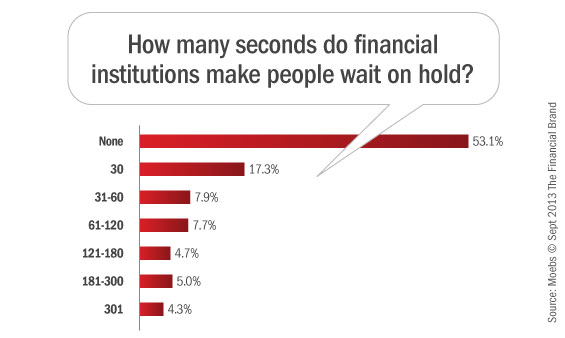

Financial institutions’ call centers answer their phones after the first ring 53.1% of the time, and many times, a call center rep answers before the phone even finishes ringing once. This according to a study from Moebs Services.

Moebs, an economic research firm, analyzed call center efficiency in the banking sector back in June. And they didn’t just look at a sample. They called all 1,676 banks and credit unions in the U.S. with $500 million in assets or more. (Smaller institutions often do not have a call center or have very limited capability, and thus were excluded from the study.) Moebs’ researchers contacted each financial institution’s call center between 9 and 5 pm on typical weekdays.

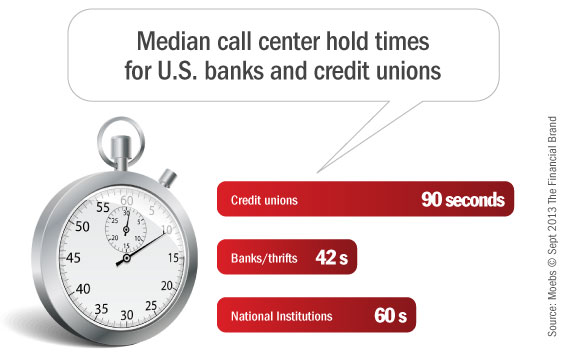

When a consumer does have to wait when they call a bank or credit union, they typically don’t have to wait very long. The median hold time is 60 seconds, well within the range of what the teleservice industry regards as “good service” standards. 46.9% of calls put on hold were for less than 30 seconds. Only 4.3% of callers were put on hold for over five minutes.

The record hold time was exactly one hour at one financial institution.

Read More: Cool Artwork Livens Up Call Center to Inspire Bank Staff

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Asset Size and Type of Financial Institution Make a Difference

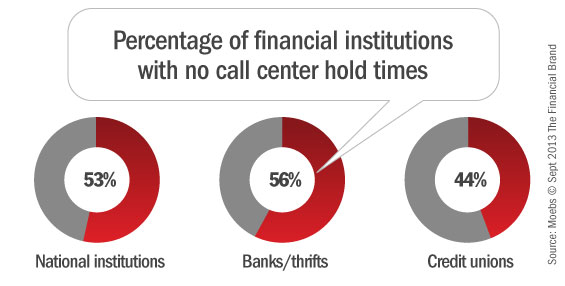

Banks beat out credit unions on hold times. 56.1% of banks didn’t put the call on hold, but only 43.8% of credit unions were capable of doing the same. Furthermore, credit unions had more than double the median hold time — 90 seconds vs. banks at 42 seconds.

Asset size does matter. Financial institutions with smaller asset sizes have substantially fewer callers experiencing any time on hold — 44.1% compared to larger depositories in the $25 billion to $50 billion range who have 64.3% of their callers with wait times. The wait time at smaller institutions averages 111.9 seconds vs. 191.5 seconds for the biggest banks — those over $50 billion. That difference amounts to nearly a minute-and-a-half, which is significant Moebs says.

| Size of Institution | % Who Have Hold Times |

Average Hold Time (Seconds) |

|---|---|---|

| >$50 billion | 58.60% | 191.5 |

| $25 to $50 billion | 64.30% | 175.3 |

| $5 to $25 billion | 61.70% | 122.7 |

| $1 to $5 billion | 47.40% | 133.5 |

| $500 million to $1 billion | 44.10% | 111.9 |

A 2012 study by Velaro, a company specializing in retail chat services, found that 32% of consumers have no hold times, while 28% wait one minute or less, and 40% wait longer than a minute. By comparison, financial institutions are 65% better with no wait time, 11% better with wait times of one minute or less, and 45% better among those waiting over a minute.

“Main Street financial institutions, community banks and credit unions are more efficient with more ‘no hold times’ and shorter ‘hold times,'” says Michael Moebs, CEO of Moebs Services. “These are results banks and credit unions should be proud to have.”

“The study is a strong response to those in Congress, financial institution regulators, and consumer advocates,” Moebs continues. “It shows that most financial institutions — even the largest — really do try to respond to their consumers.”

Moebs says these results are good, but can be improved by enhancing websites to complement call centers. Earlier this year, Moebs studied the websites of the same 1,676 banks and credit unions, and found many to be lacking information that should obviously be available.