Unmetric, a social media benchmarking firm, released its report on India’s banks and how they are performing in channels like Facebook, Twitter and YouTube. The study compares various datapoints from January 1 to March 31, 2013.

HDFC Bank, ICICI and Axis Bank all ranked high in the study.

In The Financial Brand’s own Power 100 social media database, ICICI ranks #3 and Axis ranks #7 among all financial institutions worldwide. HFDC was not ranked in the inaugural Power 100 list, but would have come in at #5.

Facebook Reigns Supreme

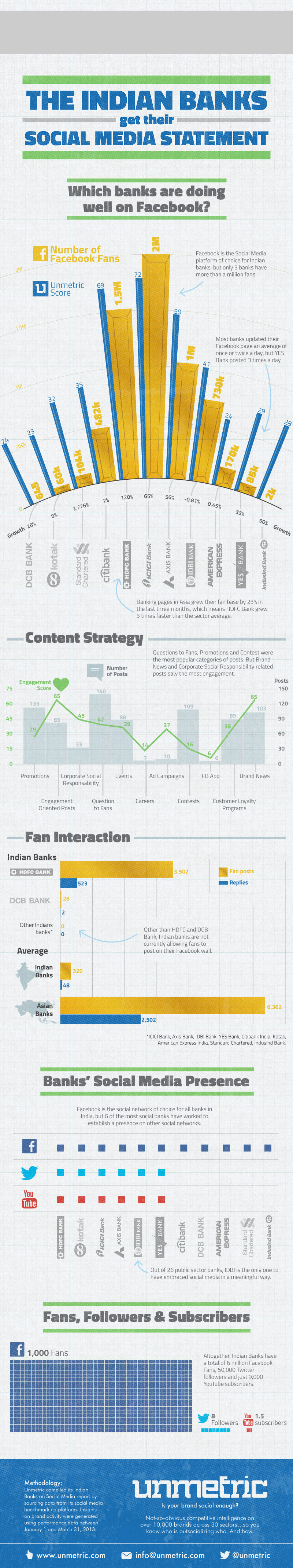

Only five banks in the world have passed the 1 million ‘Likes’ mark on Facebook, and three of them are in India. Between them, Indian banks have amassed 6 million fans, with a third of those belonging to ICICI Bank alone. HDFC Bank isn’t far behind with 1.5 million fans. Axis is the only other Indian bank in the “one million fans” club.

Standard Chartered Bank saw the most Facebook growth, registering a jaw dropping 2,780% increase in ‘Likes,’ although the fledgling account was only created in December 2012. Just the same, Standard Chartered grew from 4,000 to 100,000 fans in a span of just three months.

For a bank with a more established Facebook presence, HDFC achieved an impressive growth rate of 120%.

Unmetric had team of data analysts categorize and tag every Facebook post to uncover the content strategies of India’s top banks. It was found that they mostly focused on asking brand related questions to fans. Promotions were the second most popular type of content, followed closely by contests. However, these were not the most engaging topics for fans. It was brand news that saw the highest levels of engagement, followed by engagement-oriented posts (ie. “Like this post if…”) and posts about corporate social responsibility. Ad campaigns also saw high engagement.

Read More: Benchmarking Facebook Likes: Industry Averages for Banks & Credit Unions

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Bank Customers Wait Hours, Sometimes Days for a Reply on Twitter

Banks appear to give much less importance to Twitter, with only six out of the eleven banks studied even bothering to have a presence on this social network. Kotak Mahindra Bank comes out on top with 17,409 followers and IDBI, a public sector bank was second with 12,484 followers. In third place was ICICI Bank with 7,483 followers.

Kotak Mahindra Bank saw a staggering 1,409% growth in its fan base in the three month period analyzed. YES Bank grew by 43.2%, while Axis Bank grew by 34.6%. Interestingly, IDBI lost fans during the same period.

The six banks analyzed sent an average of 10 tweets per day. HDFC Bank was the most prolific, tweeting 18 times a day.

The banks mostly used Twitter to reply to questions, yet they don’t always seem to be in a hurry to reply. IDBI replied to 25 tweets with an average response time of 9 hours. HDFC Bank replied to 916 tweets with an average response time of 19 hours per tweet. ICICI has taken the trouble to set up a dedicated Twitter support account where customers can tweet their problems and get a response; however, it takes ICICI nearly two days, on average, to reply to a tweet.

When it came to actually dishing out the customer service, banks mostly preferred to get customers to phone the call center. ICICI always looks to take the conversation out of public view by asking people to send them a Direct Message. HDFC Bank and Kotak Mahindra Bank also direct people to send the question to a specific support email address.

Read More: Tweet This: 1 In 5 Banks Are Twitter Quitters

Oh Yeah, Don’t Forget YouTube…

Many banks in India have been slow to adopt YouTube, perhaps due to the high costs involved with producing engaging web video content. Six of the eleven banks analyzed were found to have a YouTube account. However, only three banks have any activity in the last three months.

ICICI Bank leads with the most active YouTube channel. They have uploaded a total of 140 videos, 40 in the last 30 days alone. Unlike other banks who just upload their TV commercials, ICICI Bank also uploads interviews with financial analysts to help people make sense of the global economy.

Axis Bank saw its video views shoot up by over 260% in three months, giving them more views on YouTube than all their competitors. Axis also posted an equally high subscriber growth rate of 290%, making it the most popular and most watched banking channel in India. The bank can owe much of its success to its recent “Progress Together” campaign which showed how people’s lives are intertwined.

Axis Bank has one of the shortest average video lengths out of all the banks. While other banks average 3 minutes or more per video, Axis keeps it short with an average length of 57 seconds per video. By comparison, the average HDFC Bank video is over 7 minutes long.