The value of Net Promoter Scores as a measurement of customer satisfaction is controversial and has been widely debated. The formula in theory — is straightforward enough: Take the number of customers who love you, subtract the number of customers who hate you, and ignore everyone else who feels indifferent. The resulting number is your “Net Promoter Score.”

According to the Net Promoter System website, there are a number of advantages to measuring Net Promoter Score (NPS):

1) Simplicity – surveys typically require just two or three questions

2) Ease of use – a company can conduct NPS surveys by a variety of methods

3) Quick follow-up – practitioners typically share customer feedback very quickly after it is received

4) Experience – thousands of companies across a variety of industries measure NPS

5) Adaptability – as an open-source method, NPS can easily be put to work in a wide variety of business settings.

Absent from this list, however, is any indication that tracking the metric produces, or is linked to, bottom-line benefits.

According to research conducted by The Financial Brand and Aite Group, there is evidence to suggest that, among financial institutions, NPS has no impact on- or correlation to business performance. Among the 169 banks and credit unions responding to the survey, one-third measure NPS.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

NPS Users Underperform the Market

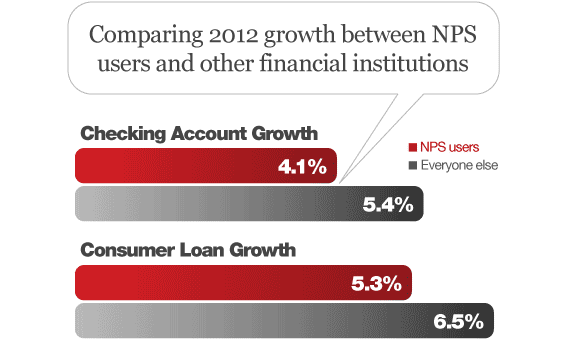

On average, NPS users increased checking account relationships from 2011 to 2012 by 4.1%, and saw a 5.3% increase in the number of consumer loans issued. In contrast, financial institutions that don’t measure NPS grew checking account relationships by 5.4%, and loans by 6.5% (see graph below). Among non-NPS users, one in four saw checking account growth in excess of 10% in 2012, compared to just 10% of NPS users.

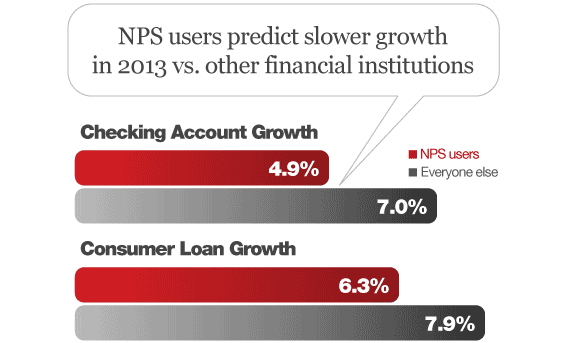

The differences between the two groups also extends to their expectations regarding growth for 2013. NPS users anticipate consumer loan growth of 6.3% in 2013, while other financial institutions expect 7.9% growth. For checking accounts, the gap in growth expectations is even larger — NPS users anticipate 4.0% growth in contrast to the 7.9% growth that non-NPS users expect.

Certainly, measuring NPS is not the cause of subpar performance. But with the hype surrounding the metric, there is an expectation that using NPS leads to better bottom-line results.

Two More Anomalies About NPS Users

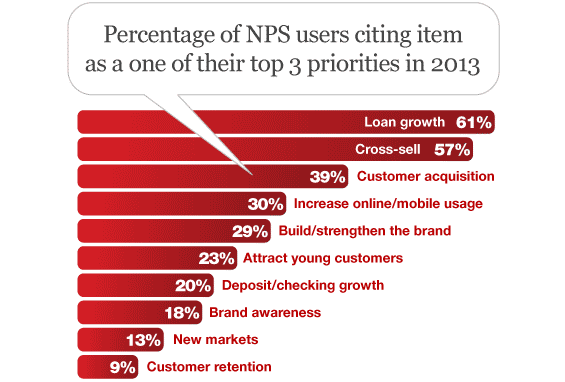

Net Promoter Score is a customer metric. It’s not an operational measure, nor does it apply to conversion rates, or the marketing or service effectiveness of dealing with prospects. NPS is touted to be a metric used to improve customer loyalty. If that’s the case, then why do just 9% of NPS-using financial institutions cite customer retention as a top three marketing priority for 2013? Why bother measuring NPS if customer retention isn’t that important a priority?

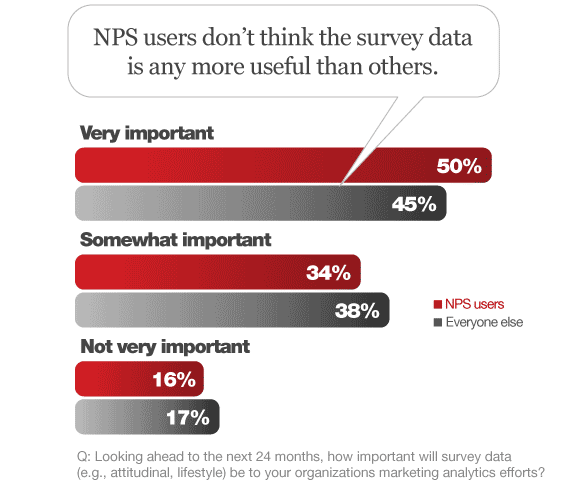

NPS is often positioned as a key element of a firm’s “voice of the customer (VOC)” efforts. As a result, wouldn’t you expect NPS-using firms to place high importance on the use of survey data for marketing analysis purposes? But that’s not the case with half of NPS-using financial institutions. The difference in percentages between NPS-using financial institutions and other financial institutions who consider survey data to be very important is negligible.

What Should Financial Marketers Measure?

The results of the 2013 Financial Brand Marketing Survey provides some evidence that financial institutions that measure Net Promoter Score don’t outperform the market, and, additionally, that their marketing actions aren’t always consistent with the Net Promoter philosophy.

This begs the question: If not NPS, then what should financial marketers measure?

The answer is certainly not a metric that relies on the periodic gathering of consumers’ attitudes. With the maturing of online and mobile technologies, it’s now feasible for financial institutions to track the behaviors of consumers that give financial institutions insights into current and future loyalty.

This is why I’ve proposed the use of a metric I call Referral Performance Score (RPS). Giving nod to the Net Promoter junkies who believe that customer referrals (i.e., word-of-mouth marketing) are important, the RPS looks at customers’ actual referral behavior, and not just their intentions.

In addition, though, the RPS takes into account changes in a customer’s own relationship with a provider. It’s great if a customer provides referrals, but if she isn’t growing her own relationship, then she’s not as good a customer who both refers and expands the relationship.

I can’t say that measuring RPS will improve an financial institution’s bottom line, but I can make a case for why it’s a superior metric to the Net Promoter Score.