ING Direct in Canada has launched Fee Tweeter, a new Twitter application that will automatically track and tally bank fees. The project is a new component of the fairfees.ca initiative previously covered by The Financial Brand.

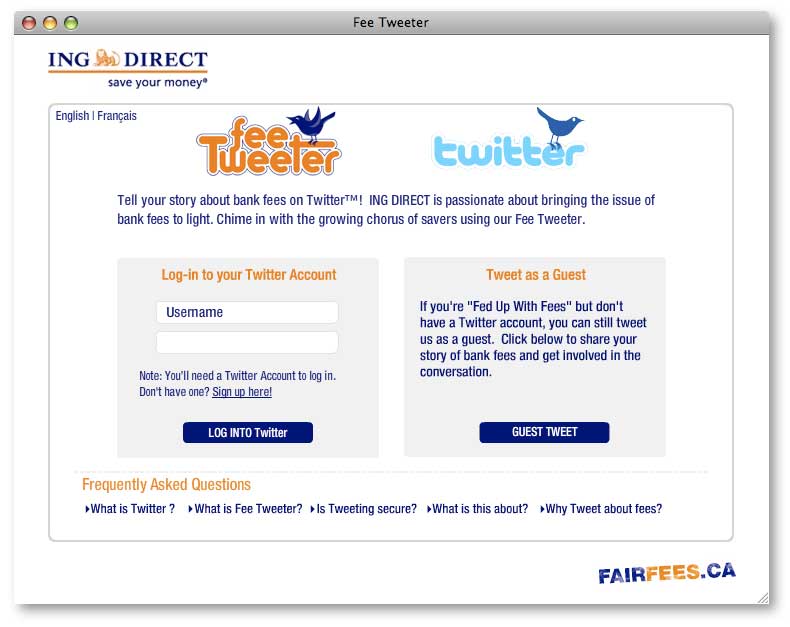

Those with Twitter account already can go to the Fee Tweeter website (feetweeter.fairfees.ca), enter their Twitter username and password, and submit any bank fees they may have been charged. Fee Tweeter will then do three things:

- Send a tweet from ING Direct’s Fee Tweeter account on Twitter announcing the fee.

- Tally the fees. The Fee Tweeter application will keep track of how many fees you’ve shared with ING Direct, and send you a weekly message with the total you’ve been charged so far.

- ING Direct also keeps a cumulative total for all fees shared at its Fee Tweeter website, $19,296 thus far.

The Fee Tweeter Interface

Includes a running tally of all fees shared with ING Direct. The Financial Brand was unable to logon to the Fee Tweeter application in two attempts. The third attempt was successful, however.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

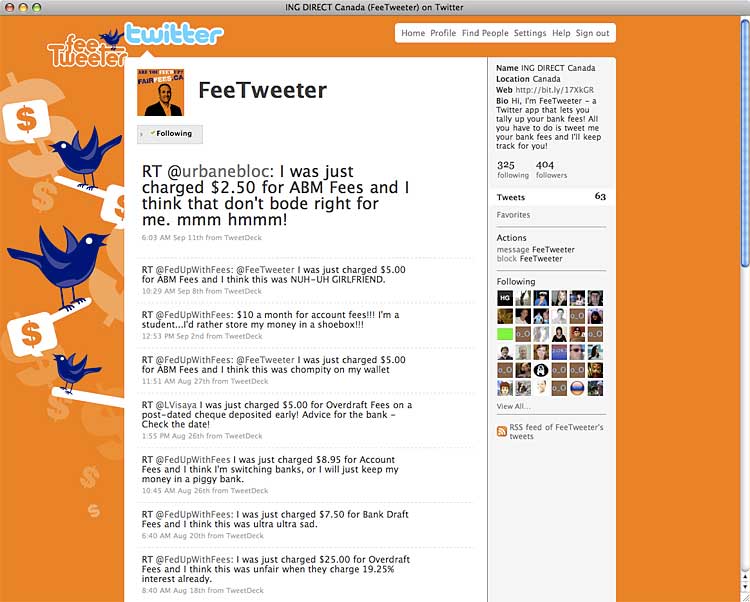

@FeeTweeter

Seeing what other people are paying in bank fees doesn’t sound very interesting, but ING Direct’s FeeTweeter account on Twitter has over 400 followers nonetheless.

A Typical Fee Tweet

Once you share a fee with ING Direct through its application,

the company will broadcast it via Twitter.

ING Direct modestly claims to (A) be the first bank in Canada to (B) launch a Twitter application that (C) tracks fees. In all likelihood, they are the first bank to launch a Twitter application — period — not just the first in Canada, nor just the first that tracks fees.

On the Fee Tweeter website, ING Direct describes the initiative as a place “where savers can share and compare the bank fees they’ve incurred.”

“It’s for Canadians who want more control over their finances. It’s for connecting people dedicated to saving their money — with help from ING Direct!”

Key Questions:

- How does sharing and tallying fees give people

“more control over their finances?” - How does this initiative “connect people” with one another?

- How do users “compare the bank fees they’ve been charged?”

“Speaking up about unfair bank fees is the first step to getting things changed and helping Canadians keep more of their hard earned savings,” ING Direct explains. “You’ll not only feel better sounding off about the high cost of fees, hopefully you’ll also be helping to one day get rid of them.”

Key Questions:

- How many people will be willing to take the time to use this website?

- How many times will someone be willing to do this?

Spending time moaning about fees instead of doing something about it seems a little pointless, and, perhaps, that’s the point. It almost seems as if ING Direct is implicitly saying, “If you’re willing to take the time to use this application, why don’t you do something about bank fees and make the switch?”

“The tool is basically an easy and fun calculator to help Canadians keep track of their fees,” Gloria Chik, an ING Direct spokesperson, told The Financial Brand.

“We don’t have fees at ING Direct,” Chik added.

No fees? That’s a powerful message, and one that probably should have been celebrated more vocally throughout the Fair Fees initiative. After all, who wouldn’t prefer to have “no fees” over “fair fees?”