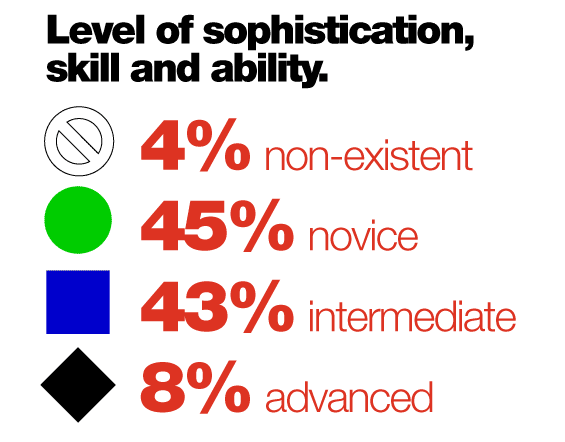

Earlier this August, 154 financial institutions participated in The Financial Brand’s 2010 Online Marketing Study, including 49 retail banks and 93 credit unions. 64 of the participants had $1 billion in assets or more. 66 had less than $500 million in assets. 46% described themselves as “novices” at online marketing, 43% said they were “intermediate” online marketers, and only 8% felt confident enough in their abilities to characterize their organizations as “advanced.” Nearly 4% admitted they don’t do any online marketing at all.

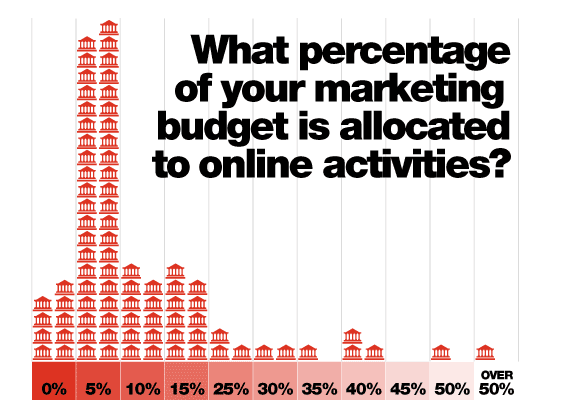

Nearly a quarter of all retail financial institutions said they allocate around 5% of their marketing budgets to online activities. 32% weren’t sure if their organization invests any money in online marketing. 6% knew the total: $0.

22% don’t track or measure their online activities, while only 8% do so all the time.

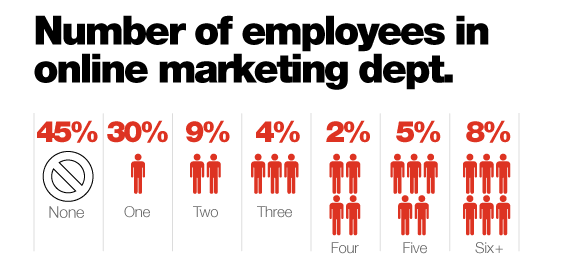

45% of banks and credit unions don’t have any online marketing staff. Nearly a third have only one full-time employee dedicated to online marketing activities.

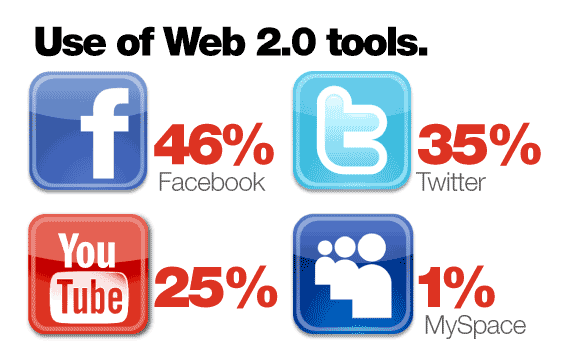

46.40% have a Facebook page, 34.60% use Twitter, 24.80% are on YouTube and only 1.3% have a MySpace page. 5% are toying around with Foursquare. 18% of retail financial institutions have a blog.

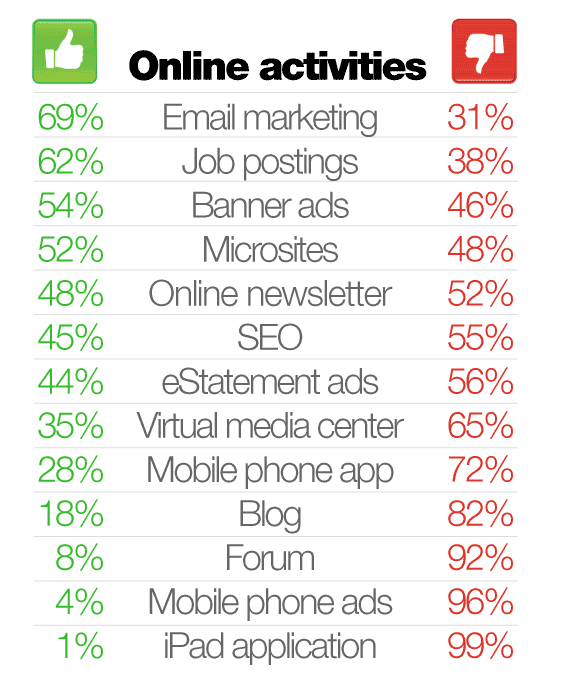

While most financial institutions embrace email marketing, a surprising 31% don’t.

57% of banks invest in search engine optimization (SEO), while only 36% of credit unions do the same — a difference of 21%. By an even greater margin, banks are much more likely to utilize search engine marketing (SEM): 57% vs. 23%.

Banks are 20% more likely to have microsites, and are 36% more likely to run banner ads than their credit union peers.

Credit unions are less likely to have a mobile phone app. They are, however, more likely to have a blog, an online newsletter and ads in their eStatements.

You can download a raw Excel file with data from the 2010 Online Marketing Study. The file includes three worksheets with comparisons between banks and credit unions and breakdowns by assets. You can perform more granular comparisons with another separate file that includes the individual entries from each study participant.

Please note: If you use any of the data from this study, you must attribute credit to The Financial Brand.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

![]()