Historically, financial institutions have been focused on product placement and have largely misunderstood the importance of brand-building in the context of digital marketing. Some, like TD Bank and Mountain America CU, understand how to leverage social media for engagement, human voice and brand value. But there are still many financial institutions both large and small that are not effectively leveraging social media.

According to the Credit Union Times, Gen X will receive $30 trillion worth of inheritance from aging Boomer parents over the course of the next 30 years. And McKinsey says retail financial institutions are expected to see more than half of their revenues coming from digital — including social media — by 2018. Credit union think tank Filene now regards social media as a standard part of a marketing department’s responsibilities. As your consumers pour into to social media platforms, your brand could be missing big opportunities by not participating.

So why have so many financial institutions been late to embrace these new channels? Partly it’s because they approach social media in the same way as they do the rest of their marketing; they think social media is a completely unique and isolated marketing medium. They lack strategy. There’s no budget. And they insist on using social as a one-way communication tool when, in fact, social media is really a completely different animal — a new way to speak to your audience. Tweets and posts are not ads. Instead, you have to think outside of marketing’s traditional approach (sell, sell, sell!), and relate to people on a human level. If you’re not speaking “human to human” and providing content relevant to your audience, then you end up spinning your wheels — no likes, no followers, no shares.

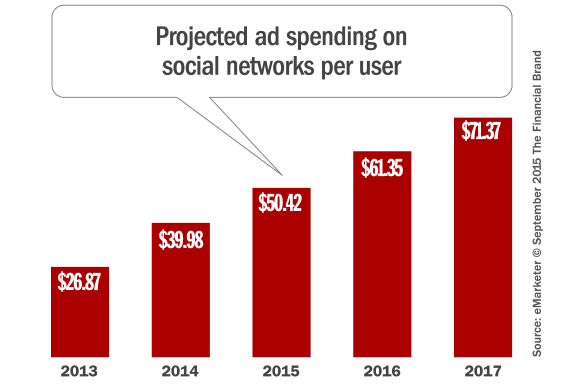

eMarketer forecasts ad spending on social networks will hit $23.68 billion worldwide in 2015. In the U.S. alone, advertisers are planning on spending 31% more this year, and will pass the $10 billion mark for the first time ever. Globally, Facebook is leading paid social media advertising with an estimated $15.50 billion in 2015 ad revenue. Twitter is at $2.09 in global ad revenue, up 71% from 2014. Social media has long passed its place as an unpaid, organic way to reach consumers.

While organic content marketing plays a central role in how financial brands can reach consumers, executing social without social advertising is no longer an option. The good news is that Facebook advertising can be extremely affordable and easily scaled depending on your reach and efforts. It’s also a treasure trove of data, providing more demographics and insights than other social media platforms.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

How Generations Federal Credit Union Tackles the Social Media Challenge

Many banks and credit union have dived into social media without any real strategy or clearly defined goals. This is an important step that cannot be skipped. For example, at Generations Federal Credit Union ($550 million in assets, 51,000 members) we assess our social media strategy every few months and perform an analysis to ensure we’re still focused on what we said we would do… and what we might also need to be doing. Every institution’s strategy is going to be different, but you need to align your social media efforts with your organization’s business goals — just like all of your other marketing initiatives.

Generations FCU

Social Media Channels

Ranked #34 overall among credit unions in The Financial Brand’s Power 100 social media database.

Facebook – 8,743 Likes

Twitter – 8,944 Followers

YouTube – 5,797 Views

LinkedIn – 575 Followers

Pinterest – 193 Followers

Google+ – 53 Followers

At Generations, social media plays a big role in the marketing mix. We see it as a place where we can provide financial education, create brand value, engage with members and hear about their experiences — both good and bad. Our marketing team is small and we only have one employee dedicated to social, a Content Manager who curates content and runs a variety of social media communities. We also leverage several bloggers across the credit union who contribute content, including our executives.

Given the significant role of content in social media, we place a particular focus on what gets produced for the Generations FCU blog and how it relates to a range of segments, generations and channels. Our bloggers have specific topics they write about, from consumer budgeting and how to buy your first house or car, to small business marketing and HR advice. We find young adults, who may be in school or who have recently graduated need help navigating how to manage their finances in school and what to do after graduation.

In addition to our in-house bloggers, we also leverage partners who work closely with us. For the past few years, NerdWallet has been a regular contributor to our blog. GreenPath, a consumer debt solutions provider has been invaluable in helping our members understand debt control and overall financial management.

Blogging is just one way we produce content. Video has been a big push for us this year — member and employee stories along with brand highlights, provide us with content we can leverage in both social media and paid advertising. Infographics along with e-books and other types of content allow us to go deeper, especially for our lead generation efforts and nurturing our email database.

Generations FCU utilizes an assortment of tools to help us not only publish content, but to measure and manage content. There is an art and science to producing content with the goal of creating SEO value, so don’t forget to leverage keyword tools to understand how your content ranks and what competition exists. Generations has seen a 103% overall audience growth in our social media communities since 2014 with engagements up over 5,000%. Facebook remains our most popular and consistent social media community while Pinterest has been the greatest traffic generator for us this year.

Remember you have to start with a strategy first and map out what makes sense for your brand. If you really want to make the case for social media, determine how you can leverage existing resources to aid your efforts. Think outside of the box when it comes to how your financial institution can leverage social channels. Stretch your imagination and find new ways to engage with your audience.