CommonWealth One FCU partners has launched a new financial literacy microsite, “In The Know,” with educational resources, knowledge and tools.

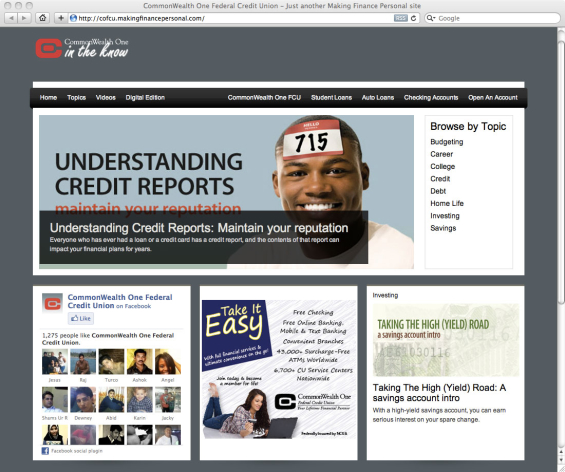

CommonWealth One launched a new microsite, “In The Know” for its members in high school and college, specifically those attending James Madison University. In The Know is an online financial resource that focuses on member education and offers a range of resources, knowledge and tools.

Visitors can explore topics including careers, college, credit, debt, home life, investing, savings and more. They can also watch videos and view the digital edition of the Brass Media financial education magazine for students.

Each month, select members receive an email newsletter which updates them on the latest news from the In The Know website.

CommonWealth One Federal Credit Union places critical importance on financial education and helping their members achieve their lifetime financial goals. “We are providing our members with a valuable education service by offering the new microsite for free. We hold true to our commitment of “people helping people” and this website does just that. It educates our members by being their virtual financial advisor and life coach,” said Ashley Baldeon, CommonWealth One Marketing Manager.

CommonWealth One partnered with Brass Media to provide this website for free.

Headquartered in Alexandria, Virginia, CommonWealth One FCU, has more than $300 million in assets serving more than 36,000 members.