In the webinar, Solving the ‘Buy’ Problem for Digital Sales of Financial Products, Forrester Research shared that life events are the #1 trigger of bank sales opportunities, and that the impending Fed interest rate increase may represent one of the most significant events in a decade. As Chris Nichols, Chief Strategy Officer at Centerstate Bank stated in a recent blog post:

“Rate changes are a huge sales event trigger and are not used enough in banking. Any time rates do, or are poised to move up or down, that event can prompt a customer to move cash, increase debt levels, or refinance.”

The question is – is your organization ready? And what does ‘ready’ really mean?

Despite not needing the plan for several years, most banks and credit unions probably already have an action plan in place to adjust interest rates and communicate the impact to your customer base. You probably also have the content for your website ready to go. But are you ready to capitalize on the new product sales opportunities that may be available?

Your historical data on new account openings, loan origination and card issuing can be the foundation of developing a proactive, highly personalized sales strategy. Simply correlate these customer and member activities with previous interest rate changes.

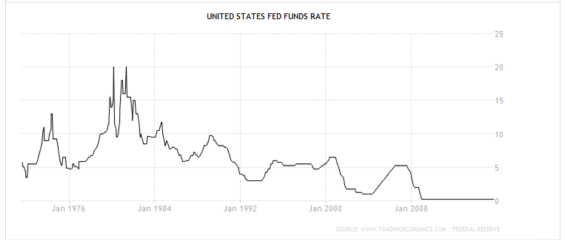

Unfortunately, with rates virtually unchanged for 9 years, organizations will need to go back over a decade to start seeing any correlations. But, by looking at the periods of 2004 to 2007, correlations between new customer onboarding or account closures and interest rate changes can provide valuable insights.

If you saw your customers change their behavior when rates changed – and you want to be able to take advantage of this behavior when rates change in the future – will you be ready for the influx of customers? Beyond your customers potentially being in a different financial stage of their lives, there’s another significant change in the way your customer or members may react – it’s called the iPhone.

In the same year the financial crisis began and interest rates bottomed out, Apple launched the iPhone … and the rest is history. With new, more powerful devices that can access the Web at any time and at any place, the appetite for consumers to apply for new banking products on their iPhone, Android phone, tablet and laptop has grown as well.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Moving From Physical to Digital Sales

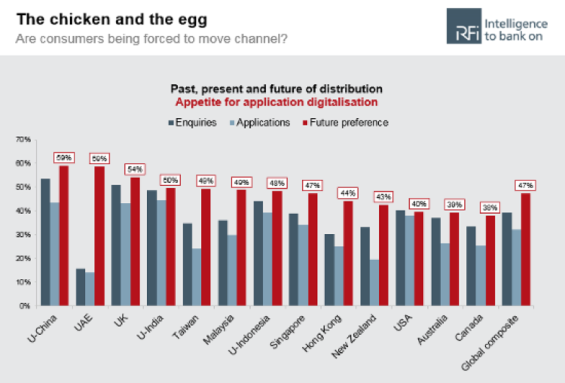

According to RFi Group, a global intelligence agency, 40% of surveyed consumers in the US would like to be able to apply for banking products through digital channels. How easy is it for a prospect to open a new account either online or on a mobile device at your bank or credit union?

As the consumer has become more comfortable with digital devices and digital expectations have risen, two aspects of the sales process have changed:

- Mobile Digital Sales: Bankers are no longer saying “Customers don’t want to apply on a smartphone … the keyboard and screen are too small!” – With new mobile experiences, organizations can deliver a great experience for account opening or a credit application on any digital or mobile platform.

- Frictionless Digital Sales: Bankers no longer see the digital channel as facilitating operational efficiency – they see it as a crucial way of acquiring new customers. And they know the experience must be ‘effortless’ and ‘frictionless,’ otherwise they will lose the opportunity to acquire a new customer.

Unfortunately, the majority of digital sales experiences in consumer banking are not mobile-friendly. In business banking, most of the experiences aren’t even online-friendly. And, in those instances where a consumer can open an account or apply for a credit product online or with a mobile device, rarely is there a truly frictionless experience.

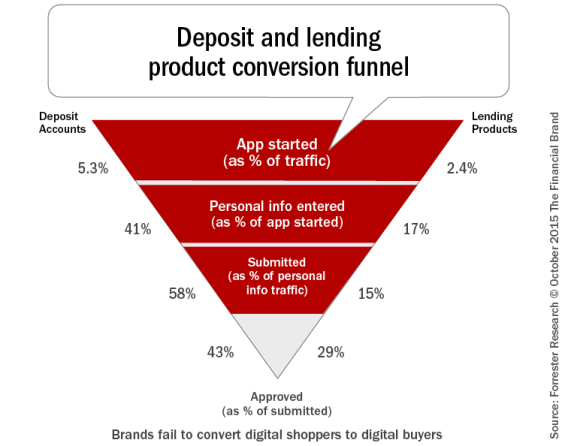

In a recent webinar, Senior Analyst Peter Wannemacher at Forrester, stated that abandonment rates for online applications in banking are at an all-time high. The following funnel shows the completion rate for each phase of the ‘buying journey’ for deposit accounts and lending products.

To put the above chart into perspective – for everyone who begins a “lending product” application, 17% enter their personal information and 15% of the people who enter personal information actually submit an application. In other words, there is a 97.5% abandonment rate!

That doesn’t mean they don’t end up getting the product they had in mind – they might visit a branch, or come back later. But at the time they were interested (‘in the moment’), an application was started and completed less than 3% of the time.

This is a huge missed opportunity. And, when you connect digital sales in banking to life events, and you know there’s an imminent event with the Fed increasing interest rates … there’s never been a better time to focus on improving the customer experience for digital account opening and onboarding for deposit accounts, cards and loans.

These two facts have become abundantly clear:

- Fact #1 – The Fed will raise interest rates and that will trigger a customer acquisition opportunity. The fact that it may not have happen yet simply ‘buys you time’ to get an improved account opening and onboarding experience for the product you think will most likely be impacted by the interest rate change.

- Fact #2 – A significant portion of the population will research and look to apply for new products through digital channels … especially on smartphones.

Taking Advantage of ‘Life Events’

Product and pricing are no longer strong differentiators in financial services – customer experience is. Each additional step in the account opening or loan/credit card application process results in higher abandonment and fewer converted customers.

To provide the ultimate ‘frictionless’ experience, you first must be omnichannel. Customers and members expect to be able to engage with you on any device or channel at any time of their choosing. They also expect to be able to change their preferred device or channel in the middle of the process without needing to start over.

To be frictionless, the process must also be as effortless as possible. Every keystroke, every screen tap, every mouse click and every field that needs to be completed contributes to abandonment. The key is to minimize each of these steps that can be digitized with today’s technology. This not only applies to digitizing the mobile and online account opening processes, but also those in the branch.

Can your customer or member open an account or apply for a credit product in 90 seconds or less? This is the attention span of today’s digital consumer. The key is to build a digital new account process that is optimized. By doing so, you are in a position to provide ‘rate alerts’ by SMS, with links to an account opening platform that can be completed before your competition can respond.

With an optimized new account process, your bank or credit union will be prepared for future rate hikes or any other life event that occurs.

The Guide to Digital Account Opening

The Guide to Digital Account Opening, is an in-depth review of the digital account opening experience, the landscape of solutions, and the workflows that comprise the end-to end account opening process. The report provides trends and projections, case studies, and an extensive review of solution providers, covering both self-service and branch-assisted digital account opening processes.

The Guide to Digital Account Opening, is an in-depth review of the digital account opening experience, the landscape of solutions, and the workflows that comprise the end-to end account opening process. The report provides trends and projections, case studies, and an extensive review of solution providers, covering both self-service and branch-assisted digital account opening processes.

This report helps banks and credit unions move forward with digital improvements to the account opening, removing friction, simplifying processes and providing a seamless digital experience.

Avoka is one of the solution providers featured in this Digital Banking Report.