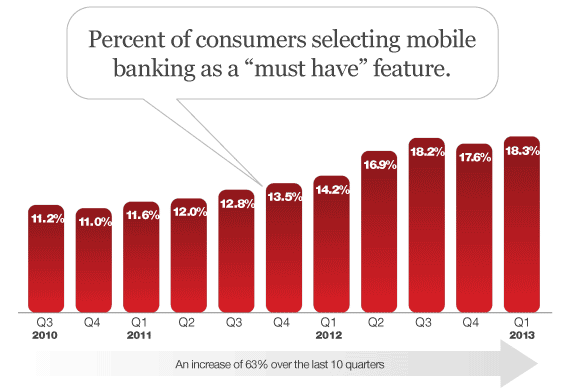

Since the third quarter of 2010, interest in mobile banking as a “must have” feature among those consumers actively shopping for new checking accounts has grown by a whopping 63%. In January 2013, over 18% of all shoppers that used the comparison tool on FindABetterBank.com indicated mobile banking is a “must have” feature.

A survey recently fielded on FindABetterBank uncovered that 88% of shoppers who said mobile banking is a “must have” feature are already mobile banking users. Therefore, as more consumers download their bank’s mobile apps and begin using them, you can expect the number of consumers demanding mobile banking when they’re shopping for a new institution to increase steadily. Few people, however, defect from an institution simply because mobile banking isn’t offered.

Banks and credit unions have raced to catch up with demand. In Q3 2010, fewer than 30% of the institutions listed on FindABetterBank offered a mobile banking app versus over 82% of institutions on the site today.