![]()

2013 marks the third year The Financial Brand has fielded its annual “State of Marketing in Retail Banking” study. This year, research was conducted in partnership with Aite Senior Analyst Ron Shevlin.

Those who completed the entire survey will receive a free copy of the Aite Group report based on the marketing data analytics section.

The Financial Brand would like to extend its deepest gratitude to the nearly 300 or so participants who completed this year’s survey. Without your gracious contribution of time and insight, this study would not be possible. On behalf of The Financial Brand and all its readers, thank you.

If you value the information provided in these studies, please participate in next year’s survey. This is a unique research project — probably the only one of its kind in the retail banking world — and broad participation is necessary to increase its worth to everyone. Most readers of this website are marketers who field many surveys themselves, so you’re familiar with how challenging it can be to recruit survey respondents. Think of it as good survey karma.

Financial Marketers Struggle With Budgets and ROI

It’s no surprise that bank and credit union marketing execs say that insufficient budgets and/or manpower is what’s holding them back. For the second year in a row, this was cited as a major challenge by at least a third of all respondents (33.8%). This was followed closely by difficulty measuring marketing ROI — a challenge for nearly 4 out of every 5 financial marketers.

Reality Check: You’ll get more money in your budget just as soon as you can prove you deserve it. If you can’t demonstrate an ROI, why should your CEO allocate more resources to marketing?

Inadequate MCIF/CRM databases were the third most commonly cited challenge facing financial marketers in 2013 (29.7%), with “limited data analytics tools/capabilities” coming in at #6 on the list. Clearly the financial industry is in no position to capitalize on the promise of “big data” this year. Banks and credit unions have a long way to go before they’ll be in any position to wield terabyte-sized data sets.

Only 15.9% of all financial institutions think social media is a major challenge, and 7.2% think consumers’ lack of trust is significant hurdle.

| What marketing challenges will you face in 2013? |

Major Challenge |

Minor Challenge |

Total Challenged |

Not a Challenge |

|---|---|---|---|---|

| Insufficient budget(s) and/or manpower | 33.8% | 40.0% | 73.8% | 26.2% |

| Difficulty measuring performance and/or proving results (ROI) | 29.9% | 49.0% | 78.9% | 21.1% |

| We have inadequate MCIF/CRM database(s) | 29.7% | 34.4% | 64.1% | 35.9% |

| Takes too long to make decisions internally | 27.6% | 35.7% | 63.3% | 36.7% |

| Limited data analytics tools/capabilities | 26.9% | 47.7% | 74.6% | 25.4% |

| We are risk adverse and/or slow to adopt new ideas | 26.0% | 39.3% | 65.3% | 34.7% |

| We have too many initiatives | 22.7% | 41.8% | 64.4% | 35.6% |

| Our I.T. infrastructure is inflexible and limiting | 22.4% | 45.9% | 68.4% | 31.6% |

| Regulation and compliance issues | 22.4% | 52.0% | 74.5% | 25.5% |

| Getting employee support for marketing/branding/sales initiatives | 20.5% | 39.0% | 59.5% | 40.5% |

| Silos | 18.1% | 37.8% | 55.9% | 44.1% |

| Our brand is ill-defined or lacking differentiation | 17.5% | 35.1% | 52.6% | 47.4% |

| Figuring out social media | 15.9% | 39.5% | 55.4% | 44.6% |

| Lack of senior management buy-in and/or support for marketing/branding initiatives | 11.3% | 29.7% | 41.0% | 59.0% |

| The lack of trust in the financial industry | 7.2% | 34.5% | 41.8% | 58.2% |

| Our rates/fees/products aren’t competitive | 6.7% | 36.4% | 43.1% | 56.9% |

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Budgets Mostly Frozen for 2013

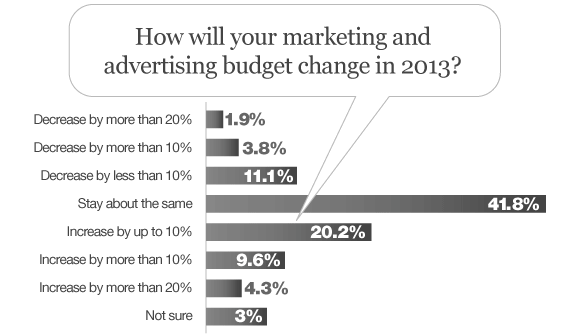

When asked how their financial institution’s marketing budget will change in 2013, 41.8% said it would stay about the same, while 34.1% said it would increase — 10.9% less than those who anticipated an increase in 2012. In 2013, 16.8% of all banks and credit unions said their marketing budget is decreasing vs. 12% in 2012.

The Financial Brand has previously noted that marketing budgets at banks and credit unions should equate to roughly 0.1% of assets — a $1 billion financial institution should have a marketing budget around $1 million.

Top 3 Strategic Marketing Priorities

For this question, respondents were asked to rank their top three marketing priorities over the next 12-24 months. The data in the table signifies the number of respondents who ranked that priority either #1, #2 or #3 on their list.

Last year, loan growth was #2 on the list. This year, loan growth climbs to the top spot, with nearly 60% saying it is one of their top priorities. Cross-selling to existing customers outranks new customer acquisition by a factor of 2:1. And only 1 in 10 think customer churn is an issue they need to focus on in 2013.

| What are your top three priorities for 2013? |

#1 | #2 | #3 | Total |

|---|---|---|---|---|

| Loan growth | 36.7% | 12.7% | 10.0% | 59.4% |

| Cross-sell, deepen relationships, improve share-of-wallet, increase PPH |

23.6% | 25.8% | 15.7% | 65.1% |

| Customer/member acquisition | 11.4% | 12.7% | 8.7% | 32.8% |

| Building and strengthening the brand | 9.6% | 6.1% | 11.8% | 27.5% |

| Attracting a younger audience | 5.2% | 7.9% | 14.8% | 27.9% |

| Increase adoption of online, mobile channels | 4.4% | 10.5% | 12.2% | 27.1% |

| Deposit/checking growth | 4.4% | 6.1% | 5.2% | 15.7% |

| Customer/member retention (reducing attrition/churn) |

2.2% | 5.2% | 4.4% | 11.8% |

| Expanding/growing new markets | 3.1% | 5.7% | 6.1% | 14.8% |

Top 20 Most Important Products & Services to Promote in 2013

In the survey, this question presented respondents with a randomized list of financial products and services, asking them to check those that their bank/credit union will concentrate on promoting most heavily in the next 12-24 months.

Even though financial marketers say “loan growth” is their most important strategic goal in 2013, they rank “mobile banking solutions” as the most critical thing to push this year… followed by auto loans (58.5%) and home loans (57.6%).

Interestingly, home equity loans/lines ranks higher than mortgage refinancing. This is odd for two reasons. First, no one really has much equity in their home to borrow against. Second, mortgage rates are at the lowest point ever, and consumers are hot to trot.

For all the hoopla surrounding prepaid cards in the last couple years, they didn’t even scrape the top 20. Only 7.4% of banks and credit unions feel prepaid cards are important product to market in 2013.

| Rank | Product/service | % |

|---|---|---|

| #1 | Mobile banking solutions | 63.3% |

| #2 | Auto loans | 58.5% |

| #3 | Mortgage loans | 57.6% |

| #4 | Home equity loans/lines | 50.7% |

| #5 | Credit cards | 50.7% |

| #6 | Mortgage refinancing | 45.0% |

| #7 | Online banking/bill pay | 44.1% |

| #8 | Small business lending | 38.4% |

| #9 | Auto refinancing | 36.2% |

| #10 | Free checking accounts | 35.4% |

| #11 | Small business banking services | 32.8% |

| #12 | Remote deposit capture | 31.0% |

| #13 | Financial education | 26.6% |

| #14 | Checking accounts (fee-based) | 18.8% |

| #15 | Retirement products | 14.8% |

| #16 | Youth/kids accounts | 13.5% |

| #17 | Savings accounts | 12.2% |

| #18 | Interest checking accounts | 10.0% |

| #19 | PFM | 10.0% |

| #20 | Certificates/term deposits | 9.6% |

Online Marketing Now Dominates Traditional Media Channels

Financial marketers’ attention is clearly shifting to online and digital channels. When asked about the media channels they felt would be most important in 2013, 7 in 10 put online advertising and social media at the top of their list.

Print ads are the big losers. Roughly one half of all financial marketers say print advertising is less important — 9.3% more than those who said the same thing last year. A third feel TV and outdoor advertising will are also less important this year.

Three out of every five financial institutions place heightened importance on their onboarding program in 2013 — an 8.3% increase over last year, and the single biggest gain.

Onboarding could be a bit tricky when 1 out of 5 financial marketers aren’t sure where their CRM system fits in.

| Media Channel | More Important |

Less Important |

About the Same |

Not Sure |

|---|---|---|---|---|

| Print advertising | 10.6% | 47.3% | 39.9% | 2.1% |

| TV/radio advertising | 23.0% | 28.3% | 45.0% | 3.7% |

| Outdoor/billboard ads | 16.4% | 30.7% | 48.1% | 4.8% |

| Online advertising | 71.7% | 7.3% | 19.4% | 1.6% |

| Social media | 70.5% | 4.2% | 18.9% | 6.3% |

| Incentives/giveaways | 27.5% | 18.0% | 49.2% | 5.3% |

| Onboarding program | 59.3% | 7.9% | 25.4% | 7.4% |

| Guerilla/word-of-mouth campaigns | 40.3% | 8.4% | 38.2% | 13.1% |

| Direct mail | 36.8% | 21.6% | 38.4% | 3.2% |

| Database/matrix marketing (MCIF) | 48.9% | 8.4% | 31.6% | 11.1% |

| Public relations, community events | 44.2% | 6.3% | 47.4% | 2.1% |

| CRM system | 31.1% | 6.3% | 41.6% | 21.1% |

| Sales collateral and brochures | 16.9% | 25.4% | 52.9% | 4.8% |

| In-branch video merchandising | 28.4% | 13.7% | 45.8% | 12.1% |

| Data analytics, big data | 43.9% | 7.4% | 37.0% | 11.6% |

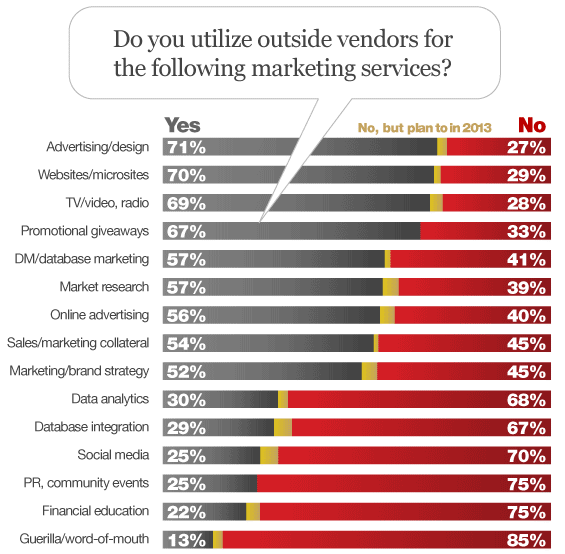

Utilization of Marketing Vendors & Suppliers

The vast majority of retail banks and credit unions use ad agencies and web development firms. 71% of respondents said they retain the services of an ad agency in 2013, up 6% since last year.

The areas where financial institutions will be seeking the most outside help? Roughly 1 in 20 say they intend to work with a social media vendor this year. A similar number are looking for a partner to help them get their customer databases integrated. One in 22 will use a market research firm this year, and 1 in 26 expect to hire a consultant specializing in marketing/branding strategy. One in 30 intend to use a vendor for either online advertising, video/radio production or financial education services in 2013.

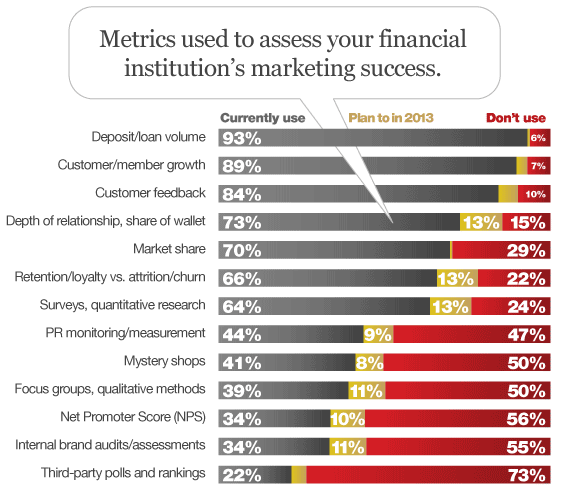

Measuring Marketing ROI & Performance

Bank and credit union marketers have ambitious plans to improve how they track and monitor the success of their efforts. One in eight plan to either start using depth-of-relationships, wallet share, products-per-household or some similar metric to benchmark marketing performance. A similar number intend to start tracking attrition/churn rates.

One in ten intend to utilize more qualitative methods: focus groups, net promoter score (NPS), or internal brand audits/assessments — or all the above.

For those financial marketers still scratching their heads about what “big data” is or isn’t, here’s a simple way to look at it: imagine combining all the sources of information above into one single megafile, then writing algorithms to triangulate it into something that predicts consumer behavior.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Tools Used to Build & Manage the Brand

| Yes | No | Not yet, But Plan to in 2013 |

|

|---|---|---|---|

| Design guidelines, brand standards manual or style guide |

66.1% | 19.1% | 14.8% |

| Brand guidelines/manual or booklet for employees | 51.9% | 25.7% | 22.4% |

| New employees receive brand orientation/training | 45.7% | 35.9% | 18.5% |

| On-going/regular brand training for all employees | 31.3% | 45.1% | 23.6% |

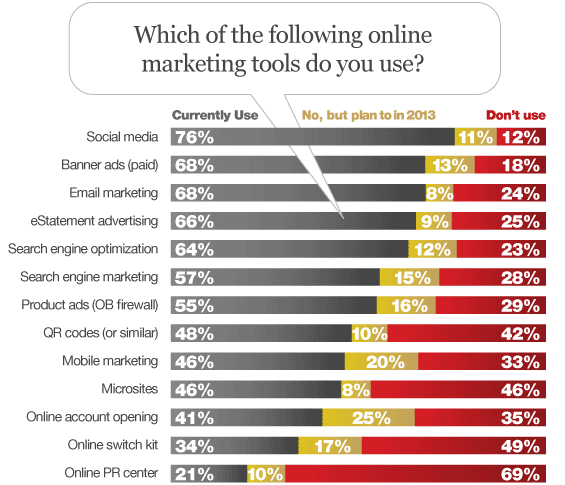

Utilization of Online Marketing Tools

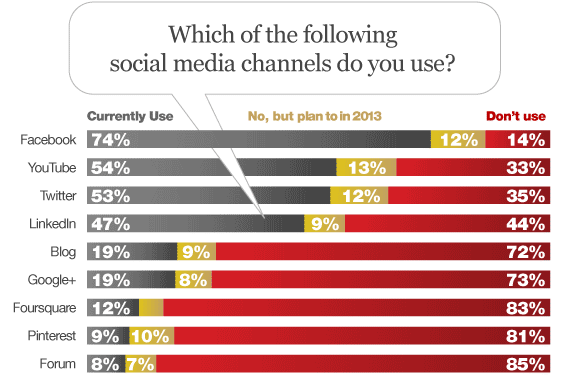

Now 3 out of every 4 retail financial institutions are engaged in at least one social media platform — more than any other digital channel, and a 7.5% increase over 2012. Another 11% say they have plans to start using at least one social media platform by the end of the year. If that happens, a stunning 87% of all financial institutions will be using social channels in 2013.

One in four financial institutions plans on adding an online account opening process to their website this year. One in five will start marketing their services over mobile devices.

A shocking 11.4% fewer financial institutions say they will be utilizing email marketing this year, down from 79% in 2012 to only 67.6% in 2013.

Adoption of Social Media Channels

Today, nearly one out of every four financial institutions is on Facebook, while just around half are on Twitter, YouTube and LinkedIn respectively.

The number of banks and credit unions using Facebook edged up slightly in 2012 (1.8%), with 11.8% saying they plan to start in 2013. The biggest increase last year was Google+, which spiked 7.3% to 18.3% this year. Another 3.4% of financial institutions started using YouTube in 2012.

Some social channels have seen a decline in usage among banks and credit unions. 2.0% fewer financial institutions say they are using LinkedIn this year, and 2.7% fewer say they are using Foursquare.

Oddly, those who say they use Twitter decreased from 54% in 2012 to 52.4% in 2013 — a drop of 1.6% — even though one in ten financial institutions said they planned to adopt the microblogging service last year. This year, 12.3% say they plan to start tweeting, but if the trend in 2012 continues, the percentage of banks and credit unions on Twitter could fall below 50%. As The Financial Brand has noted previously, 1 in 5 banks and 1 in 5 credit unions toying with Twitter have quit.

Social Media Management

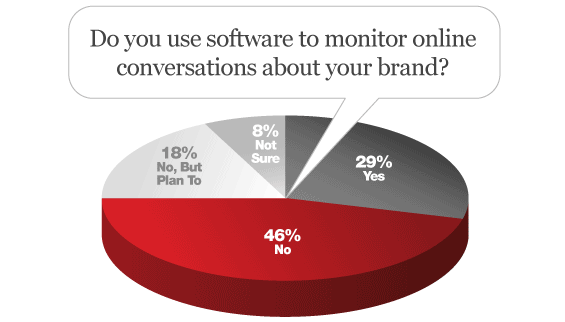

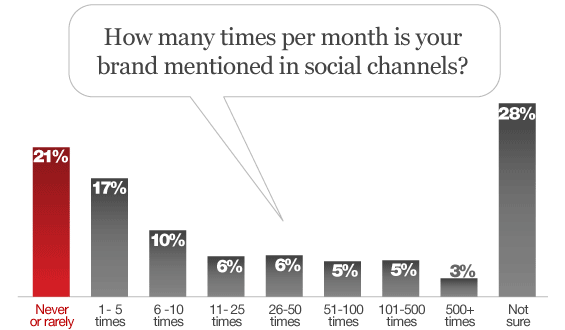

Nearly half of all financial institutions say they aren’t presently monitoring the social web for mentions of their brand. Nevertheless, 1 in 5 say they “never or rarely” see anyone talking about them on social networks.

Reality Check: Social media experts tell financial institutions they need to be “listening.” Just don’t be too disappointed when you don’t find anyone talking about you.

38% of all banks and credit unions don’t see more than five social mentions per month. More than half will find 25 or fewer. A third have no clue.

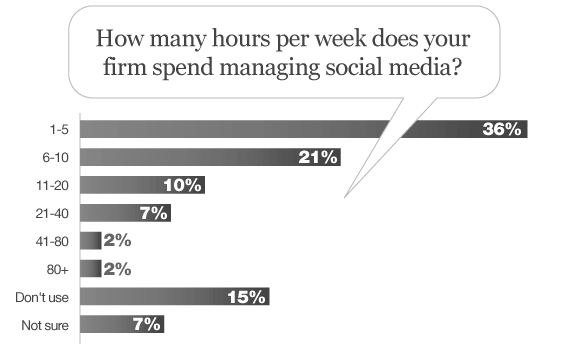

Somewhat ironically, for as much as financial institutions bluster about how important social media is and will be… for as much as they use social channels and continue to sign up for them… Most banks and credit unions only spend less than 10 hours a week on it.

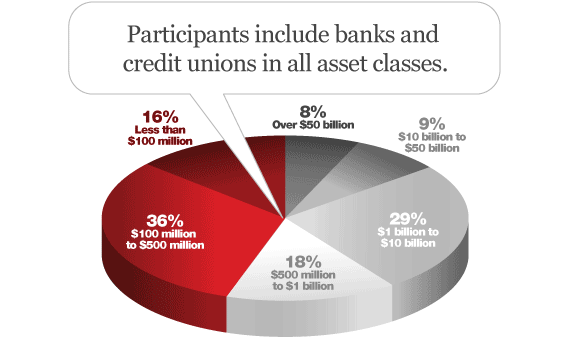

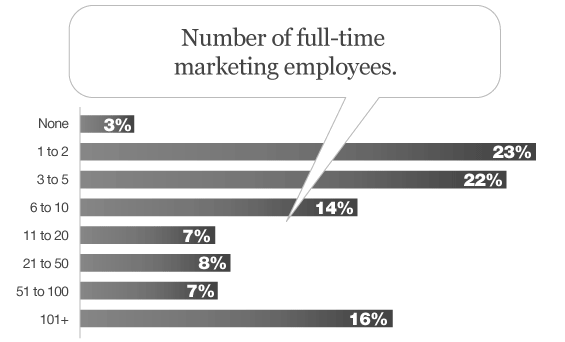

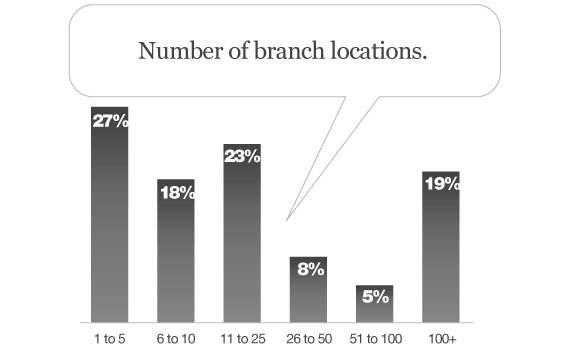

Breakdown of Participants

Just shy of 300 banks and credit unions participated in this year’s study. Most of the respondents (77%) hailed from the U.S. Another 9% came from Europe/UK, 5% from Canada, and 4% from the ASPAC region.

A fairly even cross-section of all retail financial institutions were represented: 32% banks, 15% community banks and 53% credit unions (basically split 50/50 between banks and credit unions).