This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team. Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Are You Ready for a Digital Transformation?

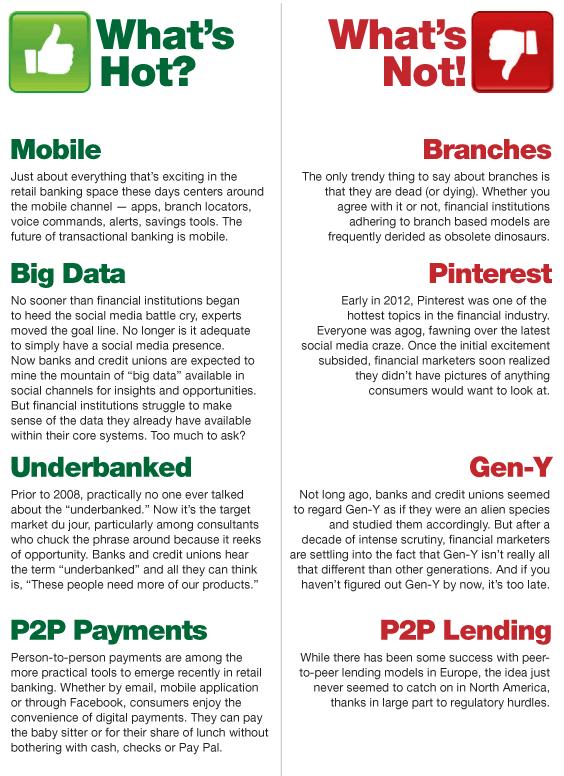

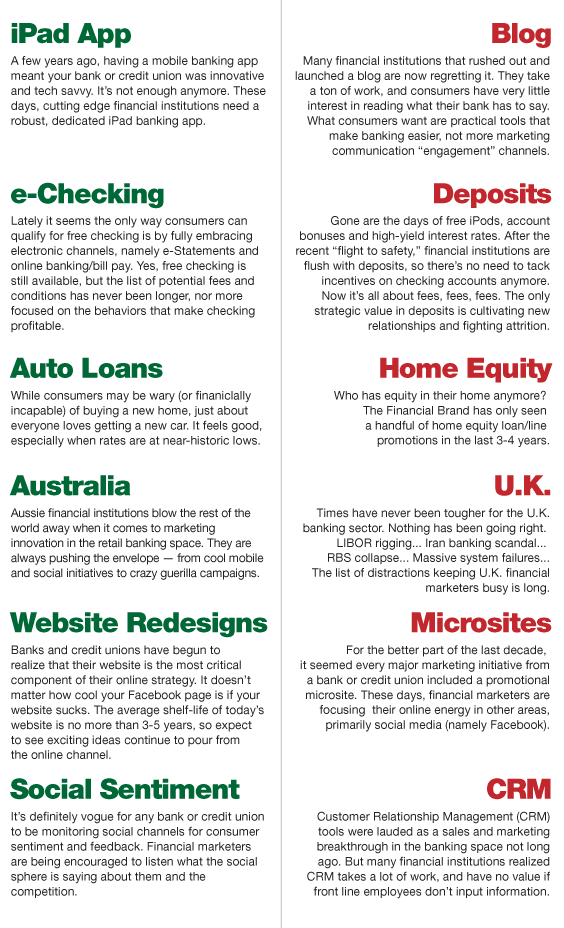

What’s Hot In Financial Marketing? What’s Not?

![]() Don't miss THE FINANCIAL BRAND FORUM, the biggest and best conference on marketing, CX, and digital growth strategies in the banking world — May 20-22, 2024. Join over 3,000 of banking's best and brightest for three days jam-packed with big ideas, latest trends, and groundbreaking innovations that are transforming the industry today. SIGN UP NOW.

Don't miss THE FINANCIAL BRAND FORUM, the biggest and best conference on marketing, CX, and digital growth strategies in the banking world — May 20-22, 2024. Join over 3,000 of banking's best and brightest for three days jam-packed with big ideas, latest trends, and groundbreaking innovations that are transforming the industry today. SIGN UP NOW.