Citibank, in its on-going quest to become “the world’s digital bank,” has rolled out a new website for its US customers. The redesigned citibank.com has been dramatically streamlined, eschewing the maze of links in the previous version for a bolder, more visual aesthetic.

“In contrast to the cluttered, link-heavy homepage commonly found on banking sites, the new Citi website offers clean pages and simplified menus to make it easier for clients to find exactly what they need,” said Tracey Weber, Citi’s Head of Internet and Mobile for North America Consumer Banking.

In a rather unusual move for the banking industry, Citi teased customers with a sneak peek at the website’s planned changes a few months prior to relaunching citibank.com.

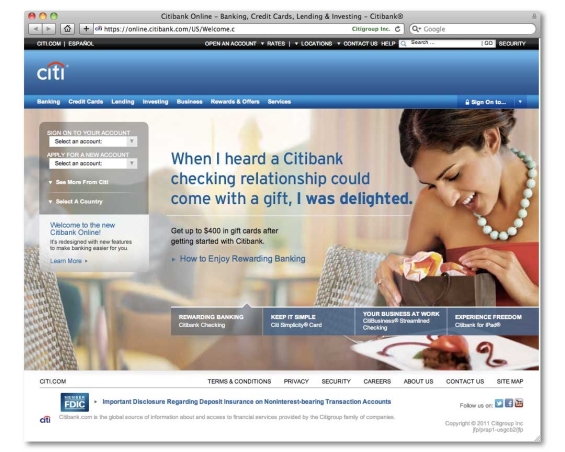

NEW CITIBANK.COM WEBSITE

NEW CITIBANK.COM WEBSITE

This conceptual layout Citi leaked back in September looks almost identical to the new version.

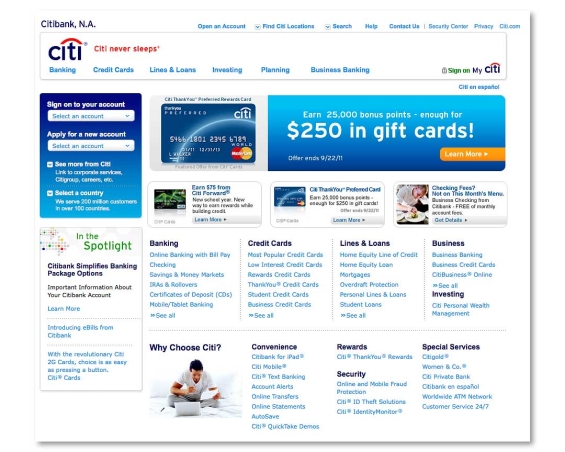

OLD CITIBANK.COM WEBSITE

OLD CITIBANK.COM WEBSITE

Citi called cluttered layouts like this one “link farms.”

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

NEW CITI.COM – OVERVIEW SITE

NEW CITI.COM – OVERVIEW SITE

The bank created this fancy subsite to put a glossy spin on the updates.

NEW CITI.COM – VIDEO TOUR

A one-minute video overview of Citi’s new website.

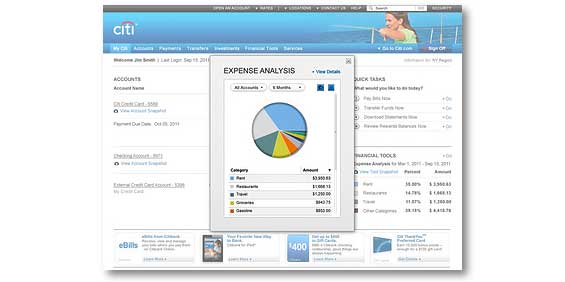

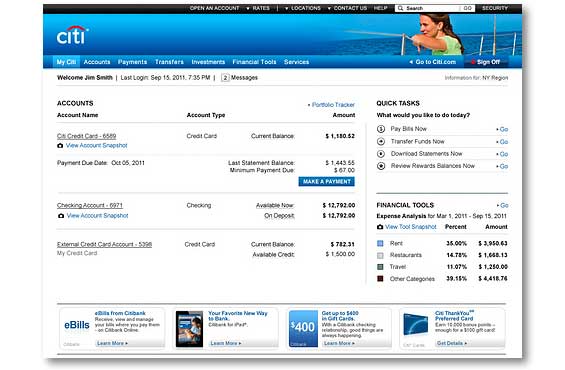

The new site allows users to complete their most frequent financial tasks right from the homepage. With just a click or two, customers can hit their dashboard and view a snapshot of recent transactions from essentially any of their bank or credit card accounts — even those from other financial institutions. The addition of a “Quick Tasks” menu allows users to perform common account management functions, such as paying bills, downloading recent statements, transferring funds and viewing rewards balances, all without leaving the home screen.

Citi completely rewrote all product and services information on the new site, replacing technical, industry-specific terminology with a more relaxed and consumer-friendly tone. Citi describes it as a deliberate transition from an “informational voice” to a “conversational and more human voice,” one designed to put clients at ease.

Citi didn’t just remodel its public-facing website. They also totally revamped their online banking system. Citi has added new personal finance tools, with the budgeting/goal-setting tools and customizable charts typically found on Mint.com-style solutions. Powered by Yodlee, Citi’s PFM platform allows users to analyze multiple accounts, including those from over 10,000 third-party retailers, including utilities and even other financial institutions.

CITI’S NEW ONLINE BANKING SYSTEM

CITI’S NEW ONLINE BANKING SYSTEM

The ability to link to external accounts is a big deal. Previous proprietary PFM tools from big banks shut the door on other financial institutions, preventing users from importing data from any third-party bank brand — a move that was invariably booed by consumers.

For a few days following Citi’s website update, users at Mint.com were unable to link their Citi accounts, causing many to speculate that Citi was cutting off Mint’s access now that the megabank had its own PFM tool. However, peace was restored — along with the Mint-to-Citi connection — by October 3.

“The folks in charge of Citibank’s website are sure brave,” wrote Jim Bruene on his Netbanker blog. “I’m not sure I’ve ever seen this dramatic of a change overnight in a major banking website.”

Celent analyst Jacob Jegher was more modest in his review. “No doubt it’s a step in the right direction,” he wrote.

Not everyone will see the new website immediately. The bank will roll out the update gradually, starting with customers in randomly selected groups.