The banking industry has been rocked by scandal and controversy in recent years. Today, by some estimates, only one in 10 consumers trust bankers to act in their best interests.

A self-funded public advocacy group called Which? put the issue of advocacy in banking to the test. Did financial institutions genuinely help customers make wise banking decisions? Or was the sales culture at banks so dominant that it perverted their integrity.

“Sales is always the priority in terms of individuals’ performance.”

— RBS Customer Services Officer

In the most fundamental and human terms: Would banks do what’s right for customers? Or only what’s right for the bank? Whose side are banks on? Can they be trusted to give credible advice uncontaminated by sales quotas?

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Turning Up the Heat

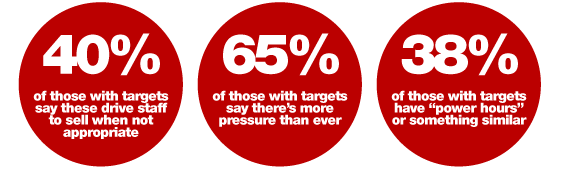

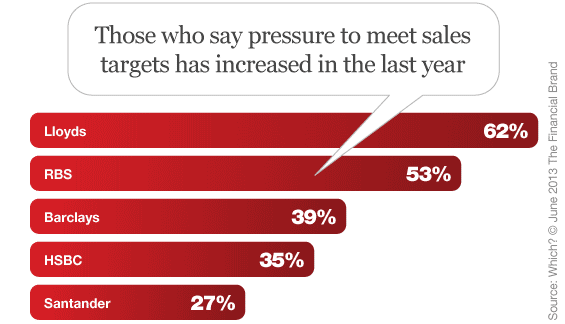

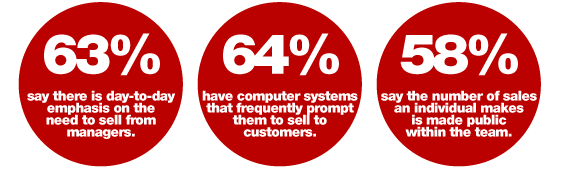

Interviews with more than 500 front-line staff at six of the largest UK banks revealed that employees feel significant pressure to sell their institution’s products and services. 81% of staffers said they felt burdened to meet sales targets at the same- or increased levels as they had in the past. Two thirds of those with sales roles said they were “sometimes” or “always” being badgered to sell more.

In total, more than a third of the bank staff interviewed admitted that they felt uncomfortable with the level of pressure put on them to sell.

| Overall | Lloyds | RBS | HSBC | Barclays | Santander | |

|---|---|---|---|---|---|---|

| I feel pressured into selling by our culture | 43% | 56% | 35% | 41% | 33% | 29% |

| I feel pressured into selling by my manager | 37% | 46% | 31% | 33% | 30% | 25% |

| The sales targets drive employees to sell when it’s not appropriate | 40% | 45% | 43% | 39% | 35% | 23% |

| I know that some of my colleagues have mis-sold products to meet targets | 46% | 47% | 51% | 53% | 37% | 31% |

| I am comfortable with the bank’s approach to sales | 32% | 37% | 32% | 33% | 27% | 14% |

| I have to focus on sales over service | 31% | 39% | 28% | 32% | 20% | 18% |

Twisted Priorities

“Each month each operator has a few calls listened to… if you fail your call monitoring then you lose your bonus, if you pass but don’t hit your sales target, you lose your bonus.”

— HSBC Customer Service Advisor

Consumers hope that when a bank staff member recommends a product or service, they do so with the customer’s best interests at heart. Unfortunately, nearly half the sales staff surveyed said they felt obligated to sell, regardless of whether the products were actually appropriate for customers or not.

Four in 10 bank staff confessed that they knew a colleague had intentionally mis-sold products in order to meet their sales targets.

Mirroring this finding, four in 10 customers said that when they last contacted their bank they had been offered a product or service that wasn’t suitable. Of those, a quarter felt they’d been harried to accept the offer — a third said they needed to refuse more than once.

Read More: Coast Capital Shows Staff How to Serve With Stylish Guerilla Stunts

Aligning Advocacy With Employee Performance Metrics

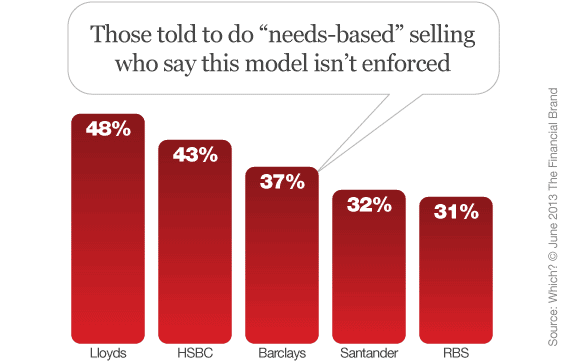

“The ethos has changed a lot to focus on customer service and needs- based selling. Sales targets have moved over to customer service targets.

— Santander Team Member

Some banks have started to revise their employee compensation schemes to remove the focus on sales targets. Monitoring, measuring and rewarding specific on-brand behaviors — not sales quotas — have become increasingly important to many banks and credit unions.

While this may sound like a step in the right direction, many bank staff told Which? that a sales culture would endure even after a quota structure was eliminated.

Read More: 5 Things HR Must Do to Build Your Brand

Analysis & Takeaways

Financial institutions expend significant quantities of marketing capital trying to convince they put anything but their own self interests first. They talk about putting people first, the community first, customers first, honesty first. Dozens of banks and credit unions use the slogan “Putting You First” (or some derivative thereof) in their marketing.

And yet how many banks and credit unions actually walk their talk? How many claim to have a culture of customer advocacy but impose sales goals so aggressive they undermine the organization’s integrity?

Bottom Line: If you say one thing but do something else, consumers will notice. And any discrepancies between promises and deeds can create huge rifts in your brand. Financial marketers need to be very careful and cautious about who or what they claim to put at the top of their priorities. Consumers will assume you are in it for yourselves and for the money unless given proof they should think otherwise. Building a brand with integrity and credibility is simple: Just say what you mean, mean what you say, and follow through on everything you say you’re going to do.