The financial crisis of 2008 and the emergence of Gen Y has created a massive generation of digital consumers that have higher debt, lower incomes, less trust of traditional financial institutions and a view of banking that differs greatly from their predecessors. These consumers are looking for ‘banking’ products that provide value, convenience and functionality that can, at times, be offered by non-traditional providers.

“The ‘underserved’ market represents more than 88 million individuals and nearly $1.3 trillion in wages.”

— KPMG

Given the sheer size of this segment of consumers, they are hard to ignore. The challenge is how to serve a market that is highly diverse, of lower immediate value and needs to be reached using new offers and media. To date, non-traditional financial services providers have done the best job in serving this market.

The primary reason is because of these players have been better at innovating, have a lower overhead structure, are less regulated, and do not need to deal with legacy operating systems. Alternatively, traditional financial organizations have better brand recognition and a more expansive distribution network (in most cases).

The Underbanked Opportunity

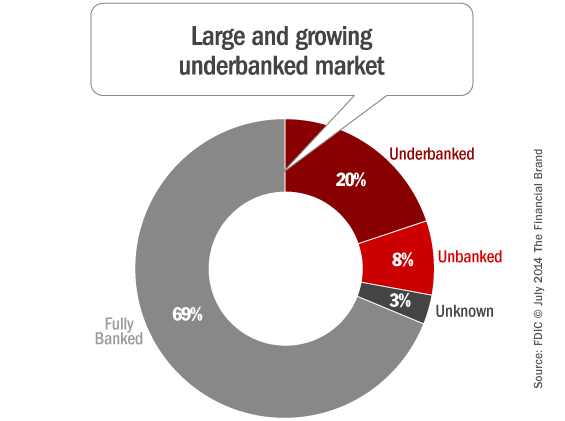

According to a new report from Acxiom entitled, “The Underbanked Market: A New Frontier for Retail Bank Growth”, the underbanked is a large and growing segment. As a group, they are consumers with a checking and/or savings account at bank or credit union but with less than average use/access to other basic banking products such as credit cards, loans and other traditional services.

Underbanked consumers conduct some of their financial transactions outside of the mainstream banking system — defined as retail banks, savings and loans and credit unions. The FDIC defines them as those who have used alternative financial services (AFS) in the past 12 months.

In the U.S., 20.1 percent of households are underbanked, representing 24 million households with 51 million adults. As a group, 29.3 percent of households do not have a savings account, while about 10 percent do not have a checking account. This is in contrast to about two-thirds of “banked” American households that have both checking and savings accounts. According to KPMG, the underbanked segment has grown by about 12 percent over the last 4 years due to the mortgage and economic crisis.

While the underbanked segment possesses some of the demographic characteristics that would be expected (lower net worth, a higher percentage of renters and lower home values), Acxiom provides an underbanked profile with a few surprises:

- The majority of the market is addressable and reachable through traditional media

- The household composition mirrors U.S. averages

- The market is older than may be expected, with half of underbanked consumers being 45 or older

- The majority of households have steady income

- The market is nearly as educated as the traditional fully-banked household

The challenge for traditional financial institutions is how to adequately and economically serve a highly diverse segment that has limited financial needs in the short term. The opportunity is that many in this segment currently pay high fees for basic banking services, a great deal of the non-traditional competition for these consumers are limited in their offerings and there is no guarantee that the underbanked will remain this way.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Correlation of Underbanked and Gen Y

While many in the Gen Y segment are already fully-banked, Acxiom’s Underbanked Index (UBI) shows a significantly greater proportion of Gen Y in the underbanked segment. At the same time, Acxiom also shows a significantly higher representation of Gen Y in the consumption of savings and checking accounts as well as alternative products such as internet tax preparation, money wiring and cash advance services.

More than one-third of the underbanked individuals in the United States would rather use a prepaid card than a checking account for basic financial transactions if costs were equal

The question is whether the higher percentage unbanked representation is simply a function of this segment being earlier in their financial lifecycle or if their financial patterns will remain different than their predecessors. Either way, it is clear that many in their segment already shop differently, communicate differently, are more comfortable than other segments using mobile devices.

Due to the size of this market, traditional financial services providers need to pay attention.

The challenge is that many younger customers that would normally choose a traditional checking account as the foundation of their banking relationship are increasingly choosing to use a prepaid debit card. In most cases, it is because this segment doesn’t see the added value of a traditional checking account versus a prepaid card that can accept ‘deposits,’ do transactions and pay bills. This segment doesn’t view checks as being important, yet they value the ability to get real-time balances and not overdraw their account.

Reaching The Underbanked Consumer

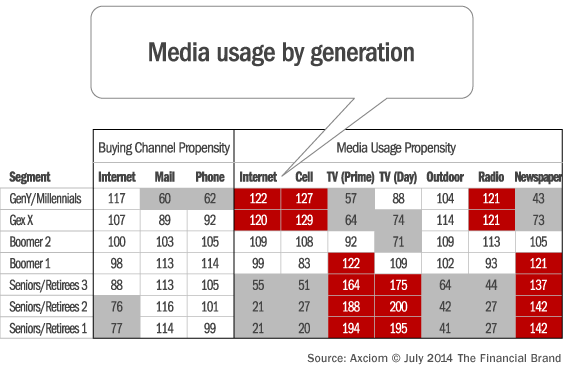

Because the demographics of the underbanked consumer include both younger and older consumers, finding the right media mix to reach these households is not cut and dry. While some of the older segments use digital channels, this is not the norm. On the other hand, the Gen Y segment prefers digital channels for much of their communication. The key is to find a cost effective media mix that can reach the underbanked segment that may generate lower revenues initially.

The good news is that the lower cost digital and mobile channels are highly effective at reaching the important Gen X and Gen Y households according to Acxiom.

Underbanked consumers need minute-to-minute information about their finances, and mobile financial services are well suited to deliver it. Although these consumers often have insufficient access to financial services, their access to mobile phones is fairly widespread. This disparity suggests a large opportunity exists for financial providers to effectively serve the underbanked population using the mobile channel.

The Center for Financial Services Innovation (CFSI) outlined four attributes to mobile that make it highly appealing and viable in serving this market:

- Portable: Portability of the mobile device is central to its utility to consumers generally, and to underbanked consumers in particular. Because most cell phone users carry their phones with them at all times, financial providers can use mobile phones to deliver time-sensitive information, such as fraud alerts, low-balance warnings, and overdraft warnings, and consumers can use them to get immediate account information at any time.

- Ubiquitous: Unlike internet access at home, mobile access is consistently high across demographic and socioeconomic groups. In fact, segments of the U.S. population overlap significantly with the underbanked, such as Hispanics, African Americans, and youth. With so many U.S. consumers now using mobile phones, financial providers can be certain that mobile services will reach a large percentage of consumers.

- Personalized: Mobile phones house a great deal of information about the people who use them, including location, purchasing behavior, interests, health, contact database, and much more. As a result, financial providers can connect with consumers more personally through a mobile device than through other channels. Increasingly, the mobile device is becoming the new wallet.

- Multi-Modal: In addition to placing calls and sending text messages, people use mobile devices to take pictures, check email, manage appointments, access maps and traffic information, edit documents, etc. The increasing sophistication of mobile phones increases the possibilities for financial providers to use them to interact with consumers for more complex purposes, such as check depositing and fraud detection.

While smartphones offer much deeper functionality than feature phones, evidence suggests that underbanked consumers are not far behind the general population in smartphone use. With pricing for both smartphones and data plans dropping, and with smartphones becoming increasingly available through prepaid wireless providers (who typically cater to a lower-income customer base than post-pay carriers), the underbanked have ever greater access to highly functional smartphones that could be the low-cost link between traditional financial providers and the underbanked.

A Growing List of Underbanked Competitors

For any financial organization looking for growth beyond organic growth or acquiring other organizations, the Gen Y segment, and more specifically, the underbanked market is a viable option. The need to effectively and efficiently reach this market becomes even more important as Baby Boomers retire and the competition from both traditional and non-traditional financial providers intensifies. Some noticeable forays into serving the underbanked consumer include:

- Walmart: Last year, Walmart generated about 1 percent of annual sales from financial services such as money orders, prepaid cards, wire transfers, check cashing and bill payments. In addition, they have developed partnerships with firms like American Express, whose Bluebird prepaid card mirrors most of the functionality of a traditional checking account with lower fees.

- T-Mobile: T-Mobile entered the underbanked marketplace well positioned to serve the underbanked since a large number of their current customers use prepaid contacts. Their Mobile Money product includes a prepaid Visa card, a mobile app customers can use to deposit checks, pay bills, transfer funds and reload cards, and free access 42,000 ATMs and more than 70,000 T-Mobile ‘branches.’ T-Mobile’s customer base is also larger than Bank of America, closing in on 50 million customers (before the potential merger with Sprint).

Read More: 7 Reasons Mobile Money From T-Mobile Should Worry Bankers

- Chase: The Chase Liquid prepaid card is targeted to its 8.7 million customer households with lower annual income. About half of the Liquid customers previously used few or no banking services, allowing Chase to economically expand it’s relationship with these households.

- USPS: A report from the United States Postal Service inspector general proposes that the agency offer non-bank financial services, including payday loans. Opinion pieces and blog posts praised this idea as a way for the post office to solve its fiscal woes while reaching a portion of Americans outside the traditional banking system. A Reuters ‘Great Debate’ piece, Transforming Post Offices into Banks, called the proposal a “win-win.”

Next Steps

First of all, according to Aite Senior Analyst, Ron Shevlin in one of his many posts on the subject, the financial services industry may want to stop using the term ‘underbanked.’ According to Shevlin, “The misuse and misconceptions surrounding the use of the term underbanked isn’t doing the industry any good. The problem is that the term underbanked has some stigma attached to it, conjuring the image of someone pushing a stolen grocery shopping cart with all their earthly possessions around town. And that the growing number of them is some kind of epidemic plaguing the nation.”

Whatever they are called going forward, the large and growing underbanked market, and especially the segment of Gen Y consumers within this segment represent a unique opportunity and challenge. The key will be how to reach and serve this diverse market efficiently. According to a report by KPMG entitled, Serving the Underserved Market, the needs of the underserved market include meeting immediate cash-flow requirements, establishing a mainstream financial footprint, developing better saving and investing habits, and better managing personal finances. Organizations that can successfully meet these needs have the opportunity to cultivate loyalty among underserved consumers and grow their services as their customers become financially stable.

But, non-traditional players also are a threat due to their agility, lack of legacy infrastructure and ability to create offerings that can be distributed through massive non-bank channels. Companies that recognize that consumer needs are changing, that are quick to develop digital and mobile offerings for this market, and who understand that ‘banking’ means different things to different people will be the ultimate winners.