Do you know what the most valuable commodity on earth is?

Spend a little time poking around on the internet, and you’ll find that people will pay crazy sums for all sorts of things. White truffles go for around $2,000 a pound. And some women have paid as much as $2,000 an ounce for a so-called age-defying miracle cream, Crème de la Mer. And ambergris — which is basically whale poop — sells for $10,000 per pound. They use it in perfumes like Chanel No. 5… no joke. There’s also a fascinating little substance called tritium that’s used in self-illuminating “EXIT” signs that goes for $30,000 a gram — that’s $13.5 million per pound! Pablo Picasso’s painting “Women of Algiers” sold for an unbelievable $178 million, the most valuable piece of art on the planet.

But the most precious commodity on earth isn’t tritium, nor plutonium, nor Picasso paintings.

The most precious commodity on earth is your time. The basic principles of economics apply: Time is in extremely limited supply, and yet very high demand. There is only so much of it, and yet everyone wants more.

Think about it. The pace of life today is downright exhausting. Between your job, your kids, your friends, your family, your hobbies, you’ve got to mow the lawn, stop by the pharmacy, go to the dry cleaners, get a present for so-and-so’s birthday. You’re so busy, you don’t even have time to watch the TV shows you’ve packed onto your DVR!

That’s because everyone is starved for time!

A recent survey found that half of us feel we don’t have enough time in our daily lives. In fact, people are so stressed for time that we spend an average of an hour a day at work taking care of our personal business, things like banking.

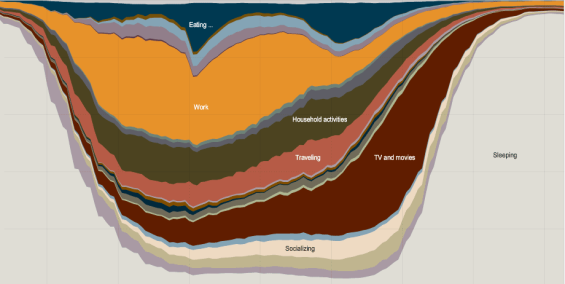

This chart shows how people spend their time from the moment they wake up until they go to bed. You can explore this interactive graphic and compare results for different demographics — age, gender, race — by clicking here.

Every day, we spend 8 hours sleeping, 8.5 hours at work, 45 minutes commuting, a couple hours eating and preparing food, 45 minutes on personal hygiene, and of course some time taking care of the house and the kids and the pets. And we spend an average of 2.5 hours a day watching TV.

So how much time does that leave the average consumer with every day? None. Well, almost none. In fact, we only have about 15 minutes of actual “free time” every day. And every day, there are over 3,000 companies scrambling to get our attention — 3,000 companies duking it out over what amounts to 15 measly minutes. Google and Amazon are billion dollar companies simply because they know how to get a sliver of those 15 minutes from us on a regular basis. Google and Amazon understand that time is so precious that they measure their performance in milliseconds!

Now this is one way you can be sure that time is indeed the most valuable commodity on earth. You see, the more valuable something is, the more precisely we measure it. Consider gold. The finest unit of measurement we use for gold is the “grain” — equivalent to what one grain of wheat weighs, or about 1/20th of a gram. It’s small, but it’s not that small. When it comes to measuring time, we are a lot more precise! The smallest unit we have for measuring time is the attosecond — one quintillionth of a second. For context, an attosecond is to a single second what a single second is to about 32 billion years. If you took a journey of 31 million miles — that’s roughly about the distance between Earth and Venus — an attosecond would be equivalent to the width of one human hair. That’s how precisely we measure time. There is nothing we measure more precisely than time.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Crisis of Complexity

Our society in general – and banking in particular – is suffering from what branding firm Siegel+Gale has called a “crisis of complexity.”

30 years ago you had one television with five channels. Today you have five TVs in your house with over 500 channels. The Cheesecake Factory has over 241 different selections on their menu, and that’s not including the specials. Makeup retailer Sephora carries 233 different mascaras, 454 lotions and 367 different fragrances — that’s a lot.

If you buy a new pair of Sennheiser headphones, they will come with a 60-page manual! Why??? 60 pages??? How complicated can a pair of headphones possibly be? You plug one end in and put the other end on your head! If you can’t figure that much out, what’s a 60-page manual going to do but just confuse you further?!?

The reality is that the world just keeps getting more and more complex, and that includes banking. In a study of 13 different industries, banking actually ranked last in terms of simplicity. Even the U.S. Post Office scored higher for simplicity in this study than the highest ranked bank.

That’s because complexity has embedded itself into every aspect of our financial system — IT systems, products, even marketing and communications.

For instance, back in 1980, the typical credit card contract was about a page-and-a-half long. Today it is 31 pages.

Reality Check: 31 pages of disclosure is not simple. Listing 14 different checking accounts with 39 possible fees is not simple. Banking terminology is not simple — HELOCs, FDIC, EHL, 401K, NSF, ARMs, IRAs. In fact, nothing about banking is simple.

And now life has become so exceedingly complex that we have all completely run out of time. That’s why people want to think about banking as little as possible — because it’s tedious, it’s a hassle, it’s complex — and there are a million other things people would rather be doing with their time.

So if your financial institution is looking for an innovation strategy, you could lay out your innovation blueprint in about 8 words:

- Simplify banking.

- Solve people’s problems.

- Save people time.

It’s this simple! You aren’t innovating unless you are making banking easier and finding ways to save people time. “Innovation” and “simplicity” mean the same thing. And “simplicity,” in turn, is about saving people time. That’s why you should all be constantly asking yourselves this question:

“How can this be simpler?”

Step one is to identify the problem. Identify those pain points in everyday processes… and remove them.

It sounds simple enough, doesn’t it? But in reality, making banking easy ain’t easy. If it was easy, everyone would be doing it. For starters, you have to adopt a whole new organizational mindset. If you’re going to simplify banking, it requires a level of insight into the customer experience that allows you to really see what truly frustrates people, what irritates them, what pisses them off.

And this can be kinda hard for those of us who work in banking and understand its complexities and inner workings. We see banking differently than consumers do. To bankers, this is an exciting world of rates and risk, balancing issues like liquidity and capital reserves to maximize ROA.

But consumers don’t see banking anything like that. In fact, in the consumer’s world, it’s really rather simple. They either have money and they just need to figure out what to do with it, or they need money and just they need to know how to get it. All consumers are looking for is the shortest distance — the simplest path — between these two points:

- I’ve got money → Help me make the most of it.

- I need money → Help me get it.

That’s what simplicity means to consumers. Simplicity means fewer steps, fewer options. Less thinking, less time. More clarity, more intuitive, more usable. A consistent experience that isn’t frustrating, it’s frictionless.

Become Champions of Simplicity

As marketing leaders, you need to be the champions of simplicity in your organization. Everyone looks to you to set the tone for your brand. Well, here’s your chance to steer your strategy in a compelling direction, and differentiate your institution in real, meaningful and relevant ways.

As stewards of your organization’s simple strategy, you need to help everyone on your team stay focused on just one or two things. This is only way to avoid getting bogged down and trapped in the “Pit of Complexity.” And when you ultimately achieve this level of organizational focus and concentrate on just a few simple things, you’ll be shocked by how easy the strategic answers come — what you should do, what you shouldn’t do, what opportunities you should be saying “yes” to, and equally important what things you should be walking away from.

Now one of the neatest things about pursuing a strategy of simplicity is that everyone in your organization can actually do something about it. The entire staff can participate, they can all be involved. Every department can rally around a mission like this. It makes sense doesn’t it — to make life easier? Who can’t get behind that? Everyone can understand it, and simplicity can touch everyone and everything inside your organization.

What else can you do to make banking simple? You can start with this exercise. Make a list of everything you can think of about your organization, then classify everything on your list into two columns — what’s easy and simple on one side versus what’s hard and complex.

Look at your website. Could it be simpler? Probably, yes. Honestly, everything about your marketing communications could be simplified somehow — everything from your website down to your disclosures. The Pew Charitable Trusts has been working with banks around the world for a couple years now to simplify their checking account disclosures. They’ve helped dozens of banks and credit unions whittle their disclosures down from a hefty 20+ pages down to a single, one-sided sheet of paper.

Here are a few more ideas to make banking easier:

1. Use plain English. Let’s dump the legalese. Get rid of all that interplanetary mumbo jumbo. Keep it short. Fewer words. Shorter sentences. Fewer paragraphs. Less! “Less” is the language of simplicity — faster, fewer, frictionless, “as easy as 1-2-3.” What else can you do?

2. Chop out steps. What could possibly be easier than “1-2-3?” How about a one-step process?

3. Dedicate yourselves to minimalism. Beware of “feature creep.” The temptation when organizations innovate is to add, add — add features, add products, add functionality. But in a simple world, it’s the exact opposite. With every process, every product, and every marketing piece you produce, you need to be asking, “What can we remove?”

4. Communicate visually. They say a picture is worth a thousand words, so you need to build your look-and-feel around simple imagery. Take all the clutter and visual noise out of your brand identity. Your design style should reflect your commitment to minimalism and simplicity.

5. Rethink your marketing messages. You see, as financial marketers, we tend to think about banking services in terms of products and features — a credit card with a 9% interest rate and no fee, or a vehicle loan at 7%. What we’re doing is pushing the product and the rate, but that isn’t how consumers necessarily relate to it. For instance, take a 38-year old blue-collar dude who just wants to buy a motorcycle, and all he needs is a little money to do it. Is he looking for a home equity line or an unsecured signature loan? He doesn’t know. He doesn’t care. He has no idea. All he really cares about is whether he can afford the payment because he’s dreaming about hitting the open road. He isn’t thinking about APRs and net interest spreads. He just wants to buy a Harley, and he can afford about $450 per month.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Make Banking More Fun

Another strategy you can take is to make banking fun. “Make banking fun??” you ask. “Is that even possible? And even if it is, why would we do it? And what the heck does fun have to do with simplicity?”

The answer to all those questions is Southwest Airlines. The story behind Southwest Airlines beautifully illustrates the psychology of fun and how it relates to a brand strategy built around simplification.

Southwest is a revolutionary innovator. They reinvented the entire airline industry though the lens of simplicity. For instance, instead of having its fleet stocked with various types and sizes of different planes, Southwest opted for a one-plane-fits-all approach by flying only Boeing 737s. And while other airlines all relied on the traditional multi-stop hub-and-spoke system, Southwest decided to build its routes around direct, nonstop flights.

Streamlining their business model in these ways created tremendous efficiencies for Southwest, saving money on everything from plane maintenance and training to food and cleaning costs, while also ensuring that its planes spent more time aloft and less time on the ground. Keeping everything simple and consistent helps Southwest drive costs down and make more money.

In turn, they use their cost savings to extend lower fares to consumers. They don’t charge for baggage either. They also have fewer flight delays than other airlines, in part because of their simpler point-to-point flying system. Southwest makes flying easy because consumers don’t have to worry about fares, fees and schedules.

Now of course, all that streamlining could have diminished the customer experience — that’s what you’d expect (e.g., “Don’t cutbacks always result in inferior service?”). But Southwest figured out how to make flying fun. They realized that they were going to be operating what is basically a public bus system in the skies, but they still deliberately chose to make it enjoyable. They actually improved their in-flight experience by encouraging their pilots and attendants to do things like banter and joke with passengers. And you have to admit it: Southwest is fun. They are funny. They have a fun brand. Southwest makes low-cost air travel tolerable by keeping it fun. And — as the expression goes — “Time flies when you’re having fun,” so the more fun your brand is, the less people will mind spending their time with it. Heck, they might even start to enjoy it!

Southwest proves that no industry is beyond simplification, no matter how complex it may be. In fact, the more complex something is, the more opportunities there are for simplification — and the more those changes will be valued and appreciated by consumers.

The ROI of Simplicity

Do you know why Apple is one of the most valuable companies in the world? It’s not because they invented personal computers. They didn’t invent the graphical user interface, smartphones, tablets, or MP3 players either. While Apple is widely praised as an “innovative company” (and rightfully so), they don’t actually invent things. They just perfect the presentation of other people’s ideas. They simplify the delivery and execution of ideas that are already out there.

Apple ended up owning the MP3 market not because they were first or because they invented MP3s, but because they made their iPods — and iTunes — so easy to use. Their Macintosh computers are easy to use. iPhones are easy. iPads are so easy, a two-year old can use them.

Companies like Southwest, Apple, Netflix and many others are successful simply because they make things easy for consumers. At any McDonalds in North America you can order a #1 with a Coke and you’ll get the exact same thing, for about the same price, at the exact same temperature, and in about the same amount of time, pretty much every time. That level of consistency makes things very, very easy for consumers. McDonalds isn’t the #1 food chain in America because they have the best food or greatest service. They are #1 because they make it easy.

If you bought an index fund of companies like these that focus on making things simple, your stocks would be outperforming the Dow and S&P by nearly double. How’s that for an ROI?

Why are these companies crushing the competition? Because consumers are starved for time and crave the level of simplicity these companies deliver. Four out five people say they are desperate to find ways to simplify their lives. Two out of five would pay more for simpler experiences. In fact, branding firm Siegel+Gale found that consumers are willing to pay what they call a “simplicity premium” as much as 6%.

The good news? No industry is more ripe for a simplicity revolution than banking.