquire scale. McKinsey believes regulation is a key swing factor in how fintech disruption could play out. “Although unlikely to change the general direction, regulation could affect the speed and extent of disruption, if there were material shocks that warranted stronger regulatory involvement, such as cybersecurity issues with leading fintechs. The impact could also vary significantly by country,” says McKinsey.

The determination of success for fintech firms will be how well they can leverage the above components as part of their business model. Despite the anticipated high failure rate of fintech firms in general, the winners will benefit from a combination of the above along with some always present business “luck.”

Six Banking Keys to Success

There is a lot of noise about fintech firms today. Some legacy banking organizations may dismiss the noise entirely, or they may panic and overreact. McKinsey recommends a middle ground, focusing on the business components that have always proven to be successful. Beyond these basics, traditional banking organizations should “follow the fintech lead,” embracing the components of a digital organization, becoming better positioned for the future.

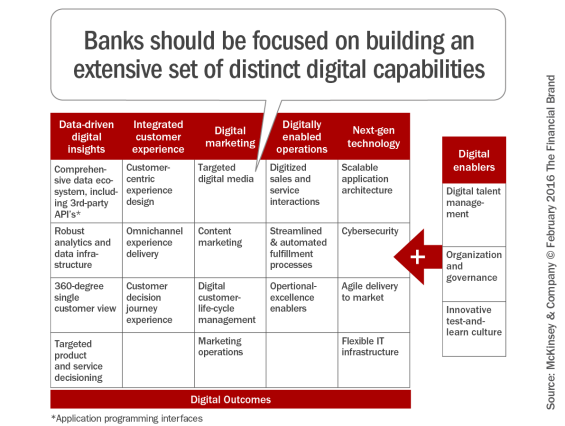

1. Comprehensive Data Ecosystem

Big data and advanced analytics provides a competitive advantage in each step of the customer journey, including customer acquisition, customer engagement, transaction processing, relationship deepening, customer retention and loyalty. “Building a comprehensive data ecosystem to access customer data from within and beyond the bank, creating a 360-degree view of customer activities, creating a robust analytics-and-data infrastructure, and leveraging these to drive scientific (versus case-law-based) decisions across a broad range of activities from customer acquisition to servicing to cross-selling to collections—all are critical to a bank’s future success,” states the McKinsey article.

2. Improved Consumer Experience

Today’s digital consumer expects real-time, multichannel capabilities that are highly personalized and contextual. As discussed numerous times in The Financial Brand, consumer expectations are increasingly being set by non-banks. At a time when advanced data analytics can be processed instantaneously, the consumer should be able to transact, engage, open accounts and check on the status of their account or loan application in real time.

3. Contextual Offerings

According to McKinsey, successful banking organizations need to be able to master digital media, content marketing, digital customer-life-cycle management, and marketing operations, providing offers (or warnings) that reflect the consumer’s individual financial situation at any moment.

4. Simplification Through Digitization

All paper processes must be replaced with a digital counterpart. Simplification, digitization, and streamlining opportunities exist across the banking organization. Until manual and paper processes are digitized, fintech firms will have an advantage since they will have a structurally lower cost base. Digitization allows banks and credit unions to test and scale to achieve efficiencies.

5. Enhanced Use of Technology

An increasing number of consumers want to interact with their financial partner digitally. This will require new standards for defending consumers’ data from breaches. Legacy banking organizations will also need to innovate and upgrade technology through techniques such as agile and continuous delivery. Finally, and probably most importantly, banks and credit unions need to move onto new technology platforms.

6. Removal of Silos

As opposed to the typical structure of banks and credit unions, fintech firms are oriented around the consumer as opposed to around products. This requires an organizational structure that supports a data- and insight-driven operating model, and provides a differentiated customer experience. This new structure will not only better serve the customer, but also be able to drive improved innovation.

A ‘Winner Take All’ Battle?

According to McKinsey, the six keys to success for fintech firms and banking, while different, have the same impact: a long-term shift in the nature of competition and successful business models. “The overarching challenge for banks is how to ‘open up’ structurally – with respect to how they leverage partnerships and how they permit other entities to access their capabilities. Those banks that pursue a thoughtful approach to meeting this challenge will be best positioned to evolve their business models and find new sources of value for their customers while performing well financially.”

Whether or not fintech firms succeed or fail individually or as a group is inconsequential. The banking industry needs to understand the overarching changes in the marketplace and adjust quickly and accordingly. New business models need to be developed that leverage the advantages of digital and mobile technology and these models need to be repositioned for success. This will require a change in culture and the ability to understand that to improve the consumer experience may require building partnerships with ‘the enemy’ and bringing the best of both worlds to the marketplace.