The banking industry has historically been relatively protected from outside competition. The slow pace of change in financial services, restrictive regulatory requirements and the need for scale (and capital) has kept barriers to new entrants prohibitively high.

New technology and the resultant digitalization of banking has changed these dynamics. New digital players, from both inside and outside the financial services industry, have changed consumer expectations by leveraging more flexible, efficient and cost-efficient IT infrastructures to attack legacy providers.

Mapa Research has done extensive research on the components of this digital transformation using their unique portfolio of live global bank accounts, identifying 10 key digital trends for 2016. Their 78-page Insight Report, Ten Things Digital Teams Should be Doing in 2016, examines why these trends are important, the potential benefits of embracing these trends (as well as the pitfalls of ignoring them), the ways to incorporate these trends into an institution’s strategy, and standout examples both inside and outside the banking industry. The report examines 16 brands over seven markets, showcasing good practices related to each of the trends.

Not surprisingly, these trends are aligned with the 2016 Retail Banking Trends and Predictions identified by our global crowdsourcing panel. While some of these trends may not be a top priority for some institutions, they all provide a foundation for better understanding of the competitive environment in the coming year.

— 10 Digital Trends Banking Should Embrace —

- Designing Customer-Centric Apps

- Streamlining App Strategy

- Removing Friction from the Onboarding Process

- Using Data Analytics for Targeted Marketing

- Personalizing Functionality

- Personalizing Products and Content

- Investing in Open API Technology

- Building a Strategy to Compete with the Disruptors

- Investigating the Potential of Blockchain

- Creating a Seamless Multichannel Experience

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

1. Designing Customer-Centric Apps

According to Mapa Research, a “product first, consumer second” approach has been applied to digital services, resulting in a preponderance of one-size-fits-all digital banking apps. As consumers become accustomed to providers that have designed apps around their specific wants and needs, the same has become expected of financial institutions.

“Products and services should be targeted more specifically to niche customer groups and the members of these groups should be heavily involved in any development process. In essence, the emphasis needs to shift from the nature of products or services to the experience that users have when using mobile banking apps,” says Jess Morley, Research Manager at Mapa Research and author of the report.

Fido Bank was provided and an example of an organization that listens to consumers and develops new products based on feedback. At Fidor, consumers are involved in each stage of the innovation cycle for any product, from voting on social media for which product they would like to have available to them next, to being alerted about any changes made by the bank and being asked for feedback.

2. Streamlining App Strategy

Financial institutions are still debating whether it is best to support multiple apps for different products/functions or to provide a single all-inclusive app. Mapa states that whether a company decides to build an all-inclusive app or a series of smaller one-purpose-only apps is less important than the digital team coming up with a clear, proactive app development strategy.

The strategy should outline what the company is hoping to achieve by offering a greater range of services through the digital channel and how it hopes to deliver on this vision. In the report. Mapa provides examples and analysis of both a multi-app strategy and an all-inclusive app strategy.

3. Removing Friction from the Onboarding Process

While traditional financial institutions have managed to partially digitize and simplify some processes and services, most banks still either have way too many steps or require paper documentation. Because consumers are accustomed to a much easier engagement, many are increasingly likely to drop out of account opening or application processes before being finished. This results in lost business and missed profits for providers.

According to Morley at Mapa, “Companies making the changes necessary to remove the friction from onboarding processes will undoubtedly incur some cost. However, resultant improvements in efficiency will decrease overhead costs enough to more than make up for this one-time outlay, especially when new business revenue is also likely to increase.”

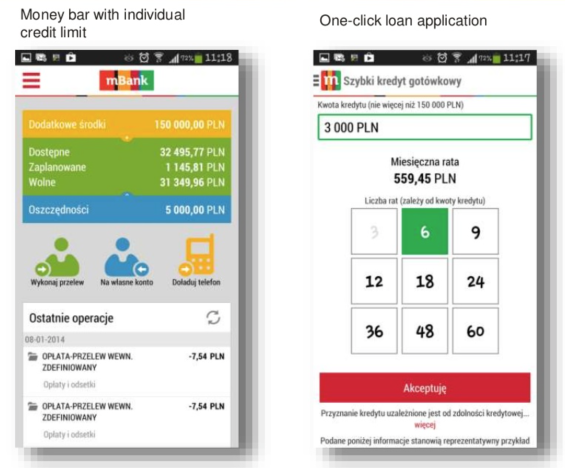

An example of the potential of streamlined mobile banking is with mBank’s one-click 30-second loan, where a customer can have near immediate access to funds via a mobile application. This was accomplished using design-driven change management.

4. Using Data Analytics for Targeted Marketing

By conducting analysis on both internal and external data, banks and credit unions can create robust profiles of their account owners. This includes insight on products held, consumer interests, preferred channel(s), shopping patterns, and even where and when banking activities are conducted. Leveraging this information can help organizations develop targeted digital marketing campaigns that come with a far higher level of success.

“Not only does such insight increase the likelihood of firms being able to effectively cross-sell to existing account holders, it also significantly improves the scope for more frequent and meaningful engagement. This is because consumer conversations that happen on their terms are far less likely to be viewed as intrusive,” stated the report.

Beyond traditional data analytics tools that leverage insights within an organization’s firewalls, new analytics tools available from Facebook and Google provide even deeper insights into how consumers engage with all types of organizations. This insight into overarching behaviors could be invaluable when competing with new start-ups and tech companies.

5. Personalizing Functionality

According to Mapa, while the stratification of consumers based on age and income is still important, the ability to understand consumers based on their attitudes towards digital channels is also important:

- Digital enthusiasts. Have embrace digital engagement and have moved from doing banking activities online via desktop to using their smartphone for banking.

- Digital acceptors. Have acknowledged the benefits of digital banking, and are happy to carry out basic transactions online, and sometimes on mobile. These individuals still prefer to carry out more complex transactions in a branch.

- Digital sceptics. Are wary of doing anything beyond checking balance digitally, or avoid digital banking services completely and conduct all banking tasks in a branch.

The solution to the challenge of varying degrees of digital banking acceptance is to design an app that is flexible enough to allow a consumer to customise the level of functionality that they want. This need not be any more complicated than providing consumers with the option to turn certain features on and off.

6. Personalizing Content and Products

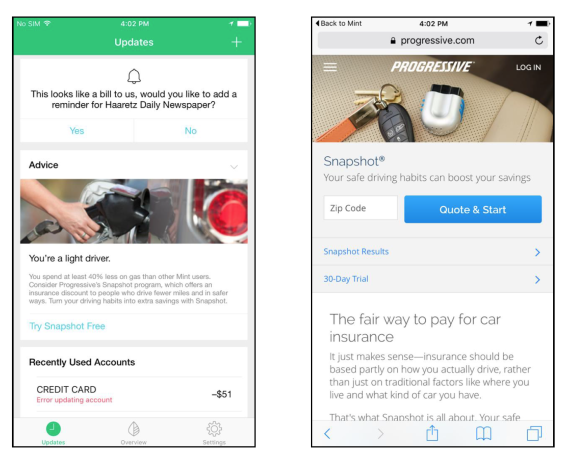

Today’s consumers are becoming accustomed to highly personalised offers big box retailers like Amazon and Best Buy. Alternatively, despite having access to enemies amounts of consumer data, financial services providers continue to mistarget product and service recommendations. Without being able to address fundamental consumer relationship needs of “know me, look out for me and reward me,” there is a reduced likelihood of consumer engagement and loyalty.

Alternatively, financial institutions that can understand the account owner’s basic financial needs and product portfolio will be in a better position to acquire new customers, advise current customers and build long-lasting relationships. An example provided in the Mapa Insight report was Mint, where lower mileage drivers (based on gasoline sales) are offered a special insurance product. By providing consumers with personalized offers, Mint is providing a visible advantage to choosing its services over others.

7. Investing in Open API Technology

One of the many differences between start-up fintech firms and traditional banking organizations is the availability of open, customisable and web-based IT systems known as Application Programming Interfaces (APIs). These facilitate fast data exchange between different software elements, and make it very easy to adapt processes, services and products almost instantaneously.

Open APIs are software development platforms that allow developers from within or outside an organization to build applications quickly, without having a detailed understanding of the underpinning IT infrastructure. Investing in open API functionality allows for quicker innovation and application development.

The Open Bank Project brings developers and financial institutions together without requiring massive investment by the banking organization. For organization wanting to quickly upgrade their digital banking offering, this is a lower cost alternative.

8. Building a Strategy to Compete with Disruptors

As discussed in the article, fintech firms and legacy banks are beginning to realize the benefits of working together to deliver innovative solutions and superior customer experiences to an increasingly digital consumer. But not all organizations want to address the increasing competition in the same manner.

Mapa outlines three alternative paths to level the playing field.

- Become the disruptors themselves. Banks or credit unions taking this route can choose to build the skills in-house and develop agile, API-based IT systems, which facilitate rapid and cumulative innovation. Firms such as Barclays in the UK and BankMobile (Customers Bank) in the US have decided to take this route, investing to support in-house innovation.

- Partner with the disruptors. Some financial institutions may choose to build mutually-beneficial relationships with one or more fintech start-ups. BBVA has taken this route with many fintech lenders in the US and overseas.

- Go ‘Low Tech’. Some financial services providers may choose not to compete on the same playing field, positioning the organization around the service and capabilities of a physical branch.

According to Mapa, the route that is the most suited to a particular firm will depend on its underpinning strategy, customer base and the resources that it has available to implement the strategy.

9. Investigating the Potential of Blockchain

“Currently, blockchain is best known for being the technology that sits behind the cryptocurrency Bitcoin. However, as almost any document or asset can be turned into code and placed on a blockchain, the potential uses of the technology within the financial services industry are far more varied,” mentioned Jess Morley in the report.

The head of Santander UK’s InnoVentures team, which is leading the bank’s research into blockchain technology, has said that the company has identified between 20 and 25 different uses of the distributed ledger. two of the often discussed uses of the blockchain are for international payments and digital documents.

Obviously, spending resources investigating or developing uses for the blockchain may be initially limited to larger organizations. There are other priorities that may be of greater importance. This is one of the digital banking strategies that may be on the front burner for some and on the back burner for other organizations.

10. Creating a Seamless Multichannel Experience

Consumers have multiple devices and use all of them to conduct banking tasks depending on what may be the most convenient at any point in time. This constant switching between devices, particularly mobile devices, means that consumers no longer see a distinction between their mobile, tablet or laptop. Instead, all channels are viewed as a means of providing access to financial services during the customer journey.

“To provide such a cohesive experience, the underpinning strategy must be consistent across each channel, as must the branding. However, more than this, the different digital platforms should both link with each other and (where applicable) with physical spaces, such as bank branches,” says Morley. “The user needs to feel as though there is no difference at all between the different channels. This means, for example, keeping login processes consistent across channels.”

Challenges and Opportunities for Success

In the words of Morley at Mapa, “Digital banking is no longer trendy. It has instead become the modus operandi for the modern financial services market.” Unfortunately, not every bank and credit union seems to have completely bought in.

While the tools and technology required to become a “digital bank” already exist, the leadership and commitment to being proactive, agile and to simplify processes are sometimes lacking. And, the investment needed is not cheap and at the center of the required change is the ability to leverage data and insight.

Becoming a digital-first organization that is customer-centric will position traditional financial organizations favorably against start-up fintech firms, many times using these same firms as part of the solution.

Access the Full Report

“Ten Things Digital Teams Should be Doing in 2016” from Mapa Research is part of a series of paid for reports that provide an overview of the key digital trends that digital teams within financial services companies should be embracing over the course of 2016. It highlights why each of the trends are important, considering what the benefits are of participating in the trend as well as highlighting some of the potential pitfalls of not doing so. For illustrative purposes, best-in-class examples for each of the themes are presented. These examples come from both within the financial services sector and outside of it. You can read more about the entire 78-page report.