Fiserv, one of the world’s biggest information management companies in the financial industry, released the results of a study looking into the financial habits and influences of Gen Y. The survey, conducted in July 2009, involved 3,271 Internet-connected households.

The study’s most surprising finding? That the level of hype regarding the importance of online communities in Gen Y’s financial lives doesn’t match its actual influence.

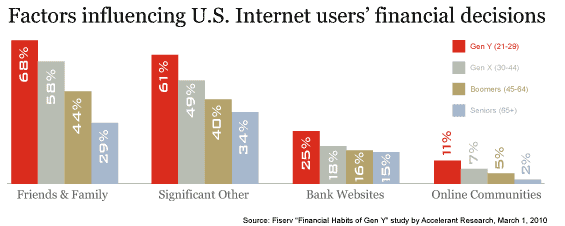

Personal relationships and relatives dwarf other influences on Gen Y’s financial decisions by a factor of 6 to 1. Gen Y relies on information it finds on bank and credit union websites more than twice as much as they rely on input and information from online communities. Gen Y is only slightly different than Gen X in this regard. Indeed if social media was any less influential, it would be essentially irrelevant.

Among the other findings in the Fiserv study:

- 80% of Gen Y has used online banking within the past month.

- One-third of Gen Y has conducted mobile banking activities in the last month.

- 43% of Gen Y plan to perform mobile banking activities in the next year.

- The most common financial activity Gen Y plans on using their mobile phone for is checking account balances (32%).

- Members of Gen Y conduct a larger number of monthly debit card transactions than average (14.1 vs. 10.6)

It’s interesting to note that in the study, Fiserv defines Gen Y as those ages 21-29, an eight-year segment. Gen X is defined as 30-44, a 14-year span. And Baby Boomers are cover a 19-year period including those ages 45-64.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Social media’s lack of influence isn’t the only surprise finding in the study.

Finding: 48% signed up for a credit card online.

That means 52% didn’t. That means most were either filling out paper applications, visiting a branch or using the phone.

Finding: Gen Y said they do not keep file cabinets full of financial records. Instead, they prefer organizing their finances electronically. They also prefer e-bills and e-statements instead of the traditional paper formats.

This isn’t a big surprise. Researchers tend to chalk this up to Gen Y’s concern for the environment, but isn’t this more the practical consequence of growing up digitally wired than it is about being eco-conscious? Young people are increasingly accustomed to managing their lives with computers — calendars, to do lists, class assignments, reminders, party invites, etc.

Finding: 75% of Gen Y consumers have a savings account, 5% higher than any other generation.

Fiserv suggests this could be tied to Gen Y’s “proclivity for responsible financial management.” Perhaps… But how many Gen Y savings accounts (1) were opened by their parents, (2) are the obligatory “share draft” accounts credit unions require, and/or (3) have less than $25 in them?