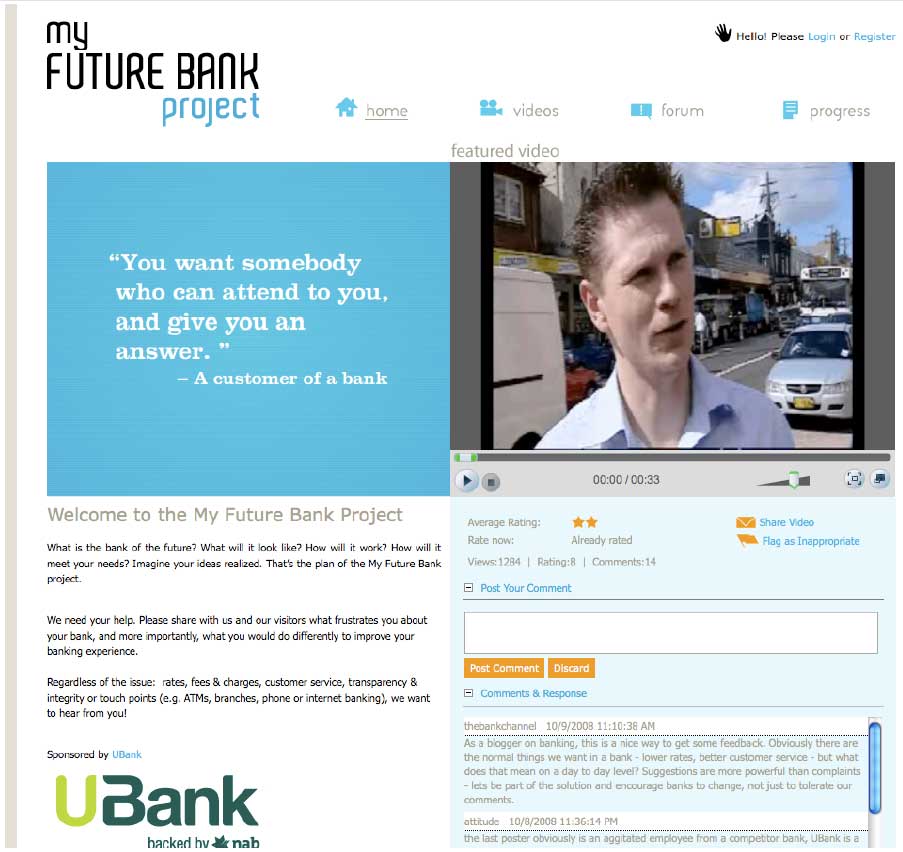

To support the launch of its new online self-service offering, UBank, NAB created a blog at myfuturebank.org. But the bank closed the blog earlier this month after one of its employees posted comments posing as a legitimate customer.

At first, the impostor denied he was a bank employee, but forensic internet analysis proved that all his comments originated from an NAB server inside the bank.

“Which of you guys are advising NAB Bank on social media? Whoever you are, you are making a real friggin’ mess of it, and you make it worse for all of us!”

— Laurel Papworth, Social Networks

The revelation immediately sparked a Twitter firestorm, followed by waves of protests across the blogoshpere: “FAIL, FAIL, FAIL!”

One blog post about NAB’s handling of the situation was so controversial, the blogger decided to pull the article down.

This isn’t the first time NAB’s found itself in deep Web 2.0 doo-doo. Earlier this year, the bank was blasted for spamming sports blogs.

Reality Check: When it comes to social media, transparency is the law of the land. Shilling will get you skewered. It almost always backfires.

Key Questions:

- What did NAB tell employees about the UBank blog? Anything? Did employees receive an announcement? Did they receive guidelines on how they should and should not participate?

- Why didn’t NAB leave the blog up and deal with the problem openly and honestly? Did they really need to scrub the whole project?

In its official response, NAB says “any unidentified comments on blogs are unauthorized.”

myfuturebank.org

“We need your help. Please share with us and our visitors what frustrates you about your bank,

and more importantly, what you would do differently to improve your banking experience.”

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Even though the site invites people to “share their frustrations,” Monty Hamilton, the head of UBank, popped in and left a comment reminding people to “keep it positive.”

Someone then pointed out the contradiction between Hamilton’s request to “keep it positive” and the site’s instructions. They went on to say, “I think this site is a pointless piece of junk. The banks already know what customers WANT — it is hardly rocket science.”

The next comment is the one that apparently came from inside NAB:

“the last poster obviously is an aggitated employee from a competitor bank, UBank is a breath of fresh air in an otherwise stale banking world, i set up a TD with them, i didnt have to speak to a robot 1st, i got professional service from them and this is at 3:30 in the morning, go UBank, i love you.”

Key Takeaway: If your staff participate in your social media projects, they can’t masquerade as legitimate customers. The same thing applies to your ad agency. Everyone on your side that might have “an agenda” needs to always reveal their connection to your financial institution.

Bottom Line: Social media projects can build your brand, so don’t be afraid to experiment with them. But never try to “salt the mine.” If you get outted, it will cause damage to your brand and make it much more difficult to launch any successful social media projects in the future.

Note: These topics (and others) will be covered by Jeffry Pilcher, publisher of The Financial Brand, in an upcoming presentation, “Results 2.0.” Catch it at Finance 2.0 next year in New York.