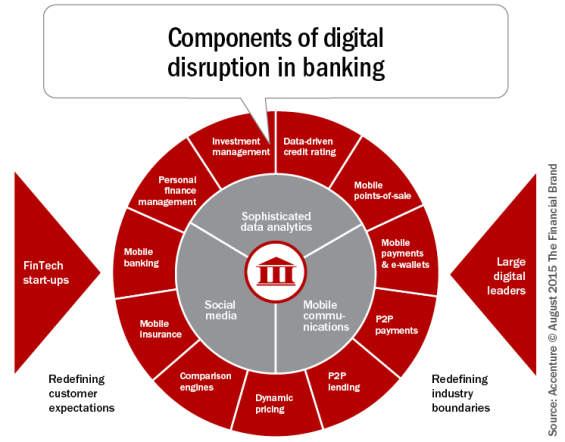

Digital disruption is occurring at every level of the financial services industry. New competitors, new channels, new processes and new consumer expectations are shifting the banking industry paradigm. In response, banking executives are balancing the need to be an agile responder, while realizing that many of the changes required will take time.

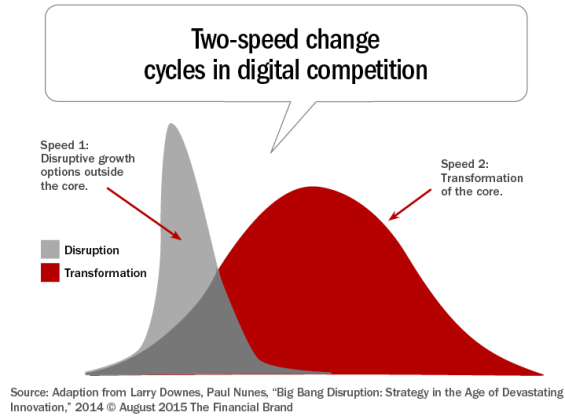

“Instead of the traditional bell curve response of a typical product or service life cycle, a series of quick-fire innovations has produced a ‘shark fin’ business model, where disruptive products or services are embraced and discarded in fast succession,” Accenture states in their report, ‘Digital Strategy Execution Drives a New Era of Banking’. Referencing research done by Larry Downes and Paul Nunes, (Big Bang Disruption, Strategy in the Age of Devastating Innovation), Accenture states that such rapid digital innovation cycles have the potential to drive up return on equity (ROE) by more than 5% for both mature or emerging market banks.

“Digital can drive up return on equity by more than 5 percent for mature or emerging market banks.”

— Accenture

Beyond the profit potential, this rapid innovation cycle is imperative as mature products get replaced by new technologies and shorter product life cycles. It is also important now that entire product lines are being created or destroyed overnight by these ‘big bang’ disruptors. As we have seen throughout the financial services industry, digital disruption can come out of nowhere and instantly be everywhere.

Larry Downes and Paul Nunes make that case that, unlike previous disruption, where being cheaper than established offerings was the way to move market share, today’s disruptors are more inventive and better integrated with other products and services. In addition, they found that many new entrants exploit consumers’ growing access to product information and their ability to contribute to and share it. Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape. Read More about Move the Needle from Attrition to Acquisition Services that scale with you.

Move the Needle from Attrition to Acquisition

Fractional Marketing for Financial Brands

Response to Digital Disruption … At Two Speeds

As competitive pressures increase, Accenture believes it’s critical to execute at two speeds to sustain market momentum while also strengthening the core underpinning of a bank or credit union.

Speed 1. Disruptive growth options outside the core: Moving at disruptive speed means being able to move at the speed of the new entrants that are making headlines. Organizations such as PayPal, Amazon, Apple, etc. are building financial services that work beyond the traditional boundaries of banking … and are doing so quickly.

Many of the most recent disruptions in financial services feature virtually integrated solutions … they are developed and deployed via the infrastructure of the cloud. With this agile and well-funded competition, traditional operational and organizational assets (systems, size, distribution network) suddenly morph into liabilities.

Accenture refers to many of these types of solutions as being the core of a consumer’s Everyday Bank. Growth ‘outside the core’ requires the banking industry to be able to disrupt itself, creating new options that may involve partnerships with non-financial firms. The culture must become entrepreneurial while being accepting of greater uncertainty.

Examples of ‘disruptive growth’ according to Accenture could include:

- Taking on the organizational personality of a digital disruptor, targeting specific target markets or product lines.

- Building a digital wallet with in-app commerce built on value-added services.

- Providing integrated financial or non-financial solutions to serve life needs beyond banking.

- Leveraging crowdsourced lending and payment capabilities.

- Monetizing big data insights.

Speed 2. Transformation of the core: While pursuing the rapid-fire components of disruptive growth outside the core, Accenture believes successful digital banking organizations must also move at a more deliberate pace to transform three elements of their underlying core:

- Digital customer strategies – Consumers must be provided an omnichannel customer experience, where they can choose how to engage with their bank or credit union at any time on any device. The channels must be integrated and contextual, with the ability to proactively engage on behalf of the consumer.

- Digital enterprise strategies – The institution must evolve to become an overarching digital banking organization, including digitizes processes and procedures, digital collaboration tools and a digital culture.

- Digital operational strategies – Evolving to much more flexible technology that supports digital transformation is required. This includes an open architecture that will allow banking organizations to integrate with third parties that may have different architectures running differently.

Transformation of the core will require shifts and redeployment of resources, people and technology and will result in new operating models and new digital ecosystems.

Strategies to Survive Digital Disruption

So how does an incumbent banking organization survive or even thrive in the face of digital disruption? While there are no magic wands or secret sauces, there are strategies that can help organizations be more prepared for the inevitable change on the horizon.

1. Assign Transformation Roles: Accenture recommends governance built on three roles supporting 1) the technological changes required; 2) the impact on the current organization model, and; 3) the needs and trends of the digital consumer. “While taking on these important roles, these ‘entrepreneurs’ need to work in a highly collaborative manner, setting the digital vision, selecting the options to be launched, defining the digital capability development strategy and guiding the long-term transformation of the core bank to scale up innovations across the enterprise,” states Accenture.

2. Adopt a ‘Digital Mindset’: To respond to digital disruption, financial organizations will need to evolve their internal and external cultures. ‘Being digital’ requires rethinking all aspects of how we conduct banking in the eyes of our employees and in the yes of the increasingly digital consumer.

Changing internal processes, moving to contextual engagement and operating in real-time are all foreign concepts for most financial institutions. A major internal change will also include the increased use of data and analytics to initiate and support decision making, product development and distribution.

Attracting and retaining top digital talent that can support this internal culture shift will become a priority. According to Accenture, “Sixty-one percent of digital organizations see shortages of digital skills as a top challenge in digital transformation and are concerned about how they can attract and retain top digital talent.”

Externally, institutions will need to illustrate a ‘digital mindset’ by leveraging digital technologies to improve customer engagement and the consumer experience. This will include gaining a better understanding of the consumer purchase journey, the preferred distribution channels, the impact of mobile on the use of products and serves and how social media will impact decision making.

Larry Downes and Paul Nunes provided four additional strategies that incumbents can use to survive digital disruption in their book “Big Bang Disruption.”

3. Monitor the Marketplace: Leverage tools and marketplace futurists to recognize when change is on the way, and to help interpret the meaning behind seemingly random events with insight and clarity. These people may or may not be your employees, but could also include customers, venture capitalists, industry analysts, etc. The key is to learn not only whom to listen to and when, but also how to react once a trend or change in the marketplace occurs.

4. Slow the Disruption: While it is almost impossible to stop disruption once it has begun to gain scale, roadblocks can sometimes be put in the way of disruptors to slow the transformation. This may include the lowering of prices if the disruptor is competing on price, or competing with the new entrant on a new battlefield or by partnering with a competing offering. As with all of the responses to disruption, speed is of the essence.

5. Exit Business Lines or Strategies: Digital disruption can quickly result in a depreciation of value of a current line of business or strategy. Borders, Circuit City, Blockbuster and many other once revered brands are illustrations of how entire industries can be upended.

In financial services, industry watchers may believe banks abandoned small business payments when few organizations responded to the infiltration by Square and PayPal. Other observers may wonder how long legacy banking organizations will continue to support massive, large footprint brick and mortar facilities at a time when there is a mass exodus to digital banking.

While a legacy bank’s brand and customer base may have significant value today, that value can be weakened if an organization doesn’t adequately respond to the digital disruption in the marketplace.

6. Diversify: “Diversification has always been a hedge against risk in cyclical industries, states Downes. “As industry change becomes less cyclical and more volatile, having a diverse set of businesses is vital.” This is where ongoing innovation and the potential for financial and non-financial partnerships become important.

Digital disruption cycles can be very impactful, but also surprisingly short. As a result, banks and credit unions will need to be ready with the next ‘best thing’ before someone else enters the marketplace.

Becoming a digital banking organization is not an option. To respond to the increasingly demanding digital consumer, and hopefully be on the ‘front screen’ of your customer’s mobile device, requires the offering of value-added digital services with a simple user interface.

By responding to the digital disruption occurring at two different speeds as recommended by Accenture allows your organization to respond to the immediate attacks by new fintech entrants while transforming your core for the future.