Mobile devices are transforming the ways consumers conduct their everyday banking. Digital technology is disrupting existing banking paradigms and creating tremendous opportunities for new financial industry players, forcing banking and credit union incumbents to change the way they operate their businesses.

Opportunities are being created by evolving devices, applications and connectivity, introducing new functionality that was previously unthinkable. The result is that more Americans than ever are becoming addicted to mobile banking.

To better understand the buying and usage patterns of the modern mobile banking consumer, Carlisle & Gallagher Consulting Group (CG) conducted an online survey of 1,005 U.S. consumers as well as surveying financial services executives at the top 20 U.S. financial institutions. The research also sought to better understand how mobile devices, and the shift in mobile device size (tablets getting smaller, smart phones getting larger), will influence how consumers do their banking in the future.

In the study, it was found that 52% of consumers are doing more mobile banking than two years ago. This behavior is reaching habitual stages, with 55% of Americans accessing mobile banking 2-3 times a week and 26% accessing mobile banking 4+ times a week! When asked what factors influenced their use of mobile banking, the top three reasons were ‘ease of use’ (72%), ‘ease of making payments’ (65%) and ‘better features’ (65%).

“An ever-increasing consumer demand for instant gratification is seeping into every facet of our lives, including how we bank,” said Byl Cameron, CG’s Digital Practice Lead. “Consumers want to do everything on every device that they own: laptop, smartphone, phablet or tablet.”

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Growth in Digital Device Ownership

Mobility continues to transform the way consumers shop, transact and communicate. Deloitte Consulting cites 2013 as a key inflexion point in the evolution of the telecommunications sector: the year in which global smartphone shipments overtook feature phones, and tablet shipments surpassed PCs. In fact, the revenues generated from sales of smartphones and tablets are due to soon overtake those of the entire consumer electronics category.

According to the Carlisle & Gallagher study, mobile device growth will dominate the next 24 months. All online survey respondents expect to buy more mobile devices by 2016, with 84% planning to purchase a smartphone, 26% a laptop, 25% a tablet, and 14% a phablet.

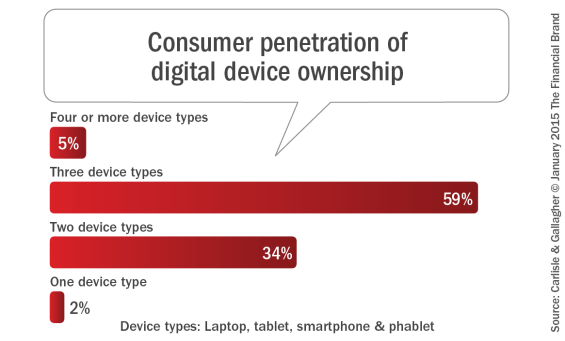

These purchases will add to an already impressive family of devices owned by most respondents. More than 50% of the consumers surveyed owned three digital devices (laptop, tablet, smartphone, phablet), while more than a third owned two digital devices.

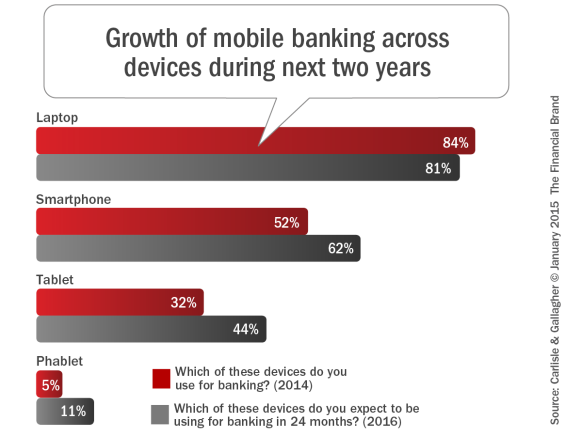

Despite ongoing predictions of its imminent demise, the laptop still remains the most popular device overall. This is a legacy from the PC era and due to the device’s benefits from a ‘content creation’ perspective, compared with tablets, phablets and smartphones that are primarily designed for ‘content consumption’ and communication.

As a result, laptop banking is the strongest digital channel, but is expected to decrease from 84% to 81% over the next two years. Alternatively, banking via a smartphone is expected to jump from 52% to 62%, with tablet banking increasing to 44%, and phablet banking more than doubling, from 5% to 11%.

Rise of the Phablet

Thanks to the introduction of the iPhone 6 Plus and increasing viewing of video content on mobile devices, there has been a recent upsurge of phablet purchases and usage among all demographic groups. The CG study illustrated the impact of this growth on banking, finding that 46% of U.S. consumers are more likely to conduct mobile banking due to larger devices, such as a phablet.

Other characteristics of a typical phablet owner were:

- Male (65%)

- Younger (more than a third are 25-34 years old)

- Habitual mobile banker (40% do mobile banking 4+ times/week)

- Multi-device owner (3 or more devices on average)

- More likely to buy a wearable (33%)

“While the use of a phablet for banking is still small compared to other digital devices, this growth is expected to continue to accelerate as more consumers opt for increased real estate as part of their mobile experience,” stated Cameron in an exclusive interview with The Financial Brand. In fact, one in six U.S. consumers believe mobile banking is an important reason to buy a large screen smartphone/phablet.

“CG believes that phablets will have approximately 30 percent of the mobile device market share by 2020 and become the dominant device for mobile banking,” said Cameron. “We also project that tablets will decline in popularity, especially as a device on which to do banking. Our study found 68 percent do not use tablets today for banking.”

Engagement Differs by Mobile Banking Activity

Carlisle & Gallagher found that consumers prefer to conduct mobile banking on all of their mobile devices. And the more devices a consumer used for their mobile banking, the more addicted they were to the process.

While consumers are focused on three mobile banking activities: checking balances, transferring funds and paying bills, they are also selective as to what types of transactions they performed on each device.

In other words, consumers who have a three-device lifestyle interchangeably use their laptops, tablets and smartphones for the most frequent mobile banking activities:

- Viewing balances: 97% on laptops, 95% on tablets and 94% on smartphones

- Transferring funds: 89% on laptops, 81% on tablets and 82% on smartphones

- Paying bills: 92% on laptops, 86% on tablets and 81% on smartphones

As depicted in the radar chart above, depositing checks with mobile devices (smartphone or phablet) is gaining popularity. More than 60% of phablet and smartphone users surveyed (online survey with a bias to higher income and younger age) are depositing checks remotely. Alternatively, alerts are primarily being received on laptops and tablets, indicating app-based alerts as opposed to real-time SMS texts or email alerts that are more easily responded to via mobile devices.

As depicted in the radar chart above, depositing checks with mobile devices (smartphone or phablet) is gaining popularity. More than 60% of phablet and smartphone users surveyed (online survey with a bias to higher income and younger age) are depositing checks remotely. Alternatively, alerts are primarily being received on laptops and tablets, indicating app-based alerts as opposed to real-time SMS texts or email alerts that are more easily responded to via mobile devices.

‘The radar chart illustrates a number of clear opportunities for improvements in the delivery of mobile banking,” stated Byl Cameron in an interview with The Financial Brand. “The lack of penetration of digital alerts, mobile shopping tools, account opening functionality, live chats and electronic signatures provide guidance for organizations wanting to differentiate mobile banking services and increase both acquisition and engagement.”

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Recommendations

As part of their mobile banking study, Carlisle and Gallagher provided the following recommendations:

- Adopt a “mobile-first” approach. Build with the mobile consumer in mind, but realize that it is important to maintain, and even expand, legacy online banking platforms for consumers who still prefer browser-based online banking via a laptop.

- Build for larger devices. Mobile banking experience differs based on the device used. Larger devices, like the phablet and tablet, provide unique functionality and ‘real estate’ unavailable with a smartphone. Applications need to be built to leverage these differences.

- Plan for ‘Opti-channel™’ experience. Consumers require an optimal experience across all of their mobile devices, with the ability to move seamlessly between channels without starting over. Consumers also want to be able to use the best digital device for any specific function.