comScore’s 2010 State of Online Banking report validates some widely accepted beliefs among financial marketers, namely that people are shifting more and more of their routine transactions online and away from offline channels. The report was based on the survey results of more than 2,500 U.S. internet users.

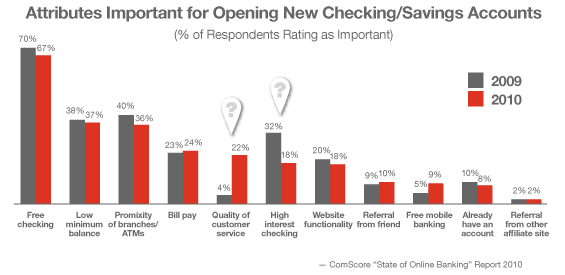

#1) Free Checking

2009: 70%

2010: 67%

Change: Down -3%

Maybe free checking has become something consumers expect so its importance is waning? Nevertheless, free checking is still the most critical aspect for new accounts, and is nearly twice as important as any other factor. Financial marketers are right to wring their hands over the introduction of new fees and/or the elimination of free checking accounts.

#3) Proximity of Branches/ATMs

2009: 40%

2010: 36%

Change: Down -4%

This confirms the intuitive belief that more and more people are increasingly comfortable managing their checking accounts online. Branches may be less important than they once were, but they are still one of the most effective ways to grow new relationships. And don’t forget about ATMs. “ATMs are an absolute necessity,” comScore observes in its report.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

#4) Bill Pay

2009: 23%

2010: 24%

Change: Up +1%

A combination of factors are probably in play here. 1) Online bill pay is more established, with awareness and acceptance on the rise. 2) People’s overall level of comfort with online security is increasing. 3) PFM providers like Mint are fueling people’s interest in using online tools for routine transactions.

#5) Quality of Customer Service

2009: 4%

2010: 22%

Change: Up +18%

This looks like not one, but two statistical anomalies. First, how can anything — even customer service — become five times more important over a 12-month period? People may be prickly about banks and banking right now, but their feelings aren’t likely to translate into wildly higher service expectations. Second, and perhaps more importantly, why would “quality of service” score so low in 2009? If comScore’s data is right, more people wanted free mobile banking than good service in 2009. Despite the wonkiness in comScore’s metric, customer service ranks relatively lower as a priority for new accounts than most financial marketers would believe.

#6) High Interest Rate

2009: 32%

2010: 18%

Change: Down -14%

That’s a big drop, but what’s the explanation? Has the fervor and excitement surrounding high-interest checking accounts waned?

#9) Free Mobile Banking

2009: 5%

2010: 9%

Change: Up +4%

People’s interest along with adoption rates are still relatively low, but they are climbing fast. Someday soon, consumers will simply expect mobile banking and it won’t be optional — just like they do with online banking today.