In much the same way that Apple pulled together disparate parties prior to the introduction of iTunes and the original iPod, they have done the same with credit card companies, banks and merchants as part of their release of the iPhone 6 and Apple Pay. For the banks and credit card networks, Apple Pay could threaten some revenue streams, since Apple is getting a financial piece of every transaction. In return, the banking industry is hoping for improved POS security and privacy benefits as well as inroads into an expanded online and mobile purchasing universe.

The banking industry also appears to be willing to allow the Apple brand become a prominent focal point in the mobile payments process.

Reports indicate that the financial services industry began working on the Apple Pay project in January 2013, when Apple had the first concrete conversations with the credit card networks. In the summer of 2013, Apple approached the top six banks involved in the project (American Express, Bank of America, Capital One Bank, Chase, Citi and Wells Fargo), without revealing what other banks were involved.

Willing participation of the top six banks as well as Barclaycard, Navy Federal Credit Union, PNC Bank, USAA and U.S. Bank suggests both Apple’s power in the mobile space and the recognition that there are other payment solutions being promoted that are not as willing to work with the banking industry. For instance, the Merchant Customer Exchange (MCX) would prefer to replace the card networks altogether. This is highlighted by the fact that the two most prominent members of MCX, Walmart and Best Buy, announced that they would not accept Apple Pay.

Read More: Is Apple Pay a Banking Trojan Horse?

Big Banks Support of Apple Pay

From day one, the biggest banks in the country jumped on the Apple Pay bandwagon. In fact, in a highly coordinated public relations blitz, chief executives from all of the major participating banks expounded on the “exceptional customer experience” and the “exciting move” related to being part of the Apple Pay network.

“JPMorgan Chase has been pleased to collaborate on Apple Pay to create a better, faster and safer payments system, which puts the customer first, creating an exceptional customer experience for consumers and merchants. Everyone wins.” – Jamie Dimon, chairman and CEO, JPMorgan Chase & Co.

“We’re providing our customers with tools to make their financial lives better, including our 30 million digital banking customers. For them, better means simple and convenient. Apple Pay is another exciting move in that direction.” – Brian Moynihan, CEO of Bank of America.

“Apple Pay is the kind of innovative thinking that brings the worlds of online and offline commerce closer together. We’re excited to work with Apple to offer Card Members and merchants a simple and secure way to make purchases in stores and on apps.” – Ken Chenault, CEO of American Express

It is thought that one of the reasons Apple was able to convince so many partners to become aligned was the initial absence of anything in Apple’s plan that appeared to be disruptive of the current payments flow. Apple’s model “still puts us at the center of payments”, says one bank executive. While still in its relative infancy, NFC will be the POS link and secure “tokens” will generate and transmit a one time code to pay for transactions rather than a signature or PIN.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

One More Thing

Buried in the Hollywood red carpet treatment provided the new iPhone 6, Apple Watch and Apple Pay, was potentially the most important component of the partnership between the banking industry and Apple. Giving consumers the ability to make mobile ‘one-touch checkout’ with Apple Pay’s Touch ID rather than typing in card information – particularly on a small screen – could greatly encourage increased digital spending.

According to Ad Age, app developers have already started building Touch ID into retail apps. For instance, Target has already announced that it has integrated the iOS 8 Touch ID capability into its Like2Buy mobile platform. Apple has made it extremely easy for the Touch ID capability to be added to virtually any mobile site to help facilitate secure payments.

“Apple’s Touch ID has the potential to improve tracking, measurability and ROI significantly. With Touch ID, the buyer never leaves the screen to transact. Attribution, tracking and conversion rates will all improve,” stated Ad Age.

In combination with iBeacon, relevant ads can also be delivered on the mobile device. While the ads could be from the retailer, they could also be from a financial institution offering merchant-funded discounts in conjunction with the retailer.

Many of the initial partner banks have begun to promote their association with Apple Pay. Illustrating the potential power of these partnership, many of the banks have placed information about Apple Pay in the #1 spot on their website.

Read More: How Will Banks Respond if Apple Becomes Mobile Payments Player?

Chase Bank

Despite being one the ‘big 5’ banks introduced as part of the Apple Pay announcement on day one, the promotion of Apple Pay on the Chase Bank website is nonexistent at this time. In fact, the term ‘Apple’ and ‘Apple Pay’ on the site do not result in any matches.

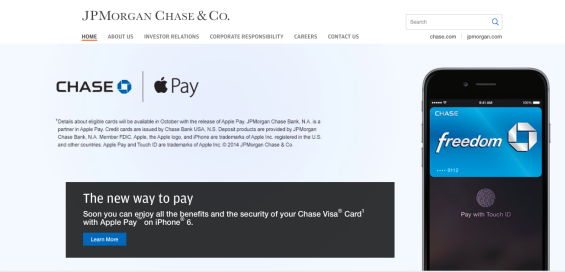

On the other hand, the Apple Pay partnership dominates the J.P. Morgan Chase home page as shown below. Probably more interesting is that the link for more information leaves the J.P. Morgan website and goes to the Apple.com Apple Pay introduction site (where Chase holds the #1 position, but where Bank of America, American Express and Citi are also prominently featured.

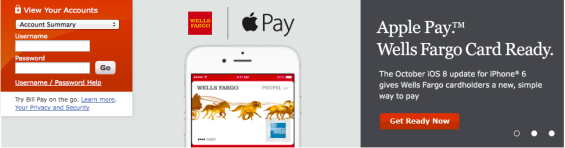

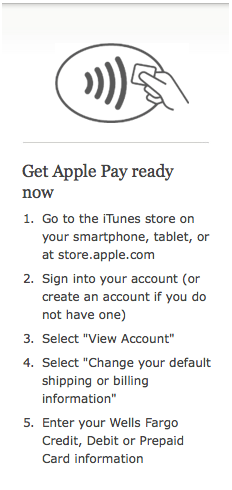

Wells Fargo

Wells Fargo “Get Apple Pay Ready” program is promoted on their front page (with the Apple Pay logo prominent). When you reach the linked site, Wells immediately discusses how they are excited to be working with Apple, stressing the importance of linking a Wells Fargo Credit, Debit, or Prepaid Card to Apple Pay to enable mobile payments at the more than 220,000 stores, restaurants, etc. already in the program.

The message on the Apple Pay jump page says, “When you activate Apple Pay on your new iPhone 6 and iPhone 6 Plus in October, confirm you’d like to use the card you’ve stored in iTunes. When you do, you’ll be able to:

- Make contactless payments in person at participating stores

- Authorize payments with just the touch of your finger using Touch ID

- Benefit from Zero Liability protection1 against liability for promptly reported unauthorized card transactions

It’s our goal to make access to your money safe and simple whenever and however you need it.”

U.S. Bank

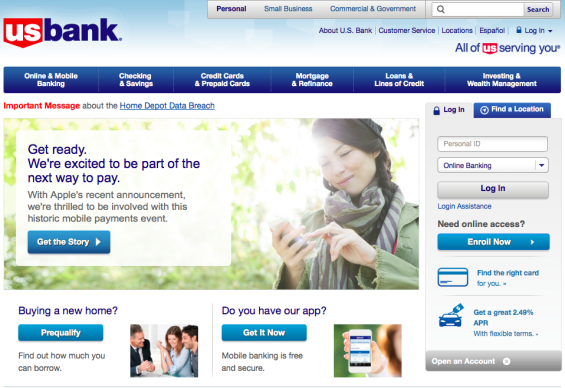

Along the line of most of the other banks that are promoting their partnership with Apple, U.S. Bank emphasizes the benefits of the process being ‘easy’, ‘secure’ and ‘private’. They go as far as to say, “Apple Pay creates a unique and incredibly intuitive experience.”

U.S. Bank Home Page

Richard Davis, chairman, president and chief executive officer of U.S. Bancorp is quoted, “As we focus on U.S. Bank’s future, we will continue to grow our mobile technology in order to keep pace with the current and next generation of banking customers, and anticipate how to make our products and services more convenient. Working closely with Apple to bring Apple Pay to U.S. Bank customers across the country aligns with our legacy of simplifying customers’ lives, developing exceptional banking products and services, and our ability to make cultural connections with current and future customers through the utilization of technology in innovative and practical ways.”

U.S. Bank Apple Pay Jump Page

U.S. Bank also brings together the benefits of both companies by referencing that, “With Apple’s history of innovation and the scale and loyalty of U.S. Bank, Apple Pay has the ability to impact and drastically accelerate the adoption of mobile payments.”

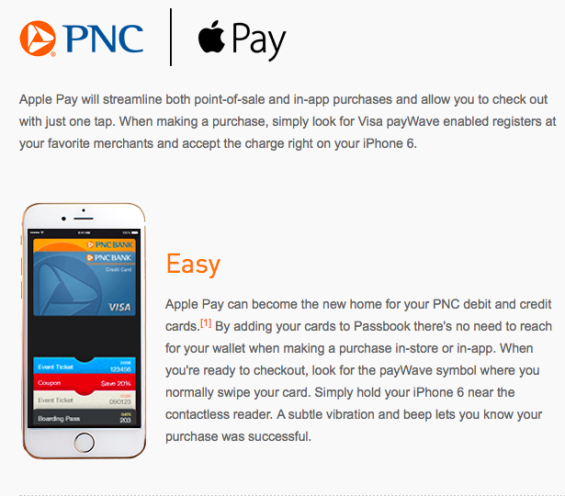

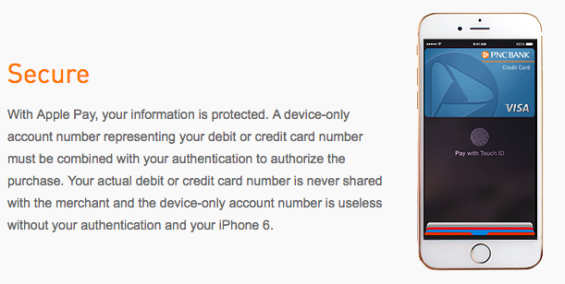

PNC

While not one of the initial ‘big five’ banking partners partnered with Apple, PNC is far from shy in the promotion of their association with Apple Pay. Not only is there a large front page reference to Apple Pay, but they do the most extensive illustration of the benefits of Apple Pay of any of the banks reviewed on their jump page. Using what may be creative elements provided by Apple (see the Navy Federal Credit Union creative), PNC illustrates how Apple Pay is “easy, secure and private” (exactly the terms used by U.S. Bank and others).

Citi

Interestingly, while the promotion of the Apple Pay partnership with Citi dominates the front page of the website, the ‘learn more’ jump page is currently just a press release about the collaboration and the benefits of the new payment option.

Beyond discussing that Apple Pay will support buying in stores or online from merchants in apps, and the ability to make payments happen in a single touch, there is another glowing quote by a payment executive. “Citi has a long history of delivering choice and value through innovation that meets our cardmembers’ needs,” said Barry Rodrigues, Head of Enterprise Payments at Citi. “We are looking forward to delivering to our cardmembers another way to simply and quickly make payments for a broad range of purchases such as buying a coffee, groceries or purchasing digital music.”

USAA

Compared to several of the other 11 banking Apple Pay partners named on the first day, USAA has tried to position their brand on equal (or better) footing than the Apple brand. In addition to comparatively downplaying the partnership on the home page, the jump page uses the headline, “Power of USAA Coming to Apple Pay.”

In the ‘news’ section USAA site, the focus is on USAA more than Apple when they say, “USAA stands at the forefront of the mobile payment movement, thanks to an innovative feature on Apple’s newly unveiled devices.”

While the rest of the article follows most of the other banks regarding the description of Apple Pay benefits, USAA goes one step further by launching several enhancements to its mobile app, including:

- Personalized mobile discounts and offers at in-store and online retailers throughout the U.S

- Facial and voice recognition for a limited number of members through a biometrics pilot

As with many banking mobile apps, the USAA mobile app for iPhone is also being optimized for iOS 8.

Navy Federal Credit Union

Possibly because Navy Federal Credit Union is one of the ‘second phase’ partner financial institutions, the prominence of the Apple Pay partnership is somewhat downplayed as it is with USAA and is referenced in the ‘Coming Soon’ section of the home page.

When a member uses the link to go to the jump page, the promotion is again comparatively low key, with only two paragraphs introducing the partnership before customized illustrations (the same as used by PNC) highlight the same benefits of easy, secure and private.

The Rest of the ‘Big 11’

Despite a great deal of searching, there were no prominent website promotions of the Apple Pay partnership on the home pages of Bank of America, American Express, Capital One or BarclayCard. While it is definitely expected that promotion will become front and center by the time the functionality for Apple Pay turns on, the absence of significant promotion at this some is somewhat surprising.

On the other hand, email programs to customers of Bank of America and Capital One have been found by our direct marketing partner Comperemedia. Similar to the website marketing, the messages continue to be non-differentiatable even though Capital One personalized their messages to different product segments.

Impact on Non-Participating Banks

According to a recent Drop Labs blog post by Cherian Abraham, “No bank wants its brand to be overshadowed by Apple, nor do banks want smartphone users to close their app and open up a different wallet to make a payment. But this was not up for debate with Apple, which wants to tightly control the payment experience. This should be a cause of concern for Apple Pay partner banks, for whom enabling payments outside of Apple Pay in iOS is now off the table.”

Going forward, big banks and smaller banks will most likely have to make some kind of ‘deal with the devil’ because of the overarching power of the Apple brand and their iPhone/iTunes customer base. As the big banks have already begun to do, it is important to convince customers to replace debit cards on file with iTunes with credit cards with your bank’s name on it. It will also be important to continually promote the use of your card in any Apple Pay in store or online transaction.

As mentioned by the American Banker, a negative scenario for smaller institutions is that Apple could offer them less favorable financial terms than it has negotiated with the biggest banks, because a relatively small percentage of payments gets processed on smaller banks’ cards. That could partially erode the advantage banks with less than $10 billion in assets currently have over larger competitors that are subject to a statutory price cap on debit card swipe fees.

Despite this potential drawback, as soon as the ability to partner with Apple is opened up to additional banks, it will be important to support this payment initiative to move the payments process forward in a unified manner. That said, the positioning of the Apple Pay brand compared to the bank’s brand will remain up for debate.