Credit unions on Twitter struggle to attract followers even after being active over two years, and 1 in 5 just give up entirely. This according to a study by The Financial Brand analyzing 350 “activated” credit union Twitter accounts.

The study’s sample size represents over 5% of all U.S. credit unions, and a minimum of 10% of all those on Twitter.

Accounts were considered “activated” if the credit union’s profile had been customized with an avatar/logo, at least one tweet had been sent through the account, and the account had at least one follower. For the study, any account that had not tweeted in the last three months was considered dormant or abandoned.

For each credit union in this study, The Financial Brand recorded the number of tweets sent, the number of accounts followed, the number of followers, when the account was created, the asset size of the credit union and the size of its membership.

The Financial Brand has been on Twitter since February 2008, and tracks over 700 separate credit union accounts. In four years and four separate Twitter studies conducted by The Financial Brand, bank and credit union Twitter profiles have now been evaluated more than 3,000 times.

Total # of credit unions in this study: 350 (5% of all U.S. credit unions)

Assets over $1 billion: 66

$500M – $1B in assets: 53

$200M – $500M in assets: 62

$100M – $200M in assets: 59

Assets less than $100M: 108

Median asset size: $230 million

Average asset size: $768 million

Total # of members (all 350 credit unions): 23,871,974

Median membership size: 26,010

Average membership size: 68,205

Average number of years active: 2.2

Number of dormant or abandoned accounts: 74 (21.1%)

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Fractional Marketing for Financial Brands

Services that scale with you.

Total # of tweets sent (all 350 credit unions): 153,876

Median # of tweets sent: 193

Average # of tweets sent per credit union: 440

Average # of tweets sent per day per credit union: 0.6

Most tweets sent by one credit union: 3,889 (5.3 per day)

Total # of accounts followed (all 350 credit unions): 102,030

Median # of accounts followed: 96

Average # of accounts followed: 292

Number of credit unions following no one: 12 (3.4%)

Number of credit unions following 10 accounts or less: 55 (15.7%)

Most accounts followed by one credit union: 10,858

Total # of followers (all 350 credit unions): 144,845

Median # of followers: 219

Average # of followers: 414

Number of accounts with over 1,000 followers: 29 (8.3%)

Number of accounts with less than 200 followers: 160 (45.7%)

Average # followers added per day: 0.5

Most followers of any credit union: 10,242

The average credit union on Twitter will have 1 follower for every 165 members.

The average credit union on Twitter will have 1 follower for every $1.86 million in assets.

The raw data file for this study is available in Excel format through The Financial Brand for $299. If you’d like your own copy, please send an email. There are literally thousands of ways to slice the data — perfect for creating your own report.

The Typical Credit Union on Twitter

The typical credit union on Twitter has 300 followers, adding approximately one new follower every two days. They follow 150 accounts themselves. They’ve been on Twitter since December 2009, and have sent 350 tweets since then — an average of about one tweet every other day. The vast majority of tweets sent are one-directional, often with links back to a press release or similar credit union web page. Very few @replies are ever sent by credit unions to other Twitter users.

The typical credit on Twitter has around $600 million in assets, and reaches an audience equivalent to 0.61% of its 50,000 members. That works out to a little more than one follower for every $2 million in assets.

Every credit union on Twitter should be able to pick up at least 100 followers: other credit unions, CU executives, vendors, analysts, the press, personal finance writers, bloggers and other financial industry insiders. Throw in a few dozen spammers, social media experts, foreigners and other random riffraff, and most credit unions should easily accumulate 200 “followers” in their first 12 months. If you leave your account open long enough, you will inevitably hit 300+ followers, even if you never tweet.

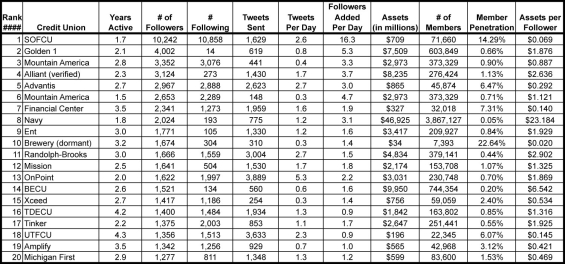

Who Has The Most Followers?

Ranked by followers, the top 20 credit unions in the study account for 48,693 followers (34% of the total), averaging 2,435 followers each. The top 44 credit unions on Twitter have more followers than the remaining 306 combined.

While 48,693 followers might sound like a lot, the top 20 credit unions have a collective membership totaling 11.6 million. That means their effective reach would be a paltry 0.4%. In other words, they have one follower for every 239 members.

Twelve of the top 20 accounts come from credit unions with assets over $1.8 billion (60%).

The top 20 have been on Twitter an average of two years and eight months. They add about three new followers every day, and only follow about 1 in 17 accounts back.

The number of tweets a credit union sends tends to correlate positively with a higher rate of new followers. The top 20 credit unions have sent an average of 1,486 tweets, or about 1.5 tweets per day. Credit unions that see the fastest growth rate for followers — those adding at least two new followers daily — send an average of at least three tweets per 24-hour period.

Southern Oregon FCU topped the list of most followers with 10,242 — 6,240 more than Golden 1, the #2 credit union the study with 4,002 followers. SOFCU has $709 million in assets, and 71,660 members, meaning they have one follower for every seven members, or one follower for every $69,000 in assets.

TDECU, ranked #16 in the list, and UTFCU at #18, are among the oldest adopters of Twitter in the financial industry. They both joined in Fall 2007, just over a year after Twitter was created, and have been active now for more than four years.

Only one credit union in the top 20, Brewery CU, has abandoned its Twitter account. They ranked #10 in the list, with 1,674 followers. The $34 million credit union only has 7,393 members total, so to reach an audience that size is a notable accomplishment. They sent a total of 310 tweets before dropping out in June 2011. Brewery has since consolidated all its social media efforts at Facebook, where the credit union has 93 Likes.

When analyzing the data, you can express the number of followers a credit union as a fraction of its membership. Only 14 credit unions (4%) reached a Twitter audience equal to 10% of its membership or greater. The vast majority — 190 out of 350 credit unions (54%) — reached an audience equating to less than 1% of its membership.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Quitters

For every five credit unions that have experimented with Twitter, one has given up. Of the 350 credit unions included in the study, 74 had abandoned their accounts (21.1%).

| Year | # of CUs Joining Twitter | # of CUs Who Joined That Year But Later Quit |

|---|---|---|

| 2007 | 2 | 0 |

| 2008 | 20 | 2 |

| 2009 | 181 | 49 |

| 2010 | 109 | 22 |

| 2011 | 32 | 1 |

The typical Twitter quitter has a average of $300 million in assets and 30,000 members. They created their account in late 2009, and sent around 100 tweets before giving up. They had about 250 followers (1 for every 128 members), and followed about 110 accounts back.

Smaller credit unions quit Twitter more frequently than big ones. Of the 74 credit unions that discontinued their Twitter efforts, 47 of those had less than $200 million in assets (63%). Comparatively, only four of the 66 credit unions that dropped out (6%) had assets over $1 billion.

There doesn’t appear to be any significant advantage gained by early adopters of Twitter. Of the 22 credit unions that joined in 2007 and 2008, they only average 777 followers — one follower for about ever 70 members. Among all credit unions with 1,000 followers or more, 75% joined Twitter in 2009 or later.

Bottom Line: With a total of 203 of the 350 credit unions (58%) initiating their Twitter initiative in 2009 or before, it’s hard to say Twitter hasn’t been given a fair run. The typical credit union has been on Twitter 2.2 years, which is more than enough time to evaluate its viability. Wouldn’t you think that if consumers had any interest in connecting with financial institutions on Twitter, they’d have done it by now?

As a tool to keep tabs on other financial institutions, to connect with industry peers, and to spread press releases, Twitter can be very effective, no doubt. But Twitter’s usefulness beyond that is highly disputable.