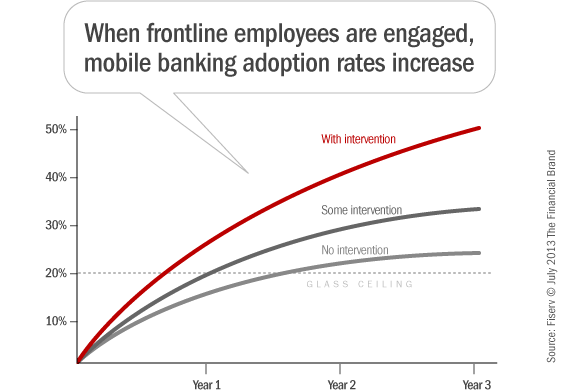

At most financial institutions, mobile banking adoption rates typically hit a “glass ceiling” of 15 to 20 percent of all online banking customers. But you don’t have to settle for that as the maximum cap. Here’s what you need to send adoption rates through the roof.

Is The Mobile Banking Explosion Right Around The Corner?

According to a study on mobile banking from The Federal Reserve published in March 2013, there is a high probability that non-mobile bankers will eventually adopt the technology.

Among those consumers with mobile phones who do not currently use mobile banking, 10% report that they will “definitely” or “probably” use mobile banking in the next 12 months. An additional 14% of those who sat they are unlikely to use mobile banking in the next 12 months report that they will “definitely” or “probably” adopt mobile banking at some point. Although consumers’ stated intentions may not perfectly reflect their subsequent behavior, there is strong evidence that “planned use” of mobile banking does in fact correlate with subsequent adoption.

The 2011 survey included a group of respondents who indicated that they would “definitely” or “probably” adopt mobile banking in the coming year. Comparing data from surveys fielded in 2011 and 2012, The Federal Reserve found that among consumers who said they would “definitely” adopt mobile banking in the next 12 months, 45% had actually adopted the service in that timeframe. Among those who said they would “probably” adopt mobile banking, 35% had become mobile banking users.

Key Insight: For the group of respondents who believed they were likely to adopt mobile banking, the most significant difference between those who actually did adopt and those who did not was that the adopters were more likely to own a smartphone.

Conversely, for those who indicated that they “probably would not” and “definitely would not” adopt mobile banking, only 9% and 5%, respectively had adopted mobile banking in the 12-month period.

In total, 9% of those who were not mobile bankers in 2011 reported being mobile banking users one year later. However, 19% of those who were mobile banking users in 2011 admitted they had not used mobile banking in 2012. Among panel respondents, mobile banking usage increased from 21% in 2011 to 25% in 2012.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Fight the Mobile Banking ‘Security’ Battle With Your Frontline Workforce

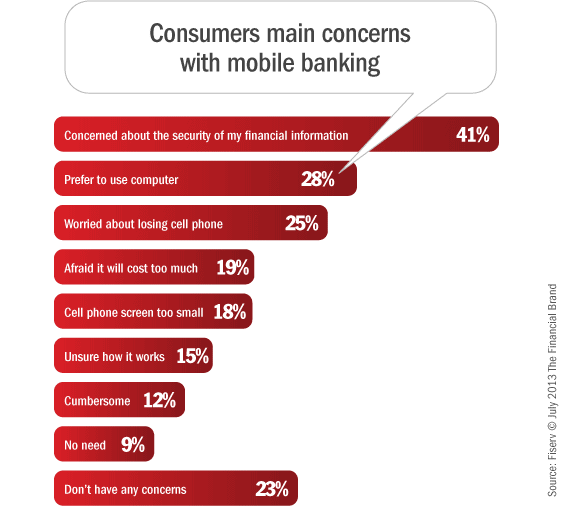

Consumers who use mobile banking appreciate the value that it provides, but the majority of consumers still lack knowledge about what mobile banking is and the benefits it offers. Along with a lack of awareness, many consumers have inordinate concerns about security that continue to be a major deterrent. The 2012 Fiserv Consumer Trends Survey found that 41% of consumers who are not using mobile banking cite their concern about the security of financial information as the primary reason.

Similar studies put the number of consumers concerned about mobile banking security anywhere between 30% all the way up to 70%. Research published by The Federal Reserve in March revealed that 26.0% felt mobile banking was “somewhat unsafe” or “very unsafe,” and other 38.5% said they weren’t sure.

Fiserv says financial institutions can overcome consumers’ security concerns with frontline reassurance. Consumer-facing employees can assuage people’s fears by explaining security features and walking them through specific situations (e.g., “What happens if you lose your phone?”).

Reality Check: Think about this… If someone is in your branch discussing mobile banking, they obviously appreciate face-to-face interactions at least at some level, otherwise they wouldn’t be in your branch in the first place. Consumers who adopt mobile banking after visiting a branch will be much different than the tech savvy digital denizen who sends an email or tweet. In the offline channel, consumers will need more hand-holding — simpler explanations and more demonstrations. With wired consumers in the online channel, you might be able to talk about 64-bit encryption.

Smart banks and credit unions will realize the difference between their audience and the type of consumer who would be attracted to an all-digital institution like Ally, First Direct or Capital One 360. While non-traditional competitors like Google and PayPal may be disrupting the financial services landscape with their payment solutions, they do not have consumer-facing staff. Having frontline staff is unique to traditional financial institutions. so exploit this competitive difference to your advantage.

( Read More: Consumers Expect More From Mobile Banking Apps Than They Get )

Frontline Staff Are Your Not-So-Secret Weapon

Fiserv says frontline staff hold the key to growth in mobile banking adopting rates. Financial institutions can leverage the referral power of employees in branches and call centers because they are viewed as professional experts, making consumers more receptive to their recommendations.

Mystery shopping audits conducted by Fiserv reveal that all too many financial institutions don’t utilize staff or supporting collateral to promote their mobile banking services. Fiserv says a lack of sustained promotion may be the reason why financial institutions aren’t experiencing higher mobile banking adoption rates. In other words, the reason adoption rates soared for Bank X when they launched mobile banking had everything to do with the fact that Bank X was busy marketing it. But after the big initial push, staff move on to the next promotion.

One of the most common solutions financial institutions deploy when marketing mobile is to provide answers to common questions about the “what ifs” in a FAQ section on the website. While this is definitely a useful and necessary tactic, banks and credit unions need to go the extra mile to help consumers understand that mobile banking is a safe and secure service.

In “Breaking the Mobile Banking Glass Ceiling,” Fiserv says the first thing frontline staff need to do is proactively head off consumers’ security concerns — e.g., “You don’t need to worry about mobile security, and here’s why.” Taking a proactive position to provide consumers with the assurance that their privacy and transactions are safeguarded is more effective than waiting for a question… that may never come.

From a technical standpoint, encryption and firewalls are important, but Fiserv says that telling consumers that “your password is never stored or remembered on your phone” and “your login session automatically times out after inactivity” will help quell their anxieties. And show consumers how they can easily receive immediate text messages whenever there’s any activity on their account. That should make them feel a lot better.

Research from Fiserv shows that financial institutions that have a program in place for branch and call center staff to educate and engage customers are achieving mobile banking adoption rates of 30% or higher. Banks and credit unions can achieve adoption rates two to three times higher than normal by taking a more proactive approach and increasing (or at least maintaining) marketing activity.

( Read More: Mobile Banking Critical, But Consumers Ho-Hum About Tablet Apps )

Employees Can’t Sell What They Don’t Understand

Fiserv says financial institutions that embrace frontline staff as the conduit to higher mobile adoption need to develop a comprehensive “Strategies for Success” program that incorporates employee training, employee incentives, consumer marketing and promotional materials and metrics to evaluate success and impact.

Financial institutions that create a complete training program can provide their staff with the education and knowledge necessary to produce results quickly. Fiserv offers the following training ideas:

- Educate customer-facing staff on the value of mobile banking so they can actively promote that value to new and existing customers

- Teach employees how to enroll new customers or members into mobile banking as part of the account opening procedure as well as to encourage enrollment for existing customers

- Explain how to enroll the mobile devices of online banking customers via the mobile enrollment section on the website

- Provide employees with convenient and self-directed training options such as e-Learning modules and training demos

- Issue smart phones to the frontline staff so they can experience first-hand how mobile banking works

- Designate team members as “mobile banking experts” to serve within each branch and call center location — people that both customers and coworkers can approach with questions

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Put Mobile in Front of Everyone’s Face

It may seem a bit ironic to crank out a bunch of printed fare to support an online service that supposedly helps cut down on paperwork. But you know what they say: Out of sight, out of mind. And that applies to both consumers and employees. That’s why banks and credit unions need to provide frontline staff with traditional tools and resources (i.e., brochures and flyers), and leave them out in conspicuous locations. If nothing else, you can think of these marketing materials of a giant PostIt, reminding staff what talking points to hit in their interactions.

Hard to miss this reminder for mobile banking — you have to walk through the giant screen to get inside this Palmetto Bank branch.

On a much smaller scale, there’s this wallet card — easy to stick a stack of these in any employee’s workspace.

( Read More: Consumers Find Their Groove With Mobile Bill Payment Technologies )

Consumers Ready to Pay for Mobile Banking 2.0

ath Power Consulting says there is revenue potential for financial institutions, with more customers willing to pay for mobile services as they mature and become more robust. The 2013 ath Power Mobile Banking Study found that retail consumers are becoming less resistant to monthly fees for mobile, with one in three now saying they would be willing to pay for mobile banking, up from only one in five in last year’s study.

According to ath, there are three significant strategic reasons for banks and credit unions to take an aggressive position on mobile services:

1. Retain current relationships – A strong mobile offering keeps consumers from defecting to other institutions with appealing, competitive technology. ath says banks are particularly at risk of losing small business customers if their mobile offering is inadequate. Two out of three small business owners (66%) say they are likely to consider leaving their current bank for one with a superior mobile offering, compared to 44% of retail customers.

2. Attract new customers – More and more consumers will be taking up mobile banking in years to come. In the not-too-distant future, adoption rates will be a lot closer to 80% than 20%.

3. Revenue and fee income – Mobile check deposits and mobile photo bill pay are only two of the more recent features to emerge in the mobile banking space, and they were almost unimaginable just a few years ago. Now skip out a few years and you could easily envision a suite of features that consumers wouldn’t gripe about paying for.

( Read More: Photo Bill Pay Makes Bank Switching A Snap )