With the pressure on financial marketers to demonstrate ROI intensifying, it’s more important than ever to understand the buyer’s journey and create content that moves people through the sales funnel. To drive measurable growth, bank and credit union marketers need to target key audiences with relevant content to that speaks to their specific needs at each stage of the funnel.

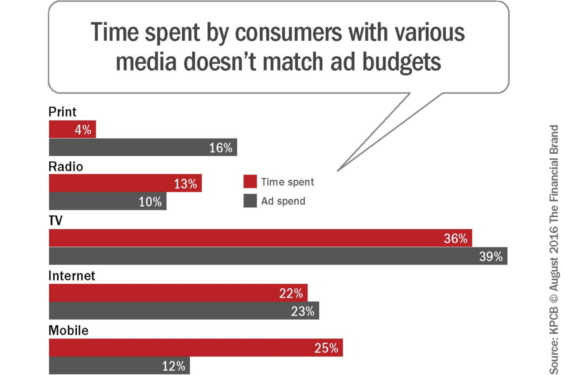

Consumers are visiting branches less often. They can open accounts on mobile phones, and apply for loans at work on their lunch break. While lead nurturing and effective prospecting can be accomplished cost effectively in digital channels, the financial services industry has lagged behind. Banks and credit unions have failed to allocate sufficient budgetary resources where users spend most of their time. Instead, financial institutions have been flushing money down the toilet on tactics that can’t be tracked and don’t produce leads.

This is why a content marketing strategy is more important than ever before. Now that people can be targeted in digital channels with amazing accuracy, it makes financial sense to move budgets away from traditional media towards content marketing strategies that focus on generating leads, growing relationships and improving the bottom line.

With that in mind, here are three tips to help you maximize your success with content marketing in digital channels.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Fractional Marketing for Financial Brands

Services that scale with you.

1. Powerful Social Media Targeting

As organic reach on Facebook continues to plummet to zero, investing in paid promotion is a necessity. One of the strengths of today’s social networks lies within the targeting capabilities available to advertisers. Social media platforms have amassed rich data on consumers that financial marketers can leverage.

Using your research and sales data, you can identify specific segments that can be targeted within social platforms. You can target people who are either engaged, married or pregnant, or those who are members of a credit union, or customers at a national/community banks. For example, 70% of people rolled over their 401k into an IRA due to a recent job change according to Oliver Wyman.

Here are some other great examples of targeting options available within Facebook, and the potential banking products that match with them:

- First-Time Home Buyer – FHA Loans, Mortgages

- Newly Engaged, Newlyweds – Mortgage, Joint Accounts, Savings Accounts, Financial Advisors

- New Job – IRA Rollovers

- New Mover, Recently Moved, Likely to Move – Checking Accounts, Mortgages, IRA Rollovers

- New Vehicle Buyers & Shoppers – Vehicle Loans

2. Synch Sales With Marketing

To develop a sound content strategy, marketing and sales teams need to be aligned. They need to share knowledge, and agree on what qualifies as “good leads.” Working together, they should define common pain points and objections, plan upcoming initiatives and establish metrics for measuring progress.

Read More: 4 Keys to Winning With Social Media Influencers

A study by Marketo found that when both sales and marketing teams are both in synch, organizations became 67% better at closing deals and generated 209% more value from their marketing efforts.

3. Map Content to Personas

People have different needs and expectations as they get deeper into the sales funnel; accordingly, they seek specific information unique to each stage. Marketers need to develop the right content that speaks to prospects’ needs at each stage of the sales funnel. Personas and journey mapping can be a powerful way to determine appropriate messaging for different segments. Although it takes more effort to develop unique messages for different target audiences, there’s greater potential to make a bigger impact and produce better results. People want to feel like you are speaking directly to them. Let’s use the persona “Frank the First-Time Homebuyer” as an example for a quick content mapping exercise:

Awareness. Frank is newly engaged and is aware of a problem – he rents and feels it’s like throwing away money and isn’t sure if he can afford a home. Create content that helps him determine if it’s better to buy or rent and how much he can afford, like a blog post with a buy or rent calculator. This isn’t the time to hard-sell Frank on a mortgage. At this time, just introduce your financial institution and offer helpful advice for his specific needs. During this stage, drop a remarketing pixel on your website, so you can target Frank to return and continue to build awareness.

Consideration to Conversion. Frank is now considering a solution to his problem, buying his first home, but wants to know how to get the lowest mortgage rate, and is concerned about his ability to afford a 20% down payment. Create content that explains how rates aren’t the only factor in the final actual cost of a mortgage (to compete with online mortgage sites with super low rates and high closing costs), and share information on how he could get a home with no money down. You can also offer more calculators, information on how to get pre-approved or pre-qualified, and a mortgage checklist. At this stage, include a strong call to action to set up appointment with a loan officer or direct him to your online mortgage application.

Loyalty. Frank has become a happy customer and moved into his new home. Now is a wonderful time to introduce a referral program to get him to refer his friends, or ask to get a positive review on social media. Frank may also benefit from some of your other banking or loan products down the road so make sure you keep him engaged with your brand for the next time he’s in the market for another financial product.