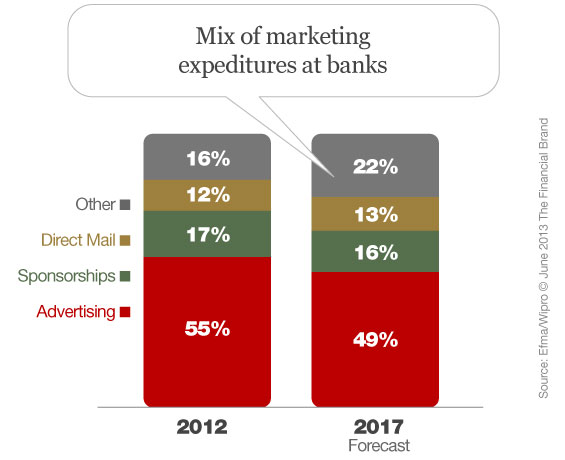

The year is 2017. No longer can bank and credit union marketers hide behind the vague and ambiguous ROI that plagued the traditional marketing campaigns of years gone by. That’s because everything (that matters) is happening in the digital universe. And that means everything can be monitored, measured, quantified, defined and tracked.

“Why are we running generic billboards on the highways,” CEOs will ask their CMOs, “when we can deliver targeted product offers with specific relevance to a unique market segment?”

in other words, how can financial institutions justify traditional marketing investments when offers can be delivered with measureable pinpoint accuracy in digital channels?

Huge Unrealized Potential

A study from the European Financial Marketing Association (Efma), in partnership with tech vendor Wipro, has released a study examining how digital technologies, social media and the explosion of online data are redefining engagement models in the retail banking space.

In the Global Retail Banking Digital Marketing Report, Efma and Wipro assert that the proliferation of banking channels has rapidly changed the way consumers use financial services, and will continue to do so at a breakneck pace. Digital will promptly be the reigning champion for many (most?) financial interactions, forcing banks and credit unions to evolve their marketing efforts from broad brand-based and branch-focused campaigns to a true, integrated, multichannel approach. One big question looms in the background: Why haven’t financial institutions done this already?

Researchers from Efma and Wipro were dismayed by how long it’s taken financial institutions to develop their digital marketing capabilities… that is, as far as they have to this point. There’s clearly still a long way to go, and the potential for improvement at most banks and credit unions is huge.

Read More: 10 Tips To Drive More Online Applications

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Read More: iPhone, iPad Video Banking Could Spell The End For Branches

Efma and Wipro say that only one in eight banks currently possess the digital marketing acumen that will be de rigueur in tomorrow’s online wonderland.

“Banks everywhere are putting online and mobile banking at- or near the top of their agendas,” says Rajan Kohli, VP/Banking and Financial Services at Wipro. “There is still a high degree of uncertainty because banks are still learning, and the digital environment is constantly changing.”

And this hyper speed, hyper fluid dynamic is precisely why testing will be a central theme dominating marketing’s future. In the online and digital world, there’s no excuse… You can test everything: products, offers, rates, fees, incentives, giveaways, headlines, design executions, etc. You’ll have to run experiments and find a winning approach quickly just to stay competitive.

Testing, segmentation, data analytics. These are the cornerstones of a digital marketing strategy… and concepts financial institutions struggle with today, slogging around with the most primitive tools imaginable. This will make the learning curve steep for most financial marketers — huge deficiencies to overcome in a short period of time — but banks and credit unions must conquer their (digital) marketing weaknesses in order to survive.

Tighten Those Segmentation Skills

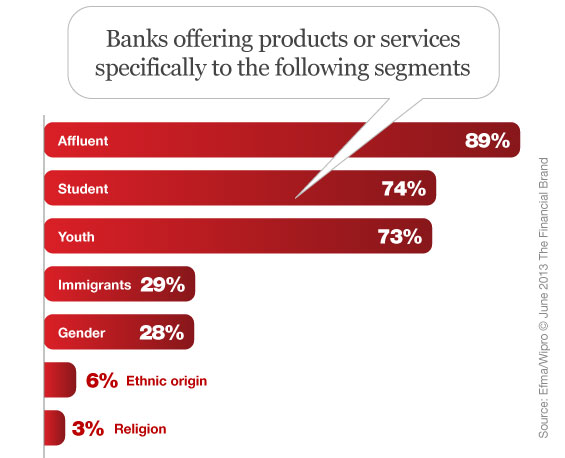

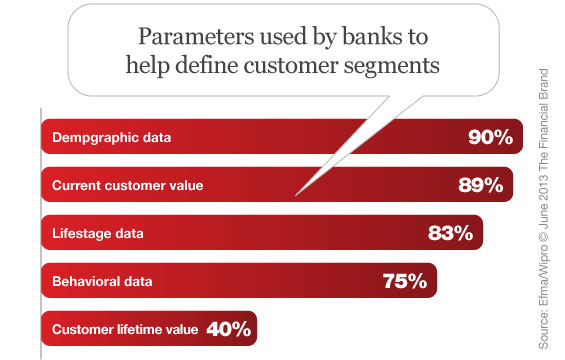

Segmenting the customer base is not a new idea in the banking sector. It’s been around — at least in theory — for decades. While some banks have restructured their entire retail business around various customer segments, most financial institutions still use crude models to breakdown their audience (e.g., “adults ages 18-55 living within 5 miles of branch X”). When working in digital channels, bank and credit union marketers’ segmentation models will need to be much more sophisticated than they are today. In the Efma/Wipro study, a commanding 90% of banks said customer segmentations strategies will be on the rise in years to come.

Read More: The Future of Online Banking: Know Thy Visitor

Return on Marketing Investment

Measuring the return on marketing investment (ROMI) has always been a CMO’s goal. How else could they decide how to allocate their marketing spend, or justify to the CEO you need more budget to work with? Measuring the direct financial benefits of activities like brand advertising is a challenge, but measurement is much easier for direct marketing campaigns. In the digital world, it should be even easier because of the number of ways that responses and reactions can be tracked.

In practice, what the Efma/Wipro study shows is that only one in four banks measure their ROMI for more than 75% of their digital marketing campaigns. Half seldom measure digital ROMI, if ever.

Researchers conclude that banks mostly fall into one of three categories:

- No effort to measure results of traditional campaigns

- Measure a small sample of campaigns

- Measure everything they spend on traditional marketing to justify the investment

While researchers concede that there are several banks in the third category — those measuring everything offline — who are otherwise not particularly sophisticated in their approach to digital marketing. The conclusion? There is low level of digital marketing maturity among banks and credit unions.

In the Efma/Wipro study, banks noted problems tracking the very large number of small campaigns they run, the cross-channel nature of many of the campaigns, and the need to measure different stages of the sales funnel to get useful data. Banks also admit that they can’t track results in real time, so the feedback loop is usually quite slow. It’s hard to pivot when it takes three months (or more) to calculate the final tally for each campaign.

There is also a question about what to measure when calculating ROMI. Typically, a bank will use a product value calculation, so the number of products sold can be translated into a quantifiable return. Efma and Wipro say it would be much more effective to use customer lifetime value (LTV) when factoring ROMI, but according to their survey, only 15% of banks are able to do this.

Perhaps the most surprising comment from participants in the study was the opinion that there was enough “low hanging fruit” ripe for picking in digital channels that it was not really necessary yet to measure the effectiveness of each campaign. If that is the case (and it’s disputable), it almost certainly won’t be true in the future when everyone else in the banking game catches up.

Read More: Responsive Web Design For Banks: Fad Or Strategy?

Struggles With Social Media Continue

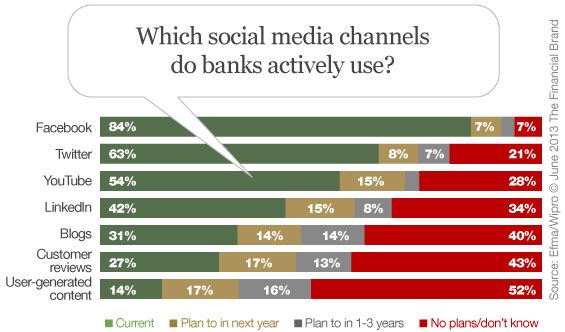

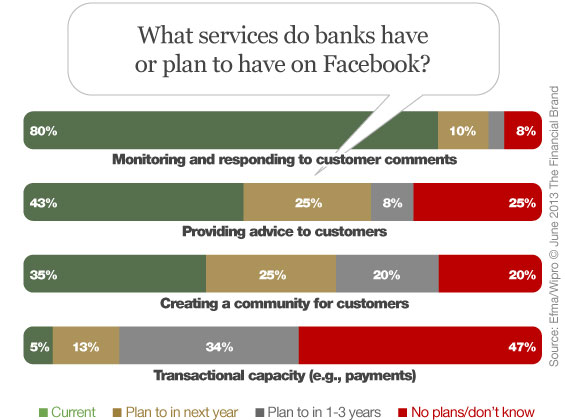

Involvement in social media is now standard practice for banks, though typically this is limited to marketing communications and monitoring of complaints on bluechip social media platforms, primarily Facebook and Twitter. The big challenge is to achieve “digital customer engagement” — developing more meaningful digital interaction with customers as an effective replacement for traditional face-to-face banking interactions.

The Efma/Wipro study revealed that social media was not yet a part of mainstream marketing and is still not considered a key customer interaction channel. In the survey, researchers discovered that social media efforts were mainly managed by the marketing department with help from the branding and communications teams (when available). 80% of the banks surveyed said their social media spend was less than €500,000 annually ($662,500 USD). And keep in mind: these are among the world’s biggest banks we’re talking about here. Half a million is nothing to these guys.

There are very mixed views about extending transactional capabilities (such as accessing a bank account or making payments) to social media, and most banks are not pursuing this as a strategy. The general preference is to lead customers back to the bank’s proprietary online and mobile services where security can be ensured and better service provided.

“Social media introduces lots of new issues for banks in their digital marketing activities,” notes Kohli from Wipro. “Most banks have some form of presence on social media but how far should they develop transactional capability, and how deep should they make customer engagement?