Nearly every financial institution now uses some aspect of social media in their marketing, and more of them than ever feel the time and expense invested are paying off. Don’t get too comfortable, however. Social media remains a fast-moving target that no financial marketer can afford to take their eyes off if they want to stay relevant.

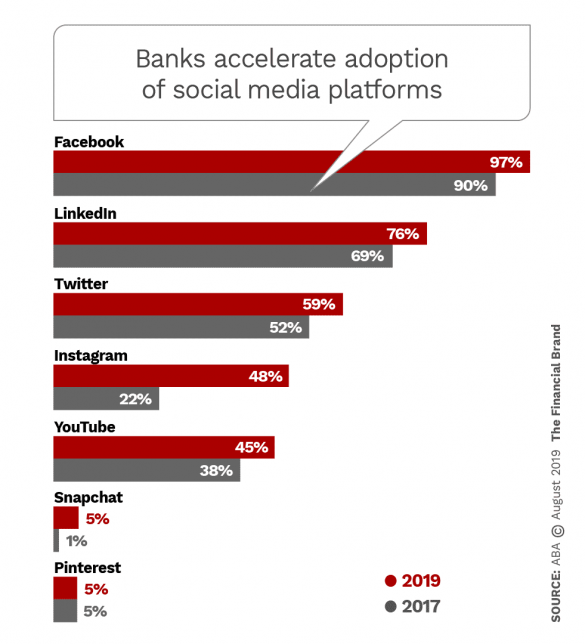

Nearly nine out of ten banks (87%) surveyed are very or somewhat active on social media, according to a study by the American Bankers Association. Among this group, nearly all use Facebook in some fashion, while growth continues on other platforms. Instagram is a standout, with bank participation there more than doubling in 2019 over the level in 2017. This brings Instagram use by banks a bit past use of YouTube.

72% of all Americans use some type of social media today, according to the latest statistics from the Pew Research Center, versus only 5% when Pew began tracking social media adoption in 2005. Overall, Pew indicates that YouTube (73%) is the most-widely used social platform, followed by Facebook (69%).

Yet while that means the majority of Americans can be reached via social, why they are there and how long they stay are fluid. How and where a bank or credit union meets them depends on which demographic segments they want to reach and other factors, including how they measure success with social.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Why Consumers Use Social Will Dictate Marketers’ Choices

Early on, getting on board social media meant almost no explicit expense. So it was easy to check the box. But once on the bus, awareness of trends becomes essential or social wastes time and effort, because social media behavior changes.

“Consumer social media usage fell for the first time. Financial institutions must now compete for a share of less eyeball time.”

According to GlobalWebIndex, in the first quarter of 2019 American social media users began exhibiting behavior seen elsewhere in the world, where in some areas usage is plateauing or even falling off. In the U.S. usage fell to 1 hour 57 minutes versus 2 hours 5 minutes the year before. Though only an eight-minute shift by itself, this directional change is significant because the firm’s measurements, going back to 2012, have until now been constantly on the rise. Financial institutions must compete for their share of less eyeball time.

Financial marketers also need to consider how social is being consumed. GlobalWebIndex’s report indicates a growing cadre of consumers who only view social postings on mobile devices. In the U.S. mobile viewing has already pulled ahead of viewing on desktop and laptop computers.

Beyond this, why social media users go to their platforms of choice has also been changing, according to GlobalWebIndex. The report indicates that social media grows increasingly less social. Many platforms originated as a way to keep up with friends. However, now 40% of social media users go to it to keep up with news and current events; 39% to keep up with friends; and 38% to find funny or entertaining content.

The report notes that the search for entertainment is the factor showing the highest growth, suggesting it could pass other reasons. But meanwhile among the youngest consumers tracked, those between 16-24, this has already occurred. In this group, 47% use social to find entertaining content, 46% to kill time, 43% to be in touch with friends, and 42% to keep tabs on the news.

This argues that banks and credit unions will have to tailor the content they put out on social media to the type of audience they are trying to reach, the audience that tends to use each particular platform, and to what they hope to accomplish. Some institutions use much of their social media flow to promote their communities and their branch-level employees or to promote causes from the local level to the national level. Others have gone into financial literacy outreach through social, sometimes using influencers like sports stars to make their points. Others have gone for entertainment, like Renasant Bank‘s various video humor and human interest programs promoted by social, and Ally Bank‘s “#Confessiongrams” program on Instagram specifically.

If a financial brand finds the right fit, they will be rewarded. The GlobalWebIndex study reports that “more than a third of internet users say they follow their favorite brands on social media, while 27% follow brands which they are thinking of making a purchase from.”

It’s Hard to Justify the Investment if You Don’t Track Social Metrics

As any bank or credit union knows that has made a serious effort at social media, it isn’t really free. In many institutions it has evolved past something done by someone who does other jobs into something done by a team, or at least a dedicated employee or contractor. The ABA report notes that even where efforts are serious, in many institutions social media spending remains a thin slice of the funding that goes to Marketing. The study indicates that just over half of the institutions surveyed plan to increase social media spending, and about 8% plan substantial spending increases.

Whatever the level of spending, senior management wants to see a return on the social media investment. In the ABA survey, 69% of institutions responding said they were satisfied or very satisfied with the results of their social media efforts. This represents a significant change from the group’s previous report, in which only 44% of institutions were satisfied with their results. 16% were not satisfied, down from 24% in the earlier research.

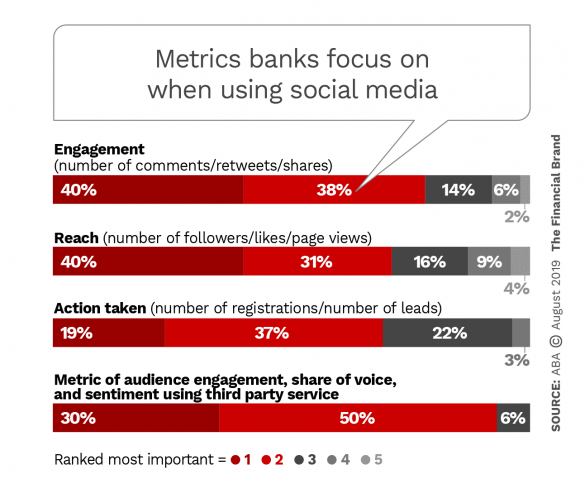

Results, and feelings about them, hinge on multiple factors, including if the institution is measuring the impact on its results of social media use, and what metrics the institution is using.

The study found, for example, that 34% of institutions surveyed that use social media don’t do anything to measure the impact.

“It’s hard to be pleased with results that you don’t know about,” the report says.

Meanwhile, not all institutions tracking results use the most meaningful metrics. A consultant interviewed in depth for the project talked about this in the report.

“The challenge has been that many banks are trying to just leverage the metrics that come from the networks natively to measure the likes, shares, and how many retweets,” says Doug Wilber, CEO of Gremlin Social. “I call these vanity metrics — how popular am I? And to me that’s not necessarily the right way to approach it.”

Continues Wilber: “The right way is to measure how the bank is using social as part of an overarching communications strategy, to put interesting and relevant content in front of the customer so that when the customer is ready to make a financial services decision, the bank is top of mind.”

The report makes an important point about results — they aren’t always as trackable as a marketer would like.

While sometimes the connection between social media posts and business results can be clear — “a campaign led to x clicks on the blog which led to y click-throughs to an online loan application, for example,” the report says. “But more often the benefits are intangibles — awareness, relationship-building, goodwill — that lead to business wins in ways that are almost impossible to trace or to attribute to social media alone.”

Read More: 6 Successful Social Media Tactics Used by Major Financial Brands

Getting More Out of the Social Media Investment

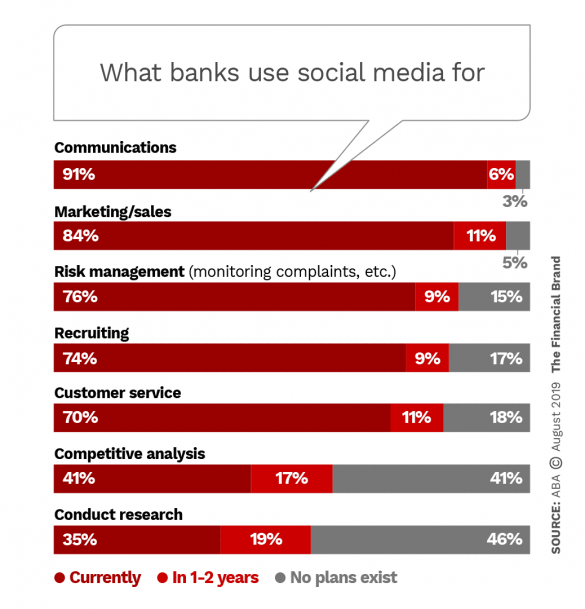

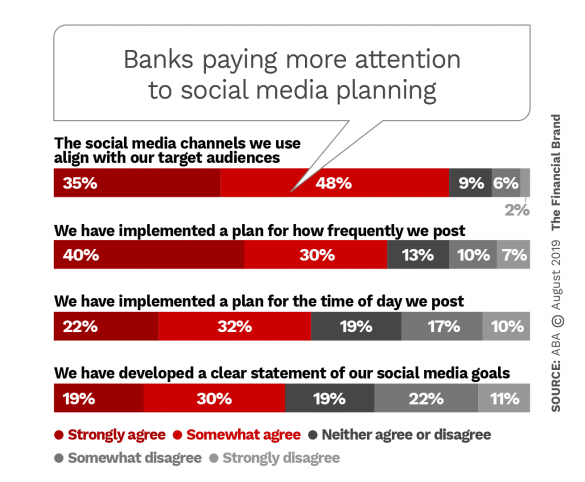

In the early days banks and credit unions might try nearly anything on social media, in a free-form effort to see what stuck. As the association report indicates, there appear to be greater efforts to direct social media efforts now, from better matching of message, target and platform, to more planning, to simply enunciating clearly what the point of the social effort is.

On the other hand, the survey indicates that very few banks feel their social media efforts are on the leading edge — many feel like they are significantly behind. Here are some suggestions from the report and various experts:

1. Consider employee advocates or “brand ambassadors.” Put a measure of the social media mission in the hands of front-line employees, with training and appropriate controls. The institution can piggyback on their market knowledge and the many connections they can build that the institution can’t.

“Engaging employees as brand ambassadors amplifies the voice,” says the report.

2. Use social media in “listening mode” to monitor complaints. The report expressed surprise that many institutions fail to use social media to monitor what’s being said about the brand. Do people make complaints? Are they being addressed or ignored? No institution can afford to not listen to what’s being said about it socially. In fact, Ben Pankonin, Founder and CEO of SocialAssurance, suggests also following up on good things people post about your brand.

3. Content is king, but simple works. For smaller institutions the thought of having to regularly produce fresh and interesting content is daunting. The report suggests keeping things straightforward, such as tying in content with notable calendar dates, such as Cybersecurity Month in October. Checklist-type articles are one way to bring useful content to consumers.

4. Tailor the message to the specific social media channel. Experts advise that you tailor the message to the likely audience you’ll have on that channel. A LinkedIn blog about budgeting will be longer and more serious in tone than an Instagram post about budgeting.

5. Try contests to stimulate interest. One idea: Post something and ask the public to follow up by posting their own suggestions on the matter. Another idea, from the ABA report: Try scavenger hunts or “Where is this?” contests with prizes. One community bank photographed a bobble-head doll of its CEO in a different place. The winner was the first person to ID the location. Another institution hid branded piggybanks in area parks. Members of the public finding them received a pair of sunglasses and were entered in a drawing for a larger prize.

6. If you are going to take stands on controversial issues, think it through first. Some institutions express opinions on issues as part of their corporate social media purpose. The report recounts how a community bank CEO wound up getting into a local controversy through his blog, and how his stand drew heat but also, somehow, renewed interest in opening deposit accounts at the bank.

To help guide an institution in this tricky area, a study by YouGov classifies consumers this way in relation to stands taken on issues:

- Reactives, representing 39% of the U.S. population, can swing both ways. If they agree with your stand, they may bring more business. But if they don’t, they can be a flight risk.

- Loyals, representing 24%, will buy more if what you support goes their way, but they will not be inclined to leave your institution or slash their business if they disagree with something.

- Indifferents, representing 25%, don’t care what your institution says either way.

- No Upsides, representing 12%, won’t buy more if they agree with your stand, but they will definitely boycott you if they don’t.