On Thursday, September 4, an ad from Silver State Bank asked, “Why do so many of Nevada’s strongest businesses trust Silver State Bank?”

The answer? “Security” and “protection.”

The answer? “Security” and “protection.”

The next day, the bank was seized by federal and state regulators.

Apparently people weren’t buying the bank’s “you can trust us” sales pitch. When you lose people’s trust, you lose their deposits. In the two months prior to the bank’s seizure, customers pulled $264 million of the $1.7 billion on deposit at Silver State.

“A run on deposits

is what kills banks.”

— Tim Coffey

VP/Research, FIG Partners

“A run on deposits is what kills banks,” said Tim Coffey, VP/Research for FIG Partners, in an interview in the Las Vegas Review Journal. “It happened that way in the Great Depression, and it’s happening again.”

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Reality Check:

People already don’t trust banks. Most financial institutions are seen as greedy and self-serving.

People already don’t trust banks. Most financial institutions are seen as greedy and self-serving.- Situations like this, where Silver State advertised blatant lies, don’t help financial institutions shake this image or build any credibility

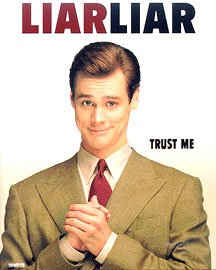

- People’s B.S. detectors trigger alerts whenever they hear someone say “Trust Me.” Images of used-car salesmen go through their minds.

Key Takeaway: It takes more than just words to earn people’s trust. Reminding people that your financial institution is “safe, sound, secure and stable” is an important communications strategy these days. Just remember: Marketing can’t ever create a sense of trust. As with all our relationships, trust is something earned — usually over time.