The negativity financial services brands commonly face when it comes to online consumer comment can be turned around into something of value, both for consumers and the bank in question.

Brandwatch, a company specializing in online reputation management, says financial institutions can’t afford to be passive about social media. In their report, “Social Listening & Financial Services,” Brandwatch argues that a combination of market forces create an imperative for financial institutions face to engage in social channels:

“Competing solely on price and product benefits is bad for many brands, banks in particular.”

— Brandwatch

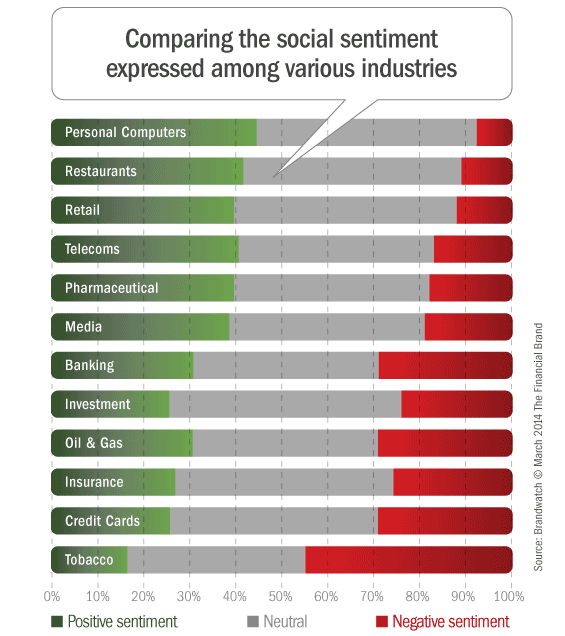

- Dour vibe and sour sentiment. Financial brands are prone to face more friction from disgruntled customers than most others. The instant someone has a problem with their bank, they can — and do — take to social sites like Twitter and Facebook to air their grievance. Millions more users visit forums like FatWallet and DepositAccounts.com where people share their candid experiences without pulling any punches. They will happily disparage brands they’re not happy with.

- Branch closures. When banks close as many branches as they have lately, they risk surrendering the personal connection they once had with their customers. Brandwatch calls this the “dehumanization of financial services.”

- Tighter margins. An increased focus on rates, fees and product benefits creates a commoditized environment for banking services.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Brandwatch says there are two fundamental ways financial institutions can use social media to combat these trends (online negativity, impersonal banking and commoditized services):

1. To enrich and differentiate brand.

2. To stand out through great customer service.

Banks and credit unions need to realize that social is a medium with “character and personality,” says Brandwatch. But finding the right balance between character and responsibility is a major challenge for financial brands.

Comparing finance brands’ social tone with those from other sectors, the difference in communicative style is significant.

Tesco is a huge British company. The maintain their @TescoMobile as an interactive, humorous and engaging account — so notoriously informal that it generates significant publicity — whereas @TescoBankNews remains strictly corporate and broadcast-driven. Because it has character and personality, the mobile division enjoys over 25 times more followers than the banking arm.

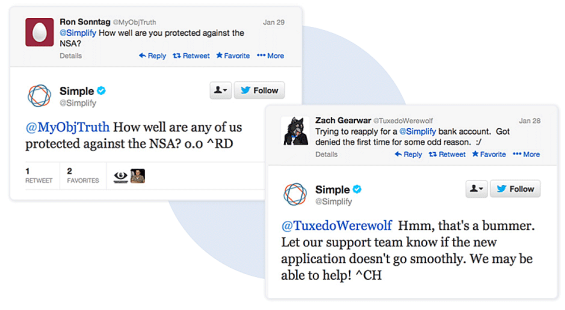

One financial brand that Brandwatch says has it right is Simple, the Portland- based banking company that sold in February to BBVA for $117 million. To highlight how financial services businesses can succeed at delivering exceptional customer service on social media while differentiating the brand (and not running afoul of regulators), Brandwatch singles out Simple’s Twitter support team.

Simple’s social media support teams are not given scripts and are encouraged to be themselves in order to serve people in the most human, natural way possible.

Brandwatch encourages financial marketers to monitor for customer comments beyond their own social media accounts, and empower online teams to assign and respond to social mentions in real-time.

Brandwatch acknowledges that banks and credit unions face a number of unique regulatory, legal, privacy, security and compliance issues, but these are still no excuse why financial marketers should shy away from social channels.

“If a blue chip financial services brand like MasterCard is able to use social with agility, it’s feasible to suggest that any brand can.”

— Brandwatch

Brandwatch recommends financial marketers create flexible but compliant protocols for customer support representatives to adhere to when handling queries and use social metrics to monitor the success in meeting them.

“As a basic compliance measure, be sure that your social platform has a multi layered permissions system and supports automatic archiving of both internal and public social messaging,” the report advises. “While security and privacy are very real concerns for financial services companies, they can truly be overcome.”

“Financial institutions need to implement enterprise-grade social media monitoring and engagement technologies that offer workflow functions, allowing multiple teams and functions to respond,” the report continues. “Look for a social media management system that offers centralized control of corporate social accounts. These are strategic assets, and should be secured as such.”