The big, burning question facing financial institutions everywhere is, “What should we be doing with social media?”

But just like any other initiative, banks and credit unions should take the time to understand the costs of social media before jumping in. While many social media tools may free, there are hidden opportunity costs that often go overlooked.

Any financial institution undertaking a social media initiative has two choices: they can either hire someone to manage the project (a new employee or agency partner), or they can tap an existing employee.

Hiring someone doesn’t sound very appealing to most organizations, especially if they just want to experiment a little and test social media’s waters. So let’s say you decide that “Susan,” someone in your financial institution’s marketing department, will be given the role and responsibilities to manage social media. But in order for Susan to devote any time to her new initiative, she’s going to have to stop doing something else. What activity should she give up?

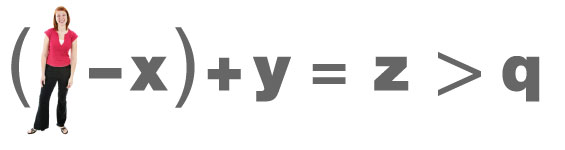

Susan’s time is finite, and her priorities can be expressed in formulaic terms: Susan should stop doing X because she should do Y in order to accomplish Z which is more important than Q.

X — what Susan can stop doing

X — what Susan can stop doing

Y — what Susan could be doing with social media

Z — the strategic or financial impact of social media

Q — something else you could be doing

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Fractional Marketing for Financial Brands

Services that scale with you.

This is the basis for a strategic framework. Now, ask yourself how does your financial institution fill in these variables?

Start with X — what Susan can stop doing. What is X? Your newsletter? A charity fundraiser? Why can Susan stop doing marketing activity X? Was it just a waste of time, or does the organization benefit when she does X? If there is value in X, what makes social media more important?

And what is Y — what Susan could be doing with social media? What specifically will she be doing? Will she be writing blog posts (5-10 hours per week)? Updating a Facebook page (another 5-10 hours per week)? Sending tweets? Time, time and more time. You can’t just say, “Susan, I need you to do social media” without understanding the exposure she’ll have in terms of hours. And a word of warning: once you crack the door and let Susan start getting involved in social media, the amount of time she invests in the channel will creep upwards. It may start at 5 hours per week… then 10… then 20.

Then we get to Z — the strategic significance of social media. This is going to be a major stumbling point for many financial institutions who hop on the social media bandwagon because they don’t really know what they might achieve. This makes it extremely difficult to determine if social media is more important than marketing activity X, or more vital to the organization than Q.

What is Q? If you’re evaluating social media at your organization, due diligence dictates that you consider all the alternatives. If you are able to free up some of Susan’s time, why is it more important that she pursue social media than other initiatives. Why shouldn’t Susan work on a matrix mail program instead? Or an internal branding program? Or any of the dozens of other projects she could be working on?

The same thing applies if you decide you can afford to hire a new employee. Is social media the right role for your new hire? Would it be more productive if a new employee did something other than social media?

Social media takes more time than you might think. A minimum of five hours per week is required to maintain each social media account, on top of the time it takes to create the accounts and explain to everyone what you are doing. If you’ve got a blog, Twitter and Facebook account, it could quickly surpass 20 hours per week. When financial institutions see Facebook penetration rates under 1% and even lower numbers for Twitter, you have to take a hard look at social media’s value and conduct your own objective, strategic analysis. You can’t just bank on the promises made by a self-proclaimed “social media expert.” You have to figure out what X, Y, Z and Q are for yourself. Does social media trump other marketing activities? If so, why?

And then, of course, you have to wonder what the risks are with choosing to wait. What are the costs involved with sitting on the social media at this time? Are there any?