In 2014, the US banking industry will spend roughly $2 billion on advertising, marketing and promotions to appeal to the 11 million plus households that will establish new primary banking relationships during the year. Feature preferences that make banking more convenient and accessible will continue to gain more traction in 2014.

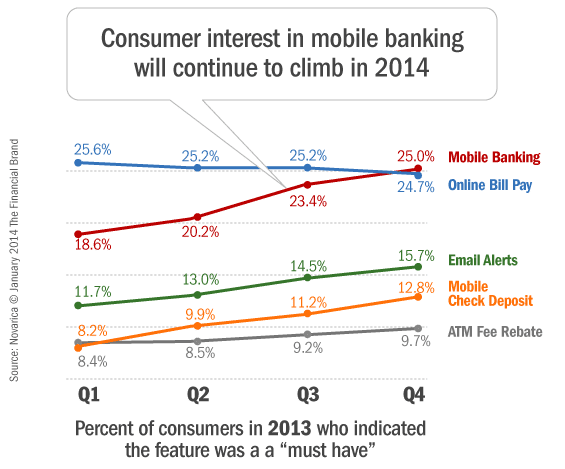

Demand for mobile banking will continue to grow. Mobile banking is now widely available — over 90% of the institutions listed on FindABetterBank offer a mobile banking app. Consumer adoption of mobile banking has been much more rapid than take-up of online banking. Today, 25% of bank shoppers indicate they”must have” mobile banking — a 34% increase from Q1 to Q4 in 2013. In Q4 2013, nearly 13% of shoppers wanted mobile check deposit – a 52% rise from Q1 to Q4 2013.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Email alerts will gain more interest. This is a sleeper feature that many marketers consider an afterthought. But with more and more consumers using smartphones, email alerts have the immediacy of text messages. We saw demand for email alerts grow by 34% during 2013.

More shoppers will want ATM fee rebates. Access to surcharge-free ATM networks like AllPoint Network continues to rank higher than ATM fee rebates for more shoppers. But demand for surcharge free ATM access has topped out at roughly 23% of shoppers, while demand for ATM fee rebates grew by 18% in 2013.

But interest in online billpay will continue to decline. In Q4 2011, a peak of 37% of shoppers said they must have online billpay. Two years later, less than 25% of shoppers are demanding online billpay. We see two causes for this decline: Many consumers consider online billpay as “table stakes” and therefore don’t feel it’s necessary to specifically demand the feature; many billers have been aggressively marketing their automated payment services.