Let’s be honest. Most brands aren’t sure how to best measure their success on Facebook. While “engagement” remains desirable, it’s not the only measure of success in social media (nor even the best). Financial institutions pursue organic and paid reach just as aggressively, though reach — on its own — isn’t the most important appraisal of social prowess, either. While the two are closely connected, even together the pair still isn’t the ultimate social media prize. What’s most critical is a combination of factors that create a brand experience — not only to gain numbers, but also to ensure that those impressions (reach) and interactions (engagement) are quality, i.e. the right message with the right audience.

To achieve this, posts must express the core elements of the brand. Consistently — with every single post. This means, for example, that if the latest memes and goofy photos feel like a stretch for your brand, resist the urge. Here’s why: “It’s not personal; it’s business.” Facebook and other social media channels must be part of a strategy that achieves business goals.

Beyond branding, the most valuable impressions and interactions for banks and credit unions are those that remain relevant to financial services (duh, right?). Think that’s too limiting? Not so. Several of the top U.S.-based banks on The Financial Brand’s Power 100 reliably post branded content tied to financial services. And the good news? These kinds of posts can be utilized by nearly all financial institutions. Here are some examples that keep their focus on the bank and its customers.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

1. Support branch-based promotions

BBVA Compass (#18* in the Power 100, Q2) used social media to support its “Dollars for Scholars” promotion. It frequently shared the link to a microsite where it housed contest information (including rules). Its prize structure was also “social,” including “rewards” for the nominators (not just money for the nominees). Most importantly in this case? The promotion drove traffic to local branches by requiring nominations to be submitted in person.

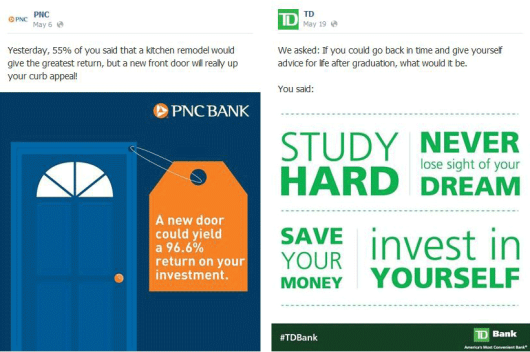

2. Focus on financial services consumers

A number of U.S. banks at the top of the Power 100 utilize user-generated content (UGC) on Facebook. In each example, PNC (#10*), TD Bank (#9*) and Chase (#3*) ask fans to respond to a question. The banks then use the answers to create additional content. The result is content that is about the financial services customer, not just the bank.

3. Publish timely (seasonal) content without losing financial services focus

Suntrust is #19* on this quarter’s Power 100, and its “#mom$advice” posts on Facebook jumped on the momentum of a major holiday… while still remaining relevant to financial topics. By requesting and utilizing user-generated content, as in the examples above, the bank’s content became as much about financial services as it was about the holiday. (Note: Be careful about reaching too far to link holidays or seasons with financial topics… the connection shouldn’t be too much of a stretch.)

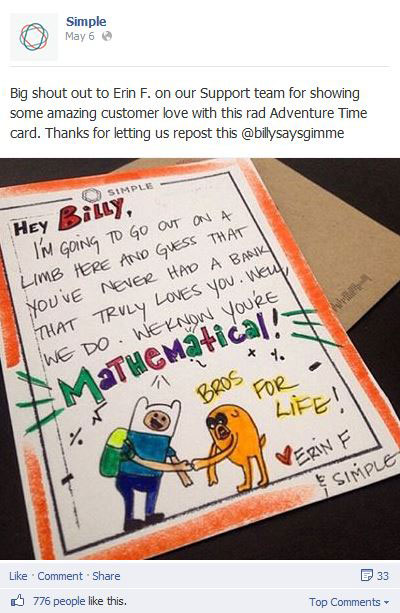

4. Highlight excellent customer service

We all know it: one of the most important aspects of financial services is customer service. Simple (#17*) used a Facebook post in Q2 to celebrate an example of excellent customer service when it shared a handmade card one support team member sent to a customer. As an online bank, Simple has to prove it can still offer personal service. And its social post about the effort nails it! (Note, also, the unique expression of the brand by one of its reps in the comments section.)

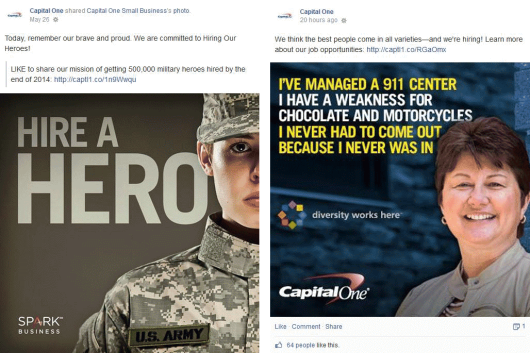

5. Promote a diverse workforce

Capital One is reliably in the top four banks in the Financial Brand’s Power 100. Some of its Facebook posts in 2014 Q2 give fans and customers a glimpse into the company’s workforce while demonstrating diversity and a commitment to hiring veterans.

6. “Sell” products, including their benefits

While it’s not advisable for any brand to post about its products at the exclusion of other content, there is great value in product- and services-based posts that “get seen” in the Facebook newsfeed. Posts like these from Citibank (#5*) focus on rewards points, card benefits and online banking. Citibank’s approach ranges from promoting selling points outright to issuing gentle reminders. (Note how Citibank gets away with posting “puppy pics,” in two of these examples without straying from a product focus.)

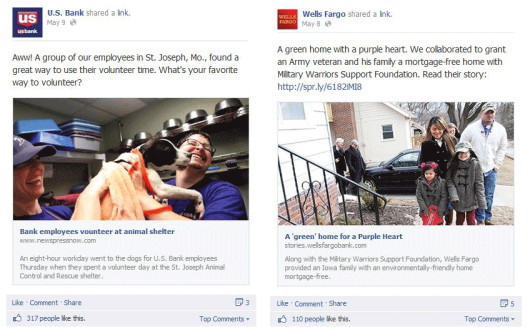

7. Showcase philanthropy and community involvement

It’s important for brands – especially financial services brands – to demonstrate their commitment to “giving back.” While Chase has dedicated its Facebook presence to its charitable efforts, other top banks utilize stories about philanthropy and community involvement as part of their content mix.

8. Integrate social content with larger marketing campaigns

Facebook posts can amplify and reiterate marketing campaigns and materials that “live” (or at least originate) outside the social network. This kind of content helps to integrate the brand experience across channels. In addition, posts like these from Capital One, which serve as reminders of a television ad campaign, a sponsorship and the brand’s Pinterest page, may contribute to consumer recall and “give legs” to existing marketing calls-to-action.

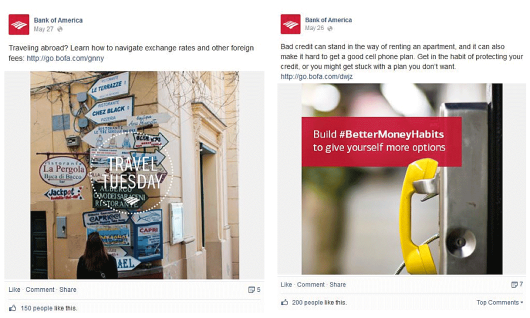

9. Share the brand’s expertise

Financial institutions have, excuse the pun, a wealth of information about financial topics, and much of that knowledge is helpful to consumers interested in their fiscal health. Recommendations and tips are assets banks can promote via social channels, as with these posts from Bank of America (#2*). The first post linked to a tip sheet, the second to an instructive video.

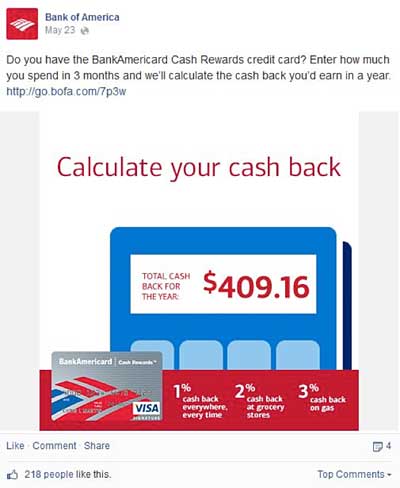

10. Use Facebook apps to bring products to life

Don’t forget about Facebook apps (the old “tabs”). These can be great tools for encouraging engagement with consumers, whether it’s simply a branch locator or a social promotion. In addition, think of how interactive assets on Facebook can bring products to life. This calculator from Bank of America, for example, encourages fans to see for themselves how much cash back they could earn with a BankAmericard. (Important note: Don’t forget to promote these digital assets, like Facebook tabs, via posts for the newsfeed.)