Millennials, the generation born between 1980 and 1994, outnumber Baby Boomers and represent a segment that is growing in economic strength, social influence and banking potential. They differ from previous generations in the way they bank and the communication channels they prefer.

The second FICO report on Millennials explores the differences, opportunities and challenges of the Gen-Y segment. It highlights the rise of alternative banking services such as mobile payments and peer-to-peer lending and examines the Millennial segment’s preference for communicating with banks across multiple digital channels.

“We already know that Millennials are inclined to conduct common banking activities through the digital channel,” said David Vonk, who leads the North American banking practice at FICO. “While alternative banking may still be in its infancy, it has the potential to grow rapidly, especially as the Millennial generation enters its prime and pushes these services to the forefront of its banking agenda.”

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

1. 52% of Millennials Prefer Non-Traditional Payments

Over 50% of Millennials are already using or would consider non-traditional payment companies like PayPal or Venmo in the next 12 months. “Millennials see value in the convenience, mobile support and ease of use of new payments solutions,” according to FICO. As expected, the consideration of non-traditional payment providers decreases with age, with only 27% of consumers over age 50 likely to consider non-traditional payment firms.

Interestingly, the appeal of non-traditional payment options is not correlated to primary bank satisfaction. This points to the opportunity of reaching this generation and other users of P2P alternatives with a simple-to-use, socially integrated payment solution. Given the marketing and referral power of some of the new mobile payment apps, the urgency of developing or building a partnership with a current solution provider can’t be overestimated.

Read More: How PayPal’s Venmo is Winning The Battle for Social Payments

2. Mobile Wallet Use By Millennials Is About To Skyrocket

While mobile POS payments still lag other payment options, twice as many Millennial respondents (32 percent) report that they are likely to use mobile wallet services like Apple Pay or Google Wallet in the next 12 months as those who are 35 and older (16 percent).

With the majority of new mobile devices being purchased today having NFC capabilities, and with the increasing penetration of NFC POS terminals at merchant locations, organizations hoping to capture Millennial banking relationships will need to be able to support mobile payments.

3. Millennials 10X More Likely To Use P2P Lenders

While the use of peer-to-peer lenders still remains low across all demographic groups, Millennials are much more likely than other groups to consider these services in the next 12 months. This is especially true with males (who are twice as likely as females to use P2P lenders) and when compared with the 50+ age group (where Millennials are over 10X more likely).

Peer-to-peer lending is so efficient, so straightforward and is delivering returns so high that the financial services industry is taking note. Once regulatory issues get resolved, financial organizations will need to determine if they can afford to lose this business or if they will become part of the marketplace themselves.

And while the sector’s pioneers point out that traditional banks may struggle to match them for innovation or agility, what big banks do have in plentiful supply is the ability to absorb losses.

Read More: Financial Institutions Unprepared For Digital Future

4. Majority of Millennials Still Use Traditional Banks … For Now

FICO stated it best when they used the headline, “The non-traditional banking revolution has already begun, but banks still have time to join.” While the growth of alternative providers is well documented, the majority of all demographic segments still prefer traditional banking organizations due to familiarity, established habits, and trust.

That said, alternative digital options are becoming more popular, especially with digital natives such as Millennials, who are looking for easy-to-use alternatives that provide value at a low or zero cost. According to the FICO research, 39% of consumers age 18-50 would consider using Venmo or Paypal in the next 12 months, while 18% would consider doing mobile payments and 10% would consider P2P lending. Banks and credit unions need to be aware of these trends and up their digital game.

5. 46% of Households Receive Irrelevant Offers

Despite greater availability of both structured and unstructured consumer data and lowering costs of processing insights, nearly half of the consumers surveyed by FICO don’t believe they receive personalized or relevant offers from their financial institution. Despite the poor targeting done by the banking industry, nearly 75% of consumers still said they didn’t receive too many offers from their bank.

The bar for effective communication and engagement is being set by other industries that have done a better job of matching needs to personalized offers. But the patience of most consumers is wearing thin. It is incumbent that banks and credit unions begin to leverage the product and lifecycle insights at their disposal to communicate more effectively.

6. 43% of Millennials Don’t Receive Communication Via Their Preferred Channel

Like most consumers, Millennials want to be communicated using their preferred channel. According to the FICO research, the preferred digital communication channels were:

- Text

- Bank Website

- Mobile App

![Preferred_communication_channels_for_communication_of_banking_informa tion[2]](https://thefinancialbrand.com/wp-content/uploads/2015/02/Preferred_communication_channels_for_communication_of_banking_informa-tion2-565x249.png)

But all Millennials are not alike. The key is to determine individual customer preferences and match how each consumer chooses to interact for different types of communication (product notifications, alerts, sales messages, service, etc.). This process of channel preference identification begins at the new account desk and should be reinforced continuously. The ability to customize communication on an individual level exists and must be leveraged to increase engagement and improve the consumer experience.

Read More: Understanding The Financial Consumer Purchase Journey

7. 80% of Millennials Conduct Basic Banking Digitally

“Millennials are more likely to conduct common banking-related activities via digital channels than other surveyed age demographics,” states the FICO study. The most common digital banking activities include checking balances on accounts (80%), checking for fraudulent activity (76%), and performing internal transfers of funds (65%).

Millennials stress the importance of alerts and notifications from their financial institution related to overdraft warnings and potential fraudulent activity. Interestingly, many are open to sales messages if they are targeted based on their individual financial situation and are not too frequent.

![Top_digital_banking_activities_by_millennials[3]](https://thefinancialbrand.com/wp-content/uploads/2015/02/Top_digital_banking_activities_by_millennials3-565x274.png)

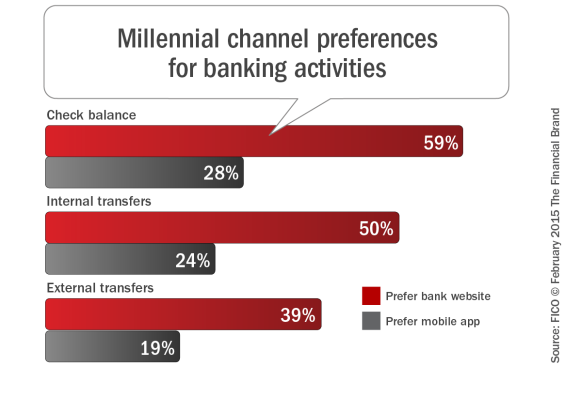

8. Millennials Prefer Mobile Websites Vs. Mobile Apps 2:1

While Millennials are more than twice as likely to use a bank’s mobile application than Generation X or Boomers (26% for Gen Y vs. 12% for Gen X and 3% for Boomers), a bank’s website is still the preferred way of banking for Millennials. Somewhat amazingly, FICO found that 30% of Millennials with smartphones don’t use any banking apps. 45 percent of those who don’t use banking apps, said they prefer not to conduct banking-related activities on their mobile device.

This anomaly, similar to the way Millennials want to be communicated to, illustrate the importance of using individual consumer insights to drive communication to this segment. Possibly driven by the newness of banking relationships to many Millennials, the reliance on mobile channels for communication and transacting may be less than most bankers realize.

Ramifications For The Banking Industry

As mentioned in a previous article entitled, Don’t Underestimate The Millennial Banking Opportunity, Millennials are the most ethnically and culturally diverse generation in US history, with varying financial needs and a multichannel method of researching and accessing financial services. As a result of their age, they are experiencing many life changes as they move from education, to employment, to marriage, to starting a family.

As these changes occur, Millennials are regularly changing their financial goals, attitudes and requirements from their financial institution. Each of these life events provide opportunities for banks and credit unions to engage the Gen Y segment with the hope of beginning the process of cultivating a long-lasting relationship

The key, however, is to realize that the diversity of this segment requires more personalized (and customized) communication than ever before. This will require institutions to leverage ‘big data’ to a greater degree to reach and engage this segment. It will also be important for banks and credit unions to develop or partner with non-traditional providers in the creation of products, services and applications that will meet the increasingly demanding needs of the Millennial.